Most of the Portfolio Consists of Illiquid Assets

Liquidation Takes Time and Discounted Sales Are Inevitable

The Yale Model Made US Universities Wealthy

But in the Trump Era, It Has Become a Weakness

Due to issues related to antisemitism and diversity, equity, and inclusion (DEI), US President Donald Trump has halted various research funding for Harvard University and has threatened to revoke its tax-exempt status and ban the admission of international students. Harvard University, which has been in conflict with the US administration, is now unable to receive federal support and is even considering layoffs. The frozen support amounts to approximately $2.2 billion (about 3.14 trillion won). Although this is a small amount compared to the $50 billion in endowment funds that Harvard has accumulated over the past several decades, the impact is significant.

Harvard, with an endowment of 76 trillion won, considers layoffs

Protesters opposing the US federal government's decision to freeze support for Harvard University. Photo by AFP

Protesters opposing the US federal government's decision to freeze support for Harvard University. Photo by AFP

The Trump administration announced on April 15 (local time) that it would freeze $2.2 billion in federal funding for Harvard University. The White House issued a statement claiming the measure was to combat rampant antisemitism on campus, but Harvard publicly opposed the decision, calling it "educational control." As a result of the funding freeze, layoffs are expected within Harvard. According to CNN, Harvard Medical School is preparing for possible staff reductions, and the Harvard T.H. Chan School of Public Health is already proceeding with layoffs and reducing its doctoral program enrollment.

As of last year, Harvard University held an endowment of $53.4 billion (about 76 trillion won). However, it is reported that even with such a vast endowment, the university cannot fully make up for the reduced federal funding. In fact, Harvard covers only one-third of its annual budget with endowment income, relying on government support, tuition, and other revenue sources for the remainder.

The blind spot of wealthy US universities... Most endowment assets are illiquid

Harvard is not the only educational institution affected by the freeze in government support. Most Ivy League universities, which have also accumulated tens of trillions of won in endowment funds, depend on government funding for their operations. This is due to the illiquidity of most endowment assets.

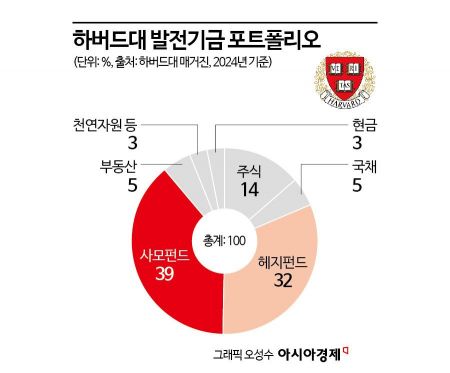

Harvard's endowment portfolio consists of 19% in "public liquidity and bonds," which are investments in stocks, government bonds, and similar assets. These are liquid assets that can be sold and converted to cash at any time. The remainder is invested in hedge funds, private equity, natural resources, and real estate?assets that are considered illiquid and difficult to sell quickly.

For example, university endowments invest in hedge funds and private equity through limited partnerships (LPs). If there is an urgent need to withdraw capital, the endowment must negotiate to find another institution to take over the LP. This process is highly complex and time-consuming. Furthermore, investments in hedge funds and private equity carry significant risk and are avoided during economic downturns. Ultimately, endowments may have to apply a discount to the LP to achieve a successful sale. A "haircut"?reducing the asset's value to reflect market realities?also affects the valuation of other high-risk assets held by the endowment, which can rapidly shrink the total assets.

The vulnerability of David Swensen's Yale Model

David Swensen, who was recruited in 1985 as the chief investment officer at Yale University and created the "Yale Model." Photo by Yonhap News

David Swensen, who was recruited in 1985 as the chief investment officer at Yale University and created the "Yale Model." Photo by Yonhap News

Not only Harvard, but the majority of US university endowment portfolios are composed of illiquid assets. In fact, this endowment management strategy was first devised at Yale University and has since been known as the "Yale Model." Before the Yale Model, endowment managers favored the "60/40 model," a simple strategy of allocating 60% to stocks and 40% to bonds. While this approach yielded relatively lower returns, it was easier to manage during crises when asset values fluctuated sharply, and assets could be sold quickly if cash was needed.

However, in 1985, David Swensen, who was recruited as Yale's chief investment officer, abandoned the 60/40 model and pushed his own strategy. This involved "diversified investment" in private equity, hedge funds, and resources?assets that are difficult to liquidate but offer much higher returns. Swensen's Yale Model achieved an average annual return of 13.4% over 20 years, enabling US universities to amass huge endowments and enhance their competitiveness.

The Yale Model, which brought prosperity to American universities, is now facing rapidly changing circumstances. Even within the US academic community, voices are pointing out the vulnerabilities of the Yale Model. Leonard Milberg, founder of the investment firm Milberg Factors, wrote in an op-ed for the Princeton University student newspaper on April 8, "There are two risks to illiquid assets. First, it is difficult or impossible to sell assets without a significant discount. Second, it is hard to accurately value these assets," adding, "These drawbacks did not stand out during boom times, but this is not the case in the Trump era. Universities must be prepared for large-scale endowment withdrawals."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.