Resolution of Distressed PF Slower Than Expected

Buyers Urgently Needed... "A Welcome Rain in a Drought"

Key Issue: Participation in Acquiring Assets Beyond Affiliate Holdings

The news that Hyundai Alternative, an alternative investment asset management company launched by Hyundai Motor Finance, is pursuing a non-performing loan (NPL) business has been welcomed by financial supervisory authorities as well as secondary financial institutions such as savings banks and mutual finance companies. The expectation is that the increase in buyers will help accelerate the resolution of distressed (at-risk and potentially problematic) real estate project financing (PF) across the entire financial sector.

According to Hyundai Card and Hyundai Commercial on May 26, the two companies invested 1.53 billion won and 1.47 billion won, respectively, to establish Hyundai Alternative on May 23. After registering as a corporation in January, the company recently received approval from the Financial Services Commission to register as a general private collective investment business and has now begun operations. In addition to real estate direct investment and private debt fund (PDF) businesses, Hyundai Alternative will also pursue an NPL business focused on real estate-backed debt.

Regarding Hyundai Motor Finance's entry into the NPL business, supervisory authorities and secondary financial institutions welcomed the move, saying it would have a positive impact on the cleanup of distressed PF. The supervisory authorities have announced plans to resolve 16.2 trillion won in distressed PF by the end of next month, but the actual amount resolved is expected to reach only 12.6 trillion won. Securing buyers for distressed PF assets is urgently needed.

Currently, NPL buyers include financial holding company-affiliated NPL investment firms such as Hana F&I and Woori F&I, as well as subsidiaries of mutual finance institutions such as the National Credit Union Federation of Korea and the National Federation of Community Credit Cooperatives. Subsidiaries of the Korea Federation of Savings Banks will also begin operations in the second half of the year, but in order to reduce soundness risks across the entire financial sector, the pace of distressed PF resolution must be further accelerated. According to the Financial Supervisory Service, among all financial sector PF exposures, the proportion of distressed assets is 6% for mutual finance institutions and 4% for savings banks.

An official from the Financial Supervisory Service stated, "The increase in buyers is positive news and will be welcomed by the savings bank and mutual finance sectors," adding, "The key issue is how actively Hyundai Alternative will participate in acquiring distressed PF from savings banks and mutual finance institutions, rather than simply taking over its own card, capital, or commercial NPLs."

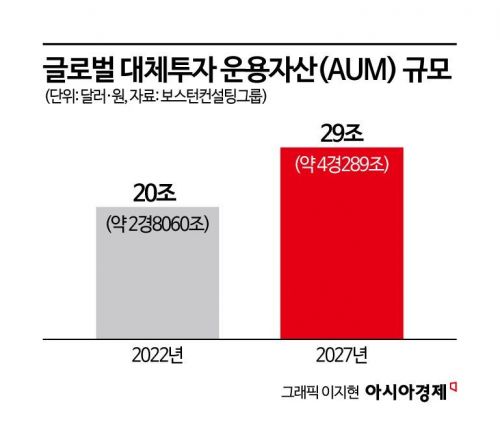

According to the Credit Finance Association, this is the first time a real estate alternative investment management company has been established with 100% investment from a specialized credit finance company. This also indicates Hyundai Motor Finance's active interest in the NPL business. Hyundai Alternative also views the alternative investment business as a favorable arena for attracting institutional investors, given its high growth potential and higher returns compared to traditional assets such as stocks and bonds. A Hyundai Alternative representative explained, "NPL is one of Hyundai Alternative's main business areas," adding, "We are considering expanding into various NPL sectors."

A savings bank industry official commented, "The current NPL market is in a state of oversupply, with few buyers," adding, "While it remains to be seen whether Hyundai Alternative can offer more competitive prices than NPL subsidiaries of secondary financial institutions, if Hyundai Motor Finance's entry strengthens buying power, it will have a positive effect on resolving distressed PF across the entire financial sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.