Concerns Rise Over Stablecoins Like Tether Undermining Stability of Existing System

Useful as a Means of Transaction, but Vulnerable to Market Shocks and Issuer Reliability Issues

Need Raised for Regulation Distinct from General Virtual Assets

As stablecoins rapidly emerge as a new means of payment, concerns are growing that they could undermine the stability of the existing currency system. Experts have pointed out that if the introduction of stablecoins cannot be prevented, a variety of institutional measures must be quickly established to mitigate the anticipated side effects.

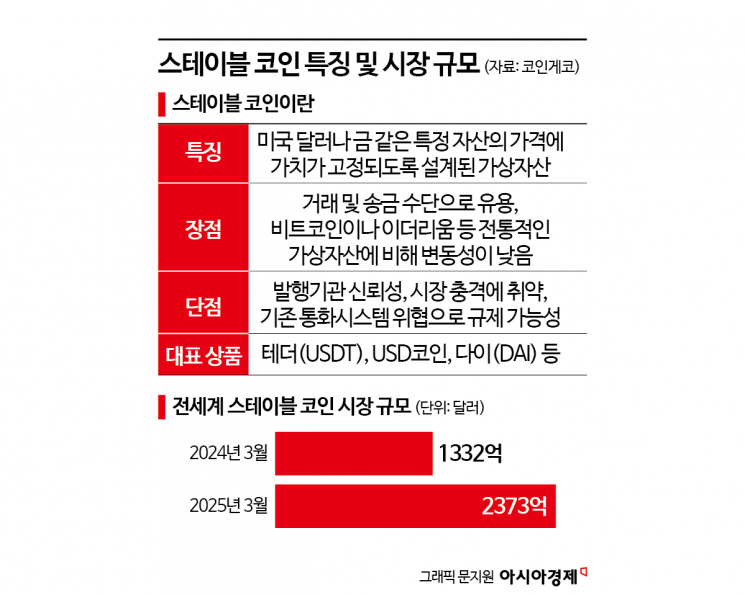

According to the Korea Institute of Finance and the virtual asset statistics platform CoinGecko on May 13, the global stablecoin market reached $237.3 billion (333 trillion won) at the end of March 2025, nearly doubling from $133.2 billion (186 trillion won) in March 2024. Stablecoins are virtual assets designed so that their value is fixed to the price of a specific asset, such as the US dollar or gold. Tether (USDT) and USD Coin, which are pegged one-to-one to the value of the dollar, are representative examples.

As the market has expanded rapidly, the volume of stablecoins circulating in South Korea has reached as much as 80 trillion won in recent months, leading to a surge in transactions. Offline currency exchange offices handling stablecoins have already appeared in central areas such as Gangnam and Myeong-dong in Seoul, and check cards that can be used with stablecoins are also in use, indicating that stablecoins are increasingly penetrating everyday life.

However, as the public influence of stablecoins grows, experts are expressing concerns about various side effects. Lee Jeongdu, Senior Research Fellow at the Korea Institute of Finance, stated, "Since stablecoins require financial institutions for issuance, reserve asset management, and redemption, any problems that arise may be transmitted to the traditional financial system." He added, "Such issues were also highlighted during the bankruptcy of the US virtual asset exchange FTX and the collapse of Silvergate Bank in the United States in the past."

Lee further pointed out, "As the volume of stablecoins in circulation increases, the need to strengthen institutional measures for user protection is also growing." He emphasized, "Above all, it is necessary to establish institutional mechanisms to ensure the fulfillment of promises regarding value stability and redeemability, which are distinguishing features of stablecoins compared to other virtual assets, in order to protect users." He also added, "It is urgent to supplement monitoring systems to prevent various illegal transactions that could occur due to uncontrolled flows of funds. Regarding the domestic circulation of foreign currency-based stablecoins, it is necessary to examine whether there are any loopholes in foreign exchange management and to actively discuss measures to prevent regulatory gaps."

Lee plans to present these points at a joint financial conference hosted by the Korean Economic Association, the Korea Institute of Finance, and the Capital Market Institute, which will be held at the Bankers Club in Jung-gu, Seoul, on the afternoon of May 13. He explained, "It is necessary to separately classify types of stablecoins that are distinct from general virtual assets under the current Virtual Asset User Protection Act and to establish an institutional framework for their issuance and distribution." He continued, "Considering the virtual asset characteristics and enhanced payment functions of stablecoins, it would be reasonable to utilize the so-called Digital Asset Basic Act and the Electronic Financial Transactions Act, which are currently being promoted as secondary legislation."

Kim Youngsik, Professor at the Department of Economics at Seoul National University, also analyzed in his presentation on May 13, "Stablecoins pegged to legal tender are emerging as a new form of private money in the digital economy, thereby influencing the monetary system." He expressed concern, "Stablecoins issued by fintech (finance + technology) companies, as a form of digital bearer certificate, could undermine the singularity of privately issued money."

Professor Kim stated, "Stablecoins collateralized by legal tender are recognized as electronic money under regulation, and their public nature and credibility may vary depending on the issuer." He further noted, "Ultimately, it is desirable for central bank digital currency (CBDC) to serve as the anchor of the digital currency system, with bank-issued stablecoins or deposit tokens complementing it, transitioning to a digital dual currency system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)