Shareholder Return Ratio of Major Banks Such as KB, Shinhan, and Hana Around 40%

Banks in the United States and Europe Exceed 70-80%

Expected to Rise Above 50% in the Mid- to Long-Term

Although domestic banks in Korea have continued to implement value-up policies to enhance corporate value, their shareholder return ratios remain lower than those of major overseas banks. Some point out that, due to the low shareholder return ratios, Korean banks are still undervalued in the market compared to banks in advanced countries such as the United States and Japan.

Shareholder Return Ratio of Domestic Banks at 40%, Overseas Banks at 80%

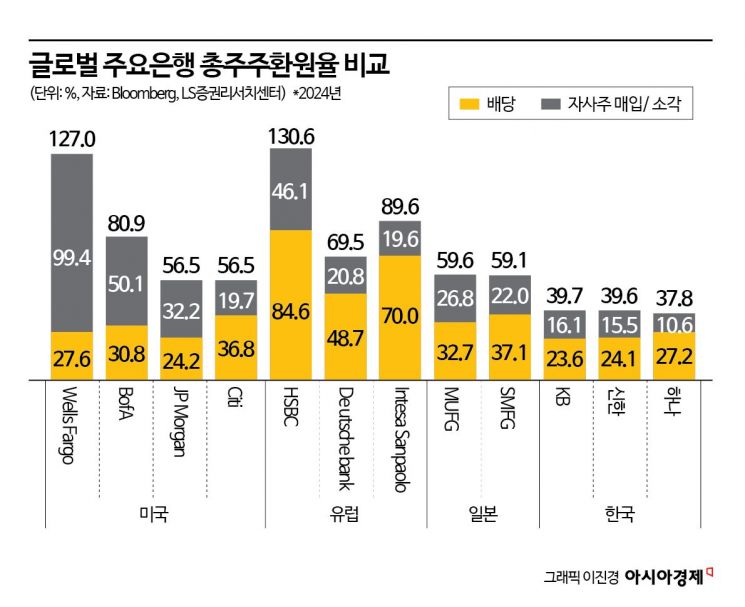

According to LS Securities and Bloomberg on June 9, the total shareholder return ratio of major domestic banks such as KB Kookmin Bank, Shinhan Bank, and Hana Bank was around 37-39% last year. The total shareholder return ratio refers to the proportion of net income used for shareholder returns, including dividends and share buybacks or cancellations.

While the total shareholder return ratio of domestic banks falls short of 40%, major banks in advanced economies such as the United States, Europe, and Japan have ratios of at least 50%, with some even exceeding 100%.

Last year, the total shareholder return ratio of Wells Fargo in the United States reached 127%, while Bank of America recorded 80.9%, and JPMorgan stood at 56.5%. The average total shareholder return ratio of major U.S. banks last year was 80%. U.S. banks are not only characterized by high shareholder return ratios but also by their flexible and proactive capital return policies that respond to changes in management conditions such as external shocks.

In Europe, the average total shareholder return ratio of major banks was 70% last year, the second highest after the United States. HSBC recorded a total shareholder return ratio of 130.6% last year, while Deutsche Bank posted 69.5%. European banks tend to have a higher proportion of dividends compared to share buybacks and cancellations, and their dividend payout ratios are less volatile than those of U.S. banks. Japan's major bank, Mitsubishi UFJ, also posted a total shareholder return ratio of 59.6% last year, higher than that of major Korean banks. Japanese banks are characterized by a stable average total shareholder return ratio in the 50-60% range, with little volatility in the scale of shareholder returns.

Low Shareholder Return Ratio Leads to Undervaluation Compared to Overseas Banks

Analysts point out that the low price-to-book ratio (PBR) of domestic banks compared to major overseas banks is largely due to their low total shareholder return ratios. As of last year, the PBR of major bank holding companies such as Shinhan Financial Group, Hana Financial Group, and Woori Financial Group was around 0.5, with KB Financial Group at about 0.7. In contrast, JPMorgan in the United States has a PBR of around 2, while Wells Fargo and Bank of America are in the range of 1 to 1.5.

Major banks in Europe and Japan also have PBRs above 1. Even Chinese banks such as Industrial and Commercial Bank of China and China Construction Bank, which have lower total shareholder return ratios than Korean banks, recorded slightly higher PBRs than domestic banks. Chinese banks have consistently maintained a dividend payout ratio of 30%, showing little change in shareholder returns over the past five years.

Analysts suggest that in order to resolve undervaluation, banks need to continuously raise their total shareholder return ratios. The market expects the total shareholder return ratio of domestic banks to reach the 50% range, similar to Japan, within a few years. Several banks have already announced plans to enhance corporate value by targeting a 50% total shareholder return ratio by around 2027. Accordingly, it is expected that the total shareholder return ratio of major domestic banks, which fell short of 40% last year, will exceed 40% this year. In particular, KB Kookmin Bank, which is showing the most proactive value-up policy, is expected to surpass a 45% total shareholder return ratio for the first time among domestic banks this year.

Jeon Bae-seung, a researcher at LS Securities, said, "The gap in total shareholder return ratios between domestic banks and those in advanced countries is narrowing," and added, "Among major global bank stocks, domestic banks show the lowest PBR, so the trend of expanding shareholder returns through share buybacks and cancellations, rather than dividends, is expected to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.