Notification and Inquiry of New Financial Assets via MyData

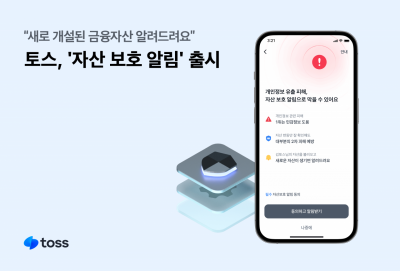

Toss announced on the 21st that it will launch its 'Asset Protection Notification' service.

The Asset Protection Notification is a service that notifies users when a new financial asset is created under their name. If a financial product is opened without the user's knowledge due to reasons such as identity theft, the service alerts the user to prevent further damage.

When applying for the service, users are guided on which financial assets need to be checked via MyData. MyData is a system that helps users manage information scattered across multiple financial institutions in one place. Toss utilizes this system to allow users to check newly opened bank deposit and savings accounts, loan accounts, and credit and debit cards.

When a service user accesses the Toss MyData service, the system checks once per day with connected financial institutions to see if there are any new assets under the user's name. If assets requiring verification are found, the user receives a notification. Even if the app is not accessed, users receive a weekly notification if a new financial asset is created.

If a financial product that the user did not directly open or issue is detected through the Asset Protection Notification, the service provides guidance on how to prevent further damage. This includes requesting a transaction freeze from the affected financial institution, reporting to investigative authorities, and blocking small payments via telecommunications companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.