Voluntary Real Estate Auctions Surge Nationwide by 21% in One Year...

Yeongkkeuljok Reaching Their Limits

Even the Three Gangnam Districts Are Not Exempt...

997 Cases in Seoul Alone, Successful Bid Prices Soaring

Fixed-Rate Mortgage Reset Period Arrives...

Average Mortgage Interest Rates Jump

This year has seen a sharp increase in the number of real estate properties subjected to 'voluntary auction' due to borrowers failing to pay their loan interest on time. This surge is interpreted as a result of the real estate market slowdown and the arrival of the interest rate reset period for mortgage loans taken out by borrowers who leveraged themselves during the low interest rate era, pushing their repayment burden to the limit.

Voluntary auction is a process in which, if a mortgage borrower is overdue on principal or interest payments for more than three months, the creditor can apply to the court to auction the property without going through a trial. Unlike compulsory auction, the judicial process is omitted, and it is mainly used when the creditor is a financial institution such as a bank.

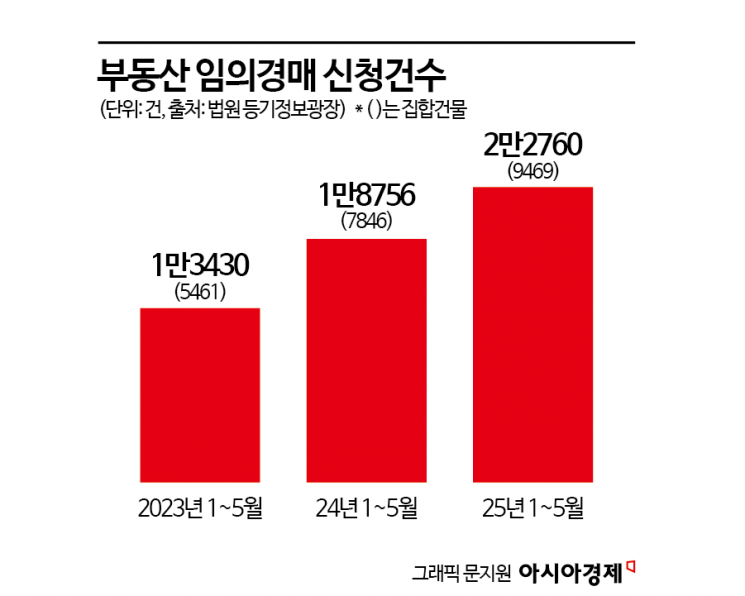

According to the Court Registration Information Plaza on June 7, from January to last month, there were a total of 22,760 real estate properties nationwide for which transfer of ownership was registered due to voluntary auction. This translates to about 150 cases per day on average. The number of voluntary auction applications increased by 21.3% compared to the same period last year (18,756 cases), and by a staggering 69.5% compared to the same period in 2023 (13,430 cases).

Among these, voluntary auction applications for collective buildings (such as apartments, officetels, and multiplex housing) accounted for 9,469 cases, representing 41.6% of the total. This figure marks a 20.7% increase from the previous year. By region, Gyeonggi Province had the highest number with 2,615 cases, followed by Seoul (997 cases), Busan (924 cases), Incheon (859 cases), and South Gyeongsang Province (767 cases). High-priced residential areas were no exception. In Seoul, the three Gangnam districts (Gangnam, Seocho, and Songpa) alone accounted for 158 cases, making up 15.8% of Seoul’s total (997 cases).

While the number of auctioned properties is rising, the atmosphere surrounding successful bids differs significantly by region. Last month, the successful bid rate for Seoul apartments reached 97.7%, the highest in 2 years and 11 months since June 2022. In contrast, the five major metropolitan cities outside Seoul?Busan (76.7%), Daegu (81.8%), Daejeon (81.8%), Gwangju (81.5%), and Ulsan (85.1%)?remained around 80%, indicating that the market remains sluggish in these areas.

The surge in voluntary auctions is also closely linked to the rising delinquency rates of mortgage loans in the Seoul metropolitan area. According to the Bank of Korea, in the first quarter of this year, the delinquency rates for mortgage loans in Seoul, Gyeonggi, and Incheon were 0.34%, 0.30%, and 0.24%, respectively?each marking the highest level since such statistics began to be compiled. A major reason is the significant increase in repayment burdens as the interest rate reset period arrives for 'hybrid' or 'periodic' mortgage loans taken out during the ultra-low interest rate era. As of last month, the average mortgage loan interest rate at banks was 3.98%, about 1.5 percentage points higher than at the end of 2019 (2.45%). For example, if a borrower took out a 500 million won loan at an annual rate of 2.45% in 2019, the monthly repayment was about 1.96 million won, but now it has increased by more than 400,000 won to about 2.38 million won.

Lee Juhyun, a senior analyst at GGI Auction, said, "In most voluntary auction cases, banks are acting as creditors, and the biggest factor is the increased burden of principal and interest repayment on borrowers due to high interest rates." He added, "In particular, the impact is concentrated on the 'Yeongkkeuljok' in the Seoul metropolitan area, who made aggressive investments during the real estate boom." He also stated, "Meanwhile, in the auction market, core locations such as the Gangnam area in Seoul are leading the rise in successful bid rates. Recently, demand has been spreading to areas around land transaction permit zones, so this upward trend is expected to continue for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)