The Second Baby Boom Generation Begins to Retire...

Elderly Self-Employed to Reach 2.48 Million by 2032

Elderly Self-Employed Concentrated in Vulnerable Sectors Like Parcel and Quick Services

Profitability Falls, Debt Ratios Rise...

After Business Closure, Many Shift to Temporary or Daily Wage Jobs

Bank of Korea Reiterates the Need for 'Post-Retirement Reemployment'

"Reduce Salaries but Ensure Stability"

Service Industries Like Coupang and Emart Should Create Demand Through Scaling Up, Not Regulation

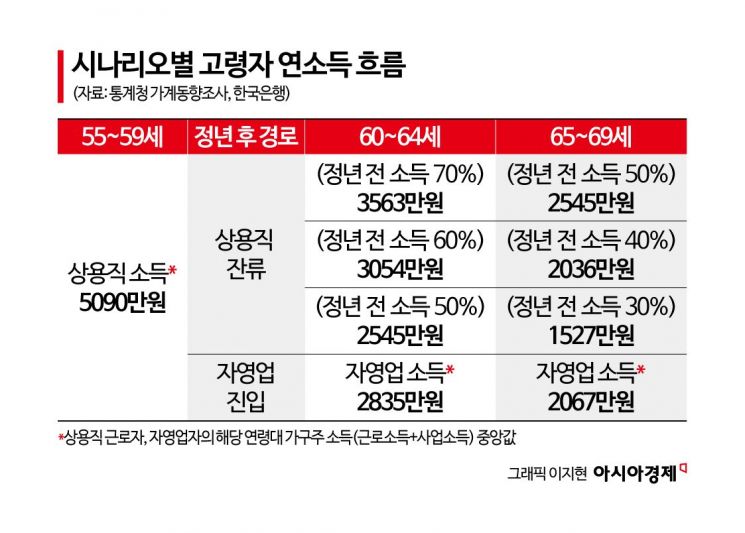

It has been found that even if annual salaries are reduced by 40?60% after the age of 60, remaining as a regular employee yields similar or higher earnings compared to starting a business at that age. Since last year, the so-called "second baby boom" generation, born between 1964 and 1974 and numbering 9.54 million, has begun to retire. Many are entering self-employment due to limited options, prompting calls to quickly strengthen post-retirement reemployment systems. If this trend continues, the number of elderly self-employed workers?who are concentrated in vulnerable sectors such as parcel delivery and quick service, have lower profitability, and higher debt ratios?is expected to surge to 2.5 million by 2032, posing risks to financial stability and economic growth.

Lee Jaeho, Deputy Director of the Macro Analysis Team at the Bank of Korea's Economic Research Department, shared these findings at the "Rising Elderly Self-Employment: Causes and Policy Responses" presentation during a joint symposium by the Bank of Korea and the Korea Development Institute (KDI) held in Sejong City on May 15. Lee explained that even if income is adjusted after age 60, there is a strong incentive to prefer wage jobs if continued employment is possible.

According to the analysis, if workers continue as regular employees after retirement, earning 60% of the income they made as regular employees aged 55?59 between the ages of 60 and 64, and 40% of that income through part-time work between 65 and 69, their income trajectory is similar to that of those who enter self-employment after retirement. Lee emphasized, "Given the high transition and startup costs and increased income volatility associated with self-employment, elderly retirees are more likely to choose regular employment if continued work is guaranteed, even if their income decreases compared to before."

The 'Second Baby Boom' Generation Begins to Retire... Elderly Self-Employed to Reach 2.48 Million by 2032

The second baby boom generation, born between 1964 and 1974, numbers 9.54 million?the largest single generation in South Korea. Since last year, they have been reaching the statutory retirement age of 60 in succession. Due to a shortage of regular jobs for retirees, a significant portion of this group is expected to enter self-employment. As a result, the number of self-employed individuals aged 60 and over is projected to increase from 1.42 million in 2015 to 2.48 million by 2032.

The problem is that elderly self-employed individuals are less prepared for entrepreneurship compared to other age groups, and tend to be concentrated in vulnerable sectors such as transport and warehousing (including parcel and quick services), as well as accommodation, food, and retail, which have lower profitability and higher debt ratios. After closing their businesses, many find it difficult to recover as they often transition to temporary or daily wage jobs. Lee pointed out, "This rapid increase poses risks not only to financial stability but also to economic growth."

A large proportion of elderly workers who become self-employed after retirement do so based on the expectation that they will be able to work longer than in wage employment. When elderly re-employed self-employed individuals are categorized by pension level and working hours, 46% fall into the "livelihood type" (monthly pension of 790,000 won and 46 working hours per week), characterized by low pension levels and long working hours. These livelihood-type elderly self-employed mainly work in vulnerable sectors, are exposed to excessive competition, and place the highest importance on the possibility of continued work, demonstrating strong work motivation despite insufficient retirement preparation.

Lee stressed the need to encourage the elderly to continue working in stable wage jobs even after reaching retirement age. Although the number of elderly self-employed is expected to continue rising due to the mass retirement of the second baby boom generation and the high rate of current self-employed individuals remaining in business, Lee warned that low productivity and excessive competition in certain sectors could increase not only the vulnerability of individual households but also macroeconomic risks.

Strengthening 'Post-Retirement Reemployment' Is Needed to Reduce Involuntary Elderly Self-Employment

To address these issues, Lee argued that the "post-retirement reemployment system" needs to be strengthened. This aligns with the findings of the Bank of Korea's report, "Super-Aged Society and Measures for Continued Employment of the Elderly," released on April 8. As a measure to promote continued employment among the elderly, Lee suggested that the government should initially encourage the spread of voluntary reemployment systems through incentives such as subsidies, and then gradually impose reemployment obligations on companies. In Japan, since 2006, the government has required companies to secure employment for the elderly, with the scope and age requirements gradually expanding.

Lee also noted the need to scale up the service industry to create more wage jobs in sectors where many elderly self-employed workers, such as Coupang and Emart, are employed. Increasing productivity and scaling up the service industry is expected to help convert many self-employed jobs into wage employment. Lee predicted, "With the advancement of ICT, global competition in the service sector will intensify, making productivity improvement in South Korea's service industry even more essential." He argued that, under these circumstances, it is more desirable to promote structural changes in line with global trends, rather than imposing excessive regulations that run counter to changes in the service sector.

Lee also explained that strengthening the matching between local small and medium-sized enterprises (SMEs) suffering from labor shortages and elderly workers could be another solution. According to the Korea Chamber of Commerce and Industry, 51% of companies outside the Seoul metropolitan area cited securing manpower as their biggest operational challenge. Lee stated, "Encouraging the elderly to choose wage employment over self-employment will greatly help address the labor shortage faced by regional companies. However, for this to be effective, local governments must also work to improve living conditions." He also emphasized the need for retraining to adapt to industrial changes such as digital transformation. Lee assessed, "The second baby boom generation, now entering retirement age, has strong human capital and IT skills, so they should be able to adapt to changes relatively quickly."

Meanwhile, in cases where retirees are forced into self-employment due to unavoidable circumstances, Lee suggested several measures: strengthening support so that the elderly can prepare for entrepreneurship in fields related to their previous jobs from an earlier age; expanding pre-registration education for business owners in highly competitive sectors such as cafes and chicken restaurants; and promoting joint purchasing among self-employed individuals and improving distribution structures through the use of joint purchasing platforms. Lee stressed, "Financial and tax support should be targeted at vulnerable self-employed individuals."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.