All Seven Medical Associations Reach Agreement for the First Time Since 2018

Additional 1.4 Trillion Won Needed for Health Insurance Fund

The fees that the National Health Insurance Service will pay to medical institutions next year will increase by an average of 1.93%. As a result, patients’ out-of-pocket medical expenses will rise, and health insurance premiums may also be increased.

Jung Ki Seok, President of the National Health Insurance Service, is delivering a greeting at the 2026 Long-Term Care Benefit Cost Contract Joint Meeting between the President and Heads of Medical Associations held on the 9th of this month at Seoul Garden Hotel in Mapo-gu, Seoul. Photo by Yonhap News

Jung Ki Seok, President of the National Health Insurance Service, is delivering a greeting at the 2026 Long-Term Care Benefit Cost Contract Joint Meeting between the President and Heads of Medical Associations held on the 9th of this month at Seoul Garden Hotel in Mapo-gu, Seoul. Photo by Yonhap News

On May 31, the National Health Insurance Service announced that, after completing negotiations with seven medical associations?including the Korean Hospital Association?for the 2026 Long-Term Care Benefit Cost Contract, the agreement was reviewed and approved by the Financial Operations Committee. This is the first time since 2018 that contracts were concluded with all seven medical associations without any breakdown in negotiations.

The medical fee is the amount the government pays medical institutions for services from the health insurance fund. It is calculated by multiplying the “relative value score” set for each individual procedure by the “conversion index.”

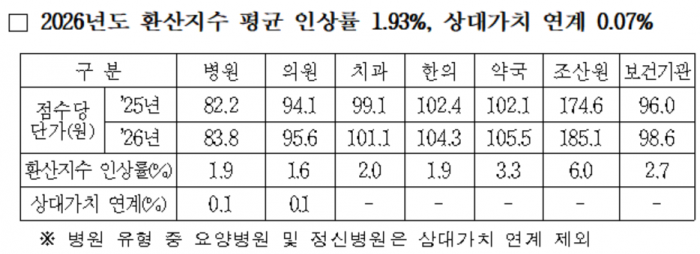

The average conversion index increase rate approved for next year is 1.93%, which is slightly lower than this year’s 1.96%. In previous years, the conversion index increase rate was 2.29% in 2020, 1.99% in 2021, 2.09% in 2022, and 1.98% in both 2023 and 2024.

For next year, the conversion index increase rates by type of medical institution are as follows: hospitals 2.0%, clinics 1.7%, dental clinics 2.0%, Korean medicine clinics 1.9%, pharmacies 3.3%, midwifery centers 6.0%, and public health centers 2.7%. Among these, hospitals and clinics will each receive an additional 0.1% increase for the relative value portion.

Due to the fee increase, an additional 1.3948 trillion won will be required from the health insurance fund. As the financial burden increases, health insurance premiums may also be raised.

The National Health Insurance Service pays fees to medical providers using premiums collected from subscribers, so the outcome of the fee negotiations directly affects the level of premium increases. According to the Service, the financial burden has grown because, in addition to health insurance premiums being frozen for the past two consecutive years, substantial funds have been allocated since last year to support emergency care systems due to medical disputes and to implement essential medical policies.

Kim Namhun, Executive Director of Benefits at the National Health Insurance Service, stated, "This year's fee negotiations took place in an environment that was even more challenging than during the COVID-19 pandemic, due to the medical crisis," and explained, "We made efforts to find a reasonable balance by considering the establishment of an essential medical system, the maintenance of medical infrastructure, the burden on subscribers, and the sustainability of the health insurance fund."

When approving the fee contract results, the Financial Operations Committee also adopted the following supplementary opinions: compliance with the legally mandated government support rate for health insurance, preparation of effective non-covered service management measures, and strengthening of government coverage for dental and Korean medicine types.

The results of the 2026 Long-Term Care Benefit Cost Contract will be reported next month to the Health Insurance Policy Deliberation Committee, the highest decision-making body for health insurance policy.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.