Bank of Korea Reports Q1 Trends in Foreign Currency Securities Investments by Institutional Investors

Bargain Hunting in U.S. Stocks... Increased Investments Driven by Hopes for Fed Rate Cuts

The balance of overseas securities investments by major South Korean institutional investors, such as asset management companies and securities firms, increased by more than $10 billion over the past three months. This growth occurred as institutional investors engaged in bargain hunting despite valuation losses caused by the decline in U.S. stock prices. Expectations of a policy rate cut by the U.S. Federal Reserve (Fed) also contributed to increased investment in bonds.

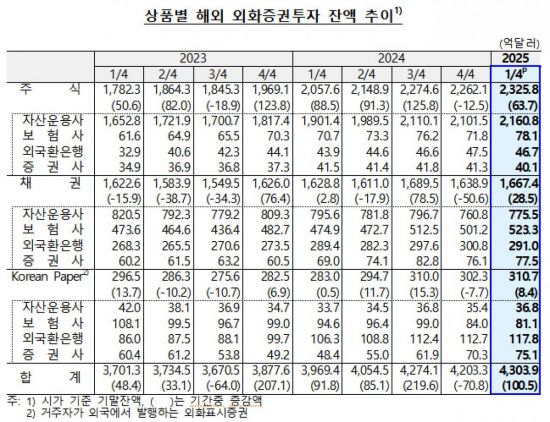

According to the "Trends in Foreign Currency Securities Investments by Major Institutional Investors in Q1" released by the Bank of Korea on May 30, the foreign currency securities investment balance (based on market value) held by major institutional investors?including asset management companies, insurance companies, foreign exchange banks, and securities firms?stood at $430.39 billion as of the end of March 2025. This represents an increase of $10.05 billion (2.4%) compared to the end of last year.

The balance of foreign currency securities investments had increased from $387.76 billion in the fourth quarter of 2023 to $427.41 billion in the third quarter of last year, driven by expanded net investments amid a global stock market rally. However, it then decreased to $420.33 billion in the fourth quarter of last year. Although net investments increased, non-transactional factors such as rising bond yields had a significant impact.

The Bank of Korea explained that the renewed increase in balances this year was due to the inflow of bargain hunting following corrections in U.S. stock prices, as well as continued expectations of a U.S. interest rate cut, which led to expanded net investments in both foreign stocks and foreign bonds.

By product, the balance of foreign stocks reached $232.58 billion, an increase of $6.37 billion compared to the end of last year. Despite valuation losses caused by corrections in U.S. stock prices, net investments?especially by asset management companies?increased significantly. In fact, the U.S. S&P index rose by 2.1% in the fourth quarter of last year but fell by 4.6% in the first quarter of this year.

The balance of foreign bonds stood at $166.74 billion, an increase of $2.85 billion over the same period. Continued expectations of a Fed rate cut, driven by concerns over a slowdown in the U.S. economy, led to expanded net investments by insurance companies and asset management firms. The probability of a Fed rate cut within this year, as reflected in futures rates, rose from 87% at the end of last year to 98% as of the end of March 2025. Korea Paper, which refers to foreign currency-denominated securities issued overseas by domestic companies, increased by $840 million, mainly due to foreign exchange banks and securities firms.

By investor type, the investment balance of asset management companies rose by $7.55 billion from the end of last year to $297.32 billion. Insurance companies also saw an increase of $2.56 billion, bringing their balance to $68.25 billion. Securities firms posted a slight increase of $500 million to $19.27 billion, while foreign exchange banks recorded a decrease of $560 million to $45.55 billion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.