6,369 Net Population Outflow from January to April

Comprehensive Housing Sales Price Index Down 0.75%

Real Estate Demand Drops Amid Population Outflow...

As the populations of regional cities gradually decline, the real estate market downturn is deepening. In Gwangju Metropolitan City, which is considered a prime example of regional decline, the population is steadily decreasing, resulting in fewer transactions, falling prices, and a sharp increase in unsold homes. Other major regional cities such as Busan and Daegu are experiencing similar situations, leading to calls for housing supply management that takes population outflows into account.

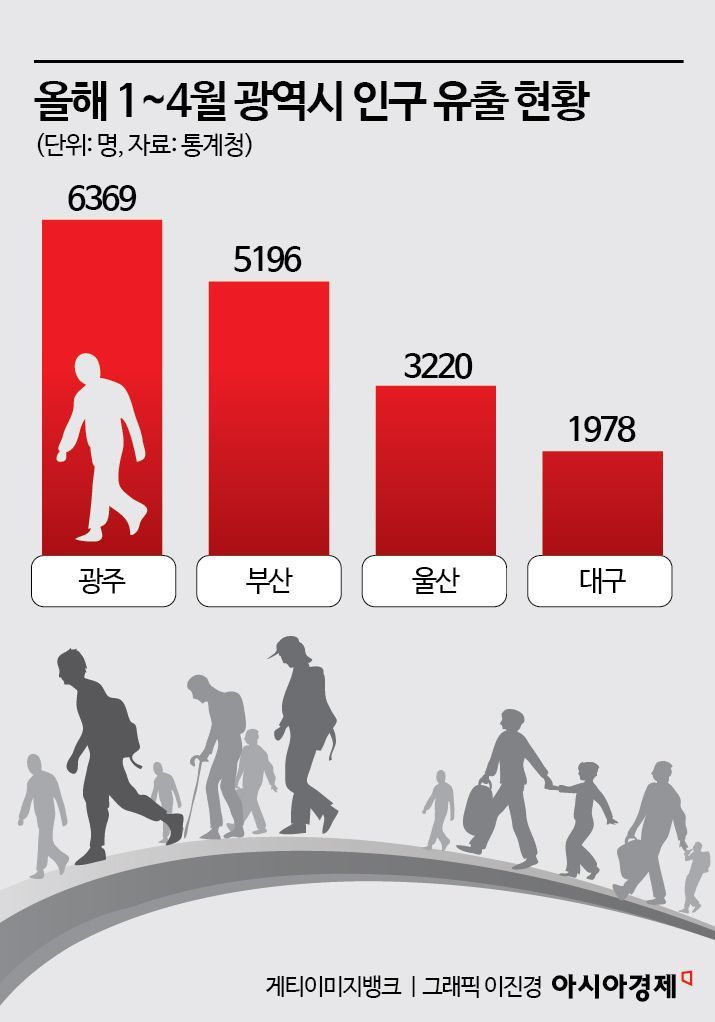

According to Statistics Korea on June 7, Gwangju recorded the highest net population outflow among metropolitan cities nationwide from January to April this year, with a total of 6,369 people leaving the city. The population decreased every month, with the largest outflow occurring in March, the peak moving season, when 2,502 people left Gwangju.

Gwangju: Real Estate Slump Driven by Population Outflow

As net population outflow reduced housing demand, Gwangju’s real estate market has gradually lost its vitality. According to data from the Korea Real Estate Board, Gwangju’s comprehensive housing sales price index fell by 0.75% from January to April. In April alone, the index dropped by 0.31%, which was lower than the average of the five metropolitan cities, at -0.19%.

Transaction volume also declined. In April, the number of housing sales transactions in Gwangju was 1,681, a sharp decrease of 17.8% from the previous month. This was the largest drop nationwide. The number of actual apartment sales transactions was 1,107 in January and 1,660 in March, but fell to 1,025 last month, representing a 7.4% decrease compared to the beginning of the year.

The economic chill in the real estate market caused by people leaving regional areas shows no signs of abating. Busan, which saw a net population outflow of 5,196 people over four months, exhibited similar trends. Busan had the second-largest population outflow after Gwangju. From January to April, Busan’s comprehensive housing sales price index dropped by 0.64%. In April, the number of housing transactions decreased by 1.6% compared to the previous month. In Daegu, which saw a decrease of 1,978 people, the comprehensive housing sales price index fell by 1.41% during the same period.

While demand is declining, housing supply has not slowed, leading to a rise in unsold homes. In April, the number of unsold homes in Gwangju was 1,298, maintaining a level above 1,200 units since December last year. In Busan, unsold homes increased by 4.9% from the previous month to 4,709 units. Daegu recorded 9,065 unsold homes, the second highest after Gyeonggi Province, which had 12,941 units.

As construction costs rise, sales prices are increasing rapidly, but incomes are not keeping pace, resulting in even more unsold homes. In 2023, Gwangju’s per capita Gross Regional Domestic Product (GRDP) was 35.45 million won, up over 50% compared to ten years ago. However, it ranked fifth out of the seven special and metropolitan cities. This figure was more than 11 million won lower than the national average of 46.49 million won. Meanwhile, according to Real Estate R114, the average apartment pre-sale price per 3.3 square meters in Gwangju last year surged by 140% compared to ten years ago, reaching 19.9 million won.

"Urgent Need for Housing Supply Management Based on Local Population"

Experts have analyzed that supply management considering population outflow is necessary. They point out that regions where supply is managed despite population decline have relatively healthier market conditions. In Ulsan, even though the population decreased by 3,220 people from January to April, the comprehensive housing sales price index actually rose by 0.07% during the same period.

Kim Hyosun, Chief Real Estate Analyst at NH Nonghyup Bank, said, "Transaction volume and prices are determined not only by population outflow but also by the level of housing supply. In Ulsan, the amount of new housing supplied during the previous real estate boom was not large, so prices are now on the rise." She added, "As real demand decreases due to population movement, supply plans that fail to reflect this have led to significant differences in real estate market conditions by region. In the past, as long as a project was profitable, homes were built without considering population movement or supply, but going forward, plans must be made by predicting changes in demand."

Kwon Youngsun, Team Leader at Shinhan Bank Real Estate Investment Advisory Center, said, "The best solution is to attract companies to regional cities to increase both population and income, but this is difficult to achieve immediate results. While it is impossible to ignore demand for new homes or apartments, it is necessary to adjust the timing of supply so that it comes after unsold inventory is absorbed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.