LS Securities analyzed on May 26 that the Chinese cosmetics market has reached a structural recovery inflection point, which will serve as momentum for the domestic sector.

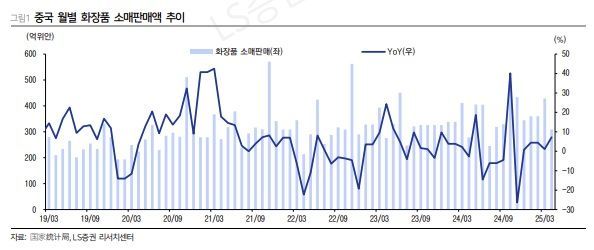

According to the National Bureau of Statistics of China, retail sales of cosmetics in April 2025 amounted to 30.9 billion yuan, up 7.2% compared to the same month last year. The cumulative amount through April this year reached 145.4 billion yuan, representing a 4.0% increase year-on-year.

Orina Oh, a researcher at LS Securities, stated, "Cosmetics retail sales, which ended 2024 with a 1.1% year-on-year decrease, have shown steady recovery this year with four consecutive months of growth." She added, "Considering that the overall retail sales growth rate has increased by 4.7% year-on-year on a cumulative basis this year, it can be judged that cosmetics consumption is maintaining relatively strong demand elasticity." She further noted, "In China, cosmetics consumption is passing an important inflection point of structural recovery this year."

Given that the Chinese cosmetics market is at an inflection point, Oh expects related stocks to be rerated. She emphasized, "It is worth noting that in the first quarter of this year, the performance of brands and ODM companies in China was better than market expectations." She explained, "With the recovery of domestic consumption in China, expansion of premium lineups, optimization of local channels, and the recovery from the worst phase in duty-free shops all occurring simultaneously, the entire sector is expected to show a clear turnaround in the second half of the year." She further stated, "In particular, we believe that consumption momentum in the Chinese market is highly likely to serve as a key catalyst for rerating stock prices within the sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.