More Than 40% Increase Compared to Previous Month

Stocks: 373.4 Billion Won, Corporate Bonds: 30.4285 Trillion Won

In April, the amount of funds raised by domestic companies through the issuance of stocks and corporate bonds exceeded 30 trillion won, marking an increase of more than 40% compared to the previous month. This is interpreted as companies proactively securing funds in response to increased uncertainty stemming from U.S. tariff policies.

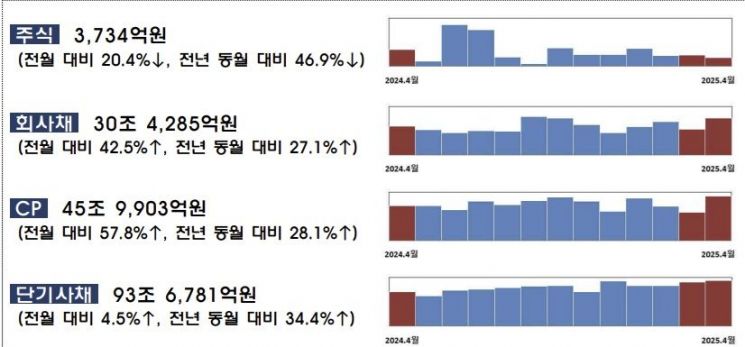

According to the "Direct Financing Performance of Companies in April 2025" announced by the Financial Supervisory Service on May 20, the total amount of stocks and corporate bonds issued by companies in April 2025 was 30.8019 trillion won, an increase of 8.985 trillion won (41.2%) from the previous month.

The amount raised through stock issuance was 373.4 billion won, a decrease of 95.7 billion won (20.4%) from the previous month. This was due to a decline in both the number of initial public offerings (IPOs) and paid-in capital increases.

Last month, there were a total of 5 IPOs, raising 90.9 billion won. In the previous month, there had been 8 IPOs, raising 168.9 billion won. Paid-in capital increases also decreased to 1 case, raising 282.5 billion won, compared to 6 cases and 300.2 billion won in the previous month.

On the other hand, the amount of corporate bonds issued was 30.4285 trillion won, an increase of 9.0807 trillion won (42.5%) from the previous month.

A total of 87 general corporate bonds were issued, amounting to 8.883 trillion won. Both the number of issuances and the total amount increased compared to the previous month, which saw 49 issuances totaling 4.202 trillion won.

The Financial Supervisory Service explained, "Corporate bond issuance increased significantly compared to the previous month, especially for general corporate bonds, as companies expanded proactive funding in response to uncertainty over U.S. tariffs."

In terms of the purpose of funding, the proportion of corporate bonds issued for refinancing purposes decreased from 91.8% to 86.9%. In contrast, the proportion issued for operating purposes increased from 8.2% to 12.6%.

By credit rating, the amount of corporate bonds rated AA or higher was 6.18 trillion won, while A-rated bonds accounted for 2.443 trillion won. Bonds rated BBB or lower amounted to 100 billion won.

By type, financial bonds totaled 19.9662 trillion won, an increase of 4.7403 trillion won (31.1%) from the previous month. The number of issuances also increased from 207 to 269. Financial holding company bonds amounted to 950 billion won, a slight decrease from 1.1 trillion won in the previous month.

Bank bonds totaled 7.7852 trillion won, an increase of 4.5791 trillion won (142.8%) compared to the previous month. The number of issuances doubled from 17 to 34. Other financial bonds also increased to 11.231 trillion won, up 311.2 billion won (2.8%) from the previous month. The number of issuances increased from 182 to 227.

Asset-backed securities (ABS) amounted to 1.5793 trillion won, a decrease of 304.6 billion won (17.7%) from the previous month. However, the number of issuances increased from 109 to 111.

Last month, the amount of commercial papers (CP) and short-term bonds issued was 139.6684 trillion won, an increase of 20.8385 trillion won (17.5%) from the previous month. Of this, CP issuance was 45.993 trillion won, up 16.8403 trillion won (57.8%) from the previous month, while short-term bonds totaled 93.6781 trillion won, an increase of 3.9982 trillion won (4.5%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.