Austan Goolsbee, President of the Chicago Fed

"Economic activity may slow this summer as corporate inventory stockpiling ends"

Consumer prices likely to rise significantly after June

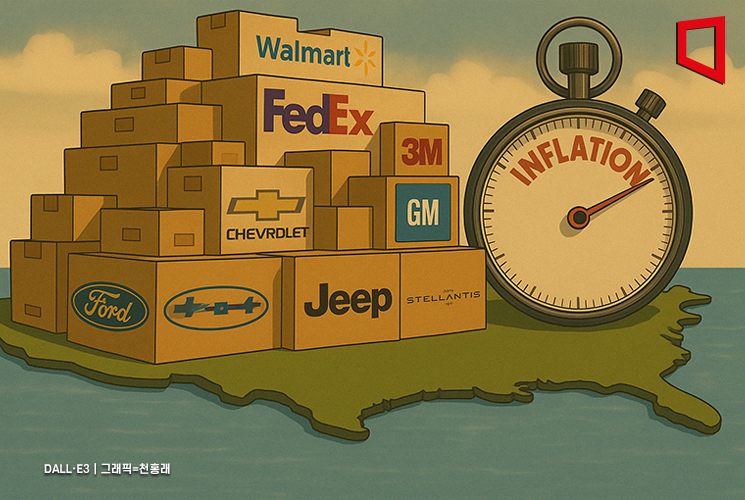

U.S. companies are stockpiling two to three months’ worth of inventory in preparation for the full implementation of tariff policies, which is artificially boosting economic activity. However, a Federal Reserve (Fed) official has warned that once this inventory accumulation effect dissipates, economic activity could slow down by this summer. There are also forecasts that tariff-driven inflation could become evident around July.

On April 20 (local time), Austan Goolsbee, President of the Federal Reserve Bank of Chicago, said in an interview with CBS’s “Face the Nation,” “Companies are stockpiling inventory, and this sudden buying spree can artificially create a high level of economic activity.”

He added, “This kind of preemptive purchasing is likely to be much more pronounced on the corporate side than among consumers,” and stated, “I’m hearing a lot about companies proactively building up inventory that will last 60 or 90 days, due to heightened uncertainty.”

President Goolsbee specifically noted that companies in the automotive sector are stockpiling imported parts in large quantities. Previously, President Donald Trump announced a 25% tariff on imported automobiles and parts. Following the implementation of tariffs on imported cars on April 2, and with tariffs on auto parts set to take effect on May 3, companies are proactively importing auto parts and stockpiling inventory in anticipation.

In particular, companies are expected to be significantly impacted as they import a substantial amount of auto parts, electronic components, and high-value consumer goods from China, which is now subject to a total tariff rate of 145% imposed by the U.S. While the U.S. is applying a basic tariff of 10% to all trading partners and deferring country-specific reciprocal tariffs for 90 days, China faces a combined 125% reciprocal tariff and a 20% fentanyl tariff, totaling 145%. Although certain electronic products such as smartphones and PCs are exempt from reciprocal tariffs, other products imported from China are subject to the high 125% tariff.

President Goolsbee warned, “After 90 days, when the (reciprocal) tariffs are reviewed, we don’t know how large they will be,” cautioning that the temporary rise in economic activity could slow down in the summer.

As companies rush to stockpile imports amid tariff uncertainty, U.S. imports in February reached $401.1 billion, maintaining the record-high level from January ($401.2 billion). Dragon Glassware, a beverage container company that imports products from China, has secured enough inventory to last until June. Once company inventories are depleted, price increases will become inevitable. Matt Rollens, CEO of Dragon Glassware, told U.S. financial news channel CNBC, “If we pay the 145% tariff on Chinese imports, we will have to raise consumer prices by at least 50%, which is likely to reduce demand.”

The market is closely watching economic and inflation indicators this summer. Once the inventories secured before the full implementation of tariffs are exhausted, companies may begin raising consumer prices from around June due to increased cost burdens from rising import prices. According to Cox Automotive, a U.S. auto market research firm, the average inventory held by U.S. car dealers as of March this year was enough for 89 days. By June, inventories are expected to run out.

Thomas Barkin, President of the Federal Reserve Bank of Richmond, also said in a media interview earlier this month, “Most companies have 30 to 60 days’ worth of inventory secured before the tariffs take effect, so we are talking about price increases in June rather than April,” and expressed concern, “While the current indicators are solid, some of the changes we’re seeing could lead to higher inflation.”

The Consumer Price Index (CPI) rose 2.4% year-on-year in March, a significant slowdown from 2.8% in February. However, the possibility remains that inflation could reignite due to tariff policies.

Meanwhile, President Goolsbee criticized President Trump’s public mention of dismissing Fed Chair Jerome Powell, calling it an infringement on the independence of the monetary authorities. He said, “Economists are virtually unanimous in the view that monetary policy should be independent from political interference,” and warned, “I strongly hope we do not move into an environment where the independence of monetary policy is called into question. That would undermine the credibility of the Fed.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.