Acquisition of 58.62% Stake in Ourhome Completed

Purchase of 58.62% Stake from Koo Bonseong and Koo Mihyun for 870 Billion Won

Officially Incorporated as a Hanwha Affiliate

Synergy Expected in Robotics, Food Tech, and New Group Businesses

Hanwha Group has completed the acquisition of Ourhome, the country’s second-largest food service company, marking its return to the group catering market after five years.

Hanwha Hotels and Resorts, a service affiliate of Hanwha, announced on May 15 that it had completed the payment for the acquisition of shares in Ourhome and finalized the contract. Over 98% of the unlisted company’s shares were previously held by the late Koo Ja-hak’s one son and three daughters. The eldest son, former Vice Chairman Koo Bonseong, held 38.56%; the eldest daughter and current Chairwoman Koo Mihyun held 19.28%; the second daughter Koo Myungjin held 19.6%; and the youngest, former Vice Chairwoman Koo Jieun, held 20.67%.

Hanwha has secured a 58.62% stake in Ourhome, which includes shares held by former Vice Chairman Koo Bonseong and Chairwoman Koo Mihyun. The total acquisition price for this stake is 869.5 billion won. The first phase of the transaction, involving the acquisition of 50.62% of the shares and a payment of 750.8 billion won, has been completed. Within the next two years, Hanwha plans to acquire an additional 8% stake from former Vice Chairman Koo Bonseong for 118.7 billion won.

Acquisition Completed After Seven Months

This deal was led by Kim Dongseon, Vice President of Future Vision at Hanwha Galleria and Hanwha Hotels and Resorts, and took about seven months since October last year. Previously, Hanwha Hotels and Resorts established a special purpose company (SPC) called Woorijib F&B in February and received merger approval from domestic and overseas government agencies last month. The transaction was initially expected to be finalized on April 29, but was delayed by more than two weeks due to a holdup in merger approval from the Vietnamese government, where Ourhome operates an overseas catering business.

With the completion of the acquisition, Ourhome has officially become a Hanwha affiliate. An extraordinary shareholders’ meeting will be held soon, and changes to the Ourhome board of directors are expected. Currently, the board includes Chairwoman Koo Mihyun, her husband Lee Youngyeol, and Koo Jaemo, the son of former Vice Chairman Koo Bonseong, all serving as inside directors.

During the acquisition process, opposition from former Vice Chairwoman Koo Jieun, who holds over 20% of the shares, was considered the biggest variable. However, she did not take direct legal action, such as filing an injunction to block the sale or exercising her right of first refusal. It is reported that she attempted to raise funds to block Hanwha’s acquisition but was unable to secure a financial investor (FI) in the process.

Unlike the eldest son and eldest daughter of the owner family, who agreed to sell their shares to Hanwha, former Vice Chairwoman Koo Jieun and Koo Myungjin have opposed the sale. There is interest in whether they will remain as major shareholders in Ourhome under new ownership. An industry insider commented, "Although Koo Jieun may voice her opinions as a shareholder, since a majority stake has been transferred to Hanwha without major conflict, the likelihood of a management dispute appears low."

Dongseon Kim, Vice President of Future Vision at Hanwha Galleria and Hanwha Hotels and Resorts. Photo by Hanwha Galleria

Dongseon Kim, Vice President of Future Vision at Hanwha Galleria and Hanwha Hotels and Resorts. Photo by Hanwha Galleria

Synergy Expected in Catering Automation and Food Tech

This marks Hanwha’s reentry into the group catering market for the first time in five years since 2020. At that time, Hanwha Hotels and Resorts sold its food distribution and group catering division (now Foodist) to domestic private equity fund VIG Partners for 100 billion won, exiting the business. With the acquisition of Ourhome, attention is focused on whether Hanwha will bring changes to the domestic group catering landscape.

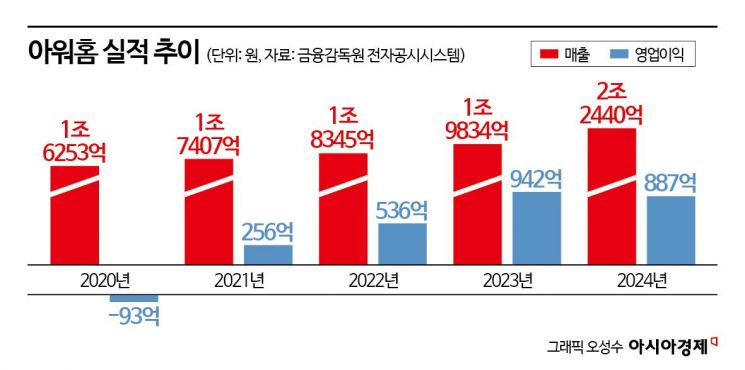

Ourhome achieved sales of 2.244 trillion won last year, surpassing 2 trillion won in annual revenue for the first time since its founding. It ranks second in the industry after Samsung Welstory, which recorded 3.1818 trillion won in sales last year. In 2020, when COVID-19 hit, Ourhome’s sales dropped to 1.6253 trillion won with an operating loss of 9.3 billion won, but the company quickly recovered from the following year. This performance was achieved through various businesses, including group catering, food distribution, concession (food and beverage outsourcing), and home meal replacement (HRM). With this acquisition, Hanwha now has an opportunity to secure catering contracts for its affiliates. The departure of Ourhome, which is part of the broader LG group, may also intensify competition among LG affiliates for catering contracts.

A Hanwha Hotels and Resorts official stated, "With Hanwha Hotels and Resorts and Ourhome, both of which have achieved various successes in leisure and food and beverage over a long period, becoming one family, the competitiveness of both companies will be further strengthened."

There is also speculation about new business ventures and collaboration opportunities eyed by Vice President Kim. Kim leads Hanwha’s distribution, dining, hotel, leisure, and robotics businesses. He is particularly interested in the food tech sector, which is valued at 450 trillion won globally. In February last year, the food service subsidiary of Hanwha Hotels and Resorts, The Tastable, was renamed Hanwha Foodtech. The company expects that the acquisition of Ourhome will accelerate the development of food tech and kitchen automation.

A Hanwha Hotels and Resorts representative said, "Together with Ourhome, which stands out in catering and food distribution, we will lead seismic shifts not only in the domestic but also in the global food market," adding, "Now that we are one family with Hanwha, we will pursue various collaborations with other affiliates within the group."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.