Net Interest Margin of Top Five Banks Falls to 1.71% in Q1

Down 0.11 Percentage Points from Q1 Last Year

Declining Trend Expected to Continue Due to Ongoing Benchmark Rate Cuts

In the first quarter of this year, domestic banks recorded their highest-ever net profits, but their net interest margin (NIM) fell sharply. This was due to lower lending rates following a cut in the benchmark interest rate. As there is a high likelihood that rates will continue to fall in the second half of the year, there are concerns that it will be difficult for banks to defend their NIMs.

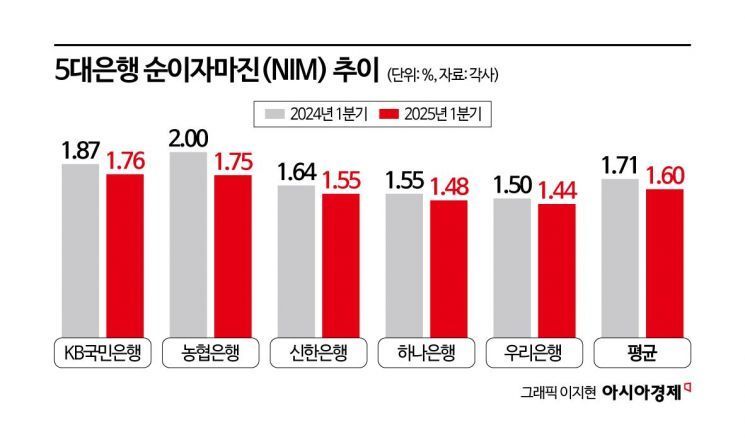

According to the financial sector on May 7, the average NIM of the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NongHyup) in the first quarter was 1.60%, down 0.11 percentage points from 1.71% in the first quarter of last year.

By bank, Kookmin Bank's NIM for the first quarter was 1.76%, down 0.11 percentage points from the same period last year. During the same period, Shinhan's NIM fell by 0.09 percentage points, Hana's by 0.07 percentage points, and Woori's by 0.06 percentage points. NongHyup Bank recorded the largest decline, with its NIM falling by 0.25 percentage points from 2.00% to 1.75%.

NIM is calculated by subtracting funding costs from financial institutions' income and dividing by total operating assets. In simple terms, it is an indicator of how much a financial company is earning from interest income. A decline in NIM means that interest income is decreasing.

The decline in domestic banks' NIM in the first quarter is interpreted as being caused by lower lending rates following a cut in the benchmark interest rate. According to the Bank of Korea, as of March, the average lending rate on new loans at domestic deposit banks was 4.36%, down 0.78 percentage points from 5.14% at the end of 2023. During the same period, the Bank of Korea's benchmark rate fell by 0.75 percentage points, from 3.50% to 2.75%.

However, despite the decline in NIM, domestic banks posted results in the first quarter that exceeded market expectations, mainly because non-interest income improved significantly rather than interest income. In particular, there was a significant base effect from the absence of the 1.3 trillion won in provisions that banks had set aside in the first quarter of last year to cover losses from Hong Kong H Index equity-linked securities (ELS).

As the Bank of Korea is expected to continue lowering its benchmark rate, there are forecasts that the downward trend in banks' NIMs will persist for the time being. The market expects the Bank of Korea to cut the benchmark rate once or twice within this year to counteract the economic slowdown. Park Hyejin, a researcher at Daishin Securities, predicted, "If two additional benchmark rate cuts are implemented this year, the NIM of commercial banks could fall by an additional average of 0.02 to 0.03 percentage points."

Worsening management conditions, such as rising loan delinquency rates and increasing non-performing loans (NPLs), are also negative factors for banks' performance in the second half of the year. At the end of the first quarter, the average overall loan delinquency rate for the five major banks was 0.41%, up 0.07 percentage points from 0.34% at the end of last year. In February, the delinquency rate on credit card loans at domestic commercial banks reached 3.8%, the highest level in 20 years since May 2005 (5.0%). This suggests that more vulnerable borrowers are taking out high-interest card loans despite the high rates but are increasingly unable to repay them properly.

The amount of NPLs with delinquency periods of three months or more also reached an all-time high of 12.615 trillion won at the end of the first quarter for the four major banks, up 27.7% from the same period last year. A commercial bank official explained, "As the economic downturn continues, asset quality indicators such as delinquency rates and NPLs are worsening, especially among vulnerable borrowers such as small business owners."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.