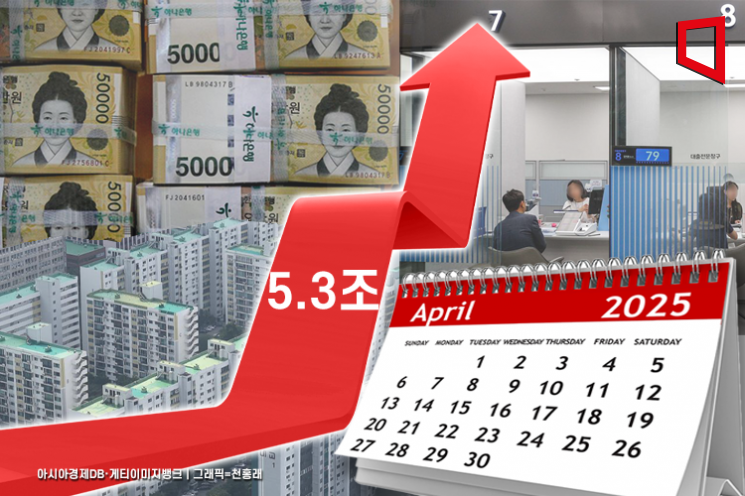

Sharp Increase in Household Loans in April

Driven by Surge in Housing Transactions After Temporary Suspension of Toheje

Authorities Vow to "Strengthen Monitoring"

Following the lifting of the Land Transaction Permit System (Toheje) in February, household loans saw a significant increase last month.

According to the Financial Services Commission and the Financial Supervisory Service on May 14, household loans across all financial sectors increased by 5.3 trillion won in April compared to the previous month. This figure far exceeds the 700 billion won increase recorded in March. In terms of monthly growth, this is the largest increase in six months since October of last year, when loans rose by 6.5 trillion won.

Financial authorities explained that the surge in housing-related loans in February and March was actually executed in April, leading to a sharp rise in mortgage loans. The market attributes the surge in housing transactions to the Seoul Metropolitan Government’s temporary suspension of the Toheje in February.

Authorities assessed that the increase in other loans, mainly unsecured credit loans, was driven by heightened demand for funds amid increased volatility in the stock market in April.

Breaking down household loans by category, mortgage loans increased by 4.8 trillion won in April, with the growth rate accelerating compared to the previous month (3.7 trillion won). In the banking sector, the increase widened from 2.5 trillion won in March to 3.7 trillion won in April, while in the non-banking sector, the growth slightly slowed from 1.2 trillion won to 1.1 trillion won.

Other loans rose by 500 billion won, reversing the previous month’s decline of 3 trillion won. This turnaround is mainly attributed to the increase in unsecured credit loans, which shifted from a decrease of 1.2 trillion won in March to an increase of 1.2 trillion won in April.

By sector, household loans in the banking sector increased by 4.8 trillion won, an expansion from the 1.7 trillion won rise in the previous month. Specifically, the increase in bank-originated mortgage loans widened, and policy loans also saw a slight increase. Other loans also shifted to growth compared to the previous month, mainly due to the rise in credit loans.

In the non-banking sector, household loans increased by 500 billion won, reversing the 900 billion won decline recorded in the previous month. Savings banks and insurance companies saw their household loans return to growth, while the decline in loans from credit card companies narrowed. In the mutual finance sector, the growth rate slowed somewhat compared to the previous month.

An official from the financial authorities stated, "Although household loans increased by a relatively large amount in April compared to March, considering the annual household loan management targets and other factors, the situation remains within a manageable range so far."

However, the official added, "We cannot rule out the possibility that household loan growth may accelerate, given expectations for interest rate cuts, increased demand for funds during Family Month in May, and the implementation of the third-stage Stress Total Debt Service Ratio (DSR) scheduled for July 1."

The official further emphasized, "We will continue to take active measures to manage household debt, including strengthening monthly, quarterly, and regional monitoring of household loans, and encouraging financial institutions to implement proactive self-management, all under close cooperation among relevant agencies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.