Number of Funeral Service Subscribers Expected to Exceed 9 Million

Surge in Conversion Services Targeting the MZ Generation

Education and Rental Industries Enter the Market... Competition Intensifies

The domestic funeral service market has finally surpassed the 10 trillion won mark. As South Korea enters a super-aged society, demand for funeral and senior care services is increasing, and the MZ generation (Millennials and Generation Z), which has emerged as a new consumer base, is rapidly entering the market. In addition, companies from outside the industry?such as Woongjin, Daekyo, and Coway?have identified the funeral service business as a future growth engine and have entered the market. With the 'total life care' strategy, which covers the entire customer life cycle, at the center, competition for market leadership is expected to intensify.

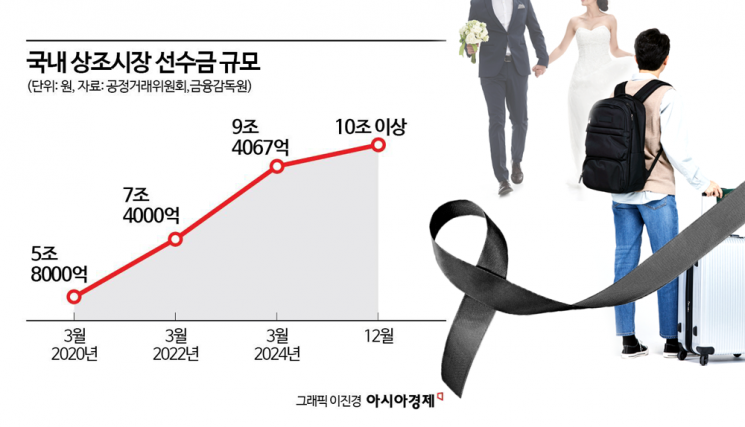

According to the funeral service industry on April 22, as of the end of last year, the amount of advance payments in the domestic funeral service market exceeded 10 trillion won. According to the Fair Trade Commission's announcement in June last year, as of the end of March of that year, the total amount of advance payments held by 77 prepaid installment sales companies was 9.4486 trillion won. Of these, 70 companies sold funeral service products, and the advance payments held by these companies amounted to 9.4067 trillion won, or 99.6% of the total. The number of subscribers to funeral service products was 8.63 million, accounting for 96.8% of all subscribers to prepaid installment sales companies.

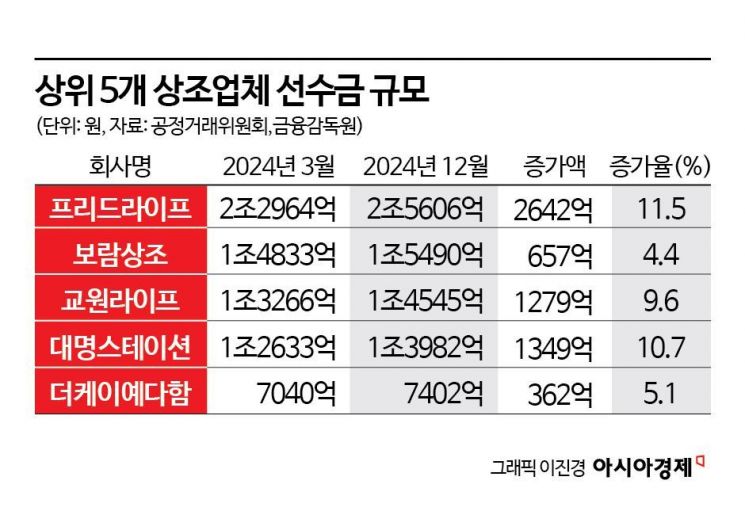

Within nine months of the Fair Trade Commission's announcement, the advance payments held by the top five funeral service companies increased by more than 620 billion won. According to each company's '2024 audit report,' as of the end of last year, Preed Life recorded 2.5607 trillion won in installment advance payments. This is an increase of 264.2 billion won (11.5%) compared to March. Installment advance payments refer to the cumulative amount of funeral service fees prepaid monthly by members of funeral service companies, and are used as a key indicator of both market size and each company's management capability. During the same period, Boram Sangjo saw an increase of 65.7 billion won (4.4%), Kyowon Life 127.9 billion won (9.6%), Daemyung Station 134.9 billion won (10.7%), and The K-Ye Daham 36.2 billion won (5.1%). These five companies account for 75% of all advance payments and are leading market growth. When the increase in advance payments from some other major companies is also taken into account, the total is estimated to approach 10.1 trillion won. Along with the expansion of advance payments, the number of funeral service product subscribers is expected to exceed 9 million.

The growth trend of the funeral service market is expected to continue. South Korea, which has already entered a super-aged society, is projected to see its total population decrease from a peak of 51.84 million in 2020 to about 37.66 million by 2070. As a result, demand for funeral and senior care services is expected to increase.

Funeral service companies are especially launching conversion services tailored to the demands of the new customer base, the MZ generation, such as weddings, travel, language study abroad, and pet care. The subscription rate for funeral service products among those in their 20s and 30s has been steadily increasing. According to Preed Life, the number of new contracts by people in their 20s and 30s last year more than doubled compared to 2021. Boram Sangjo also saw the proportion of subscribers in their 20s and 30s rise from 17% in 2021 to 30% in 2023.

As the market grows, companies from outside the industry are actively entering the field. Education companies such as Woongjin and Daekyo have turned to the funeral service business as a new growth engine as their early childhood education businesses have reached their limits due to low birth rates and a declining school-age population. Woongjin plans to complete its acquisition of Preed Life by next month and seek synergies between education and funeral services. Coway, a leader in the home appliance rental industry, has also established 'Coway Life Solution' and is set to officially launch in the first half of the year. Both companies plan to leverage their strong door-to-door sales networks to secure customers.

Established companies are focusing on defending their market share by further strengthening their existing advantages. They are securing directly operated funeral halls and upgrading facilities, while also accelerating the development of various bundled products and conversion services in addition to pure funeral service products. Their strategy is to attract customers and enhance service sophistication at the same time. An industry insider said, "The funeral service business is now expanding beyond simple funeral support to total life care, so it will be important to lay the foundation for long-term growth by providing services tailored to the customer's life cycle."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.