Bank of Korea Keeps Base Rate at 2.75% per Annum

Financial Instability Triggered by Trump’s Tariffs: "We Need to Monitor for the Time Being"

Reversed 'Land Transaction Permission System' Raises Household Debt Concerns: "Needs Verification"

Downside Risks to the Economy Have Increased... Rate Cut Expected in May

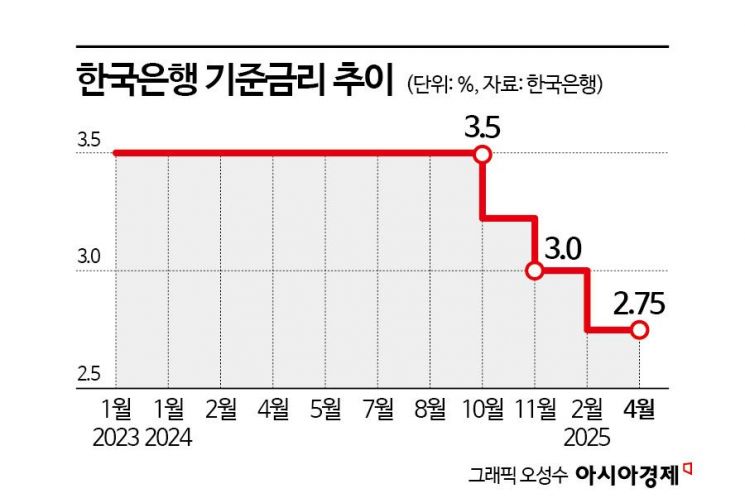

The Bank of Korea has kept the base interest rate steady at 2.75% per annum. This decision took into account the unstable financial and foreign exchange market conditions triggered by the tariff conflicts ignited by U.S. President Donald Trump. However, considering the increasingly pronounced shadow of low growth, the prevailing forecast is that a rate cut will be implemented in May.

On the 17th, the Monetary Policy Board of the Bank of Korea announced at a monetary policy direction meeting held at the Bank’s headquarters in Jung-gu, Seoul, that it would maintain the base rate at the current level of 2.75% per annum. This follows three consecutive 0.25 percentage point (25bp) cuts in October and November last year and February this year, after which the Bank took a breather.

In the monetary policy statement, the Board said, "Given the high uncertainty in the outlook due to changes in U.S. tariff policies and the government’s economic stimulus measures, as well as the need to further monitor the high volatility of the exchange rate and household loan trends, it was deemed appropriate to maintain the current base rate level while reviewing changes in domestic and external conditions."

Lee Chang-yong, Governor of the Bank of Korea, strikes the gavel to declare the opening of the Monetary Policy Committee plenary meeting held at the Bank of Korea headquarters in Jung-gu, Seoul, on the 17th. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, strikes the gavel to declare the opening of the Monetary Policy Committee plenary meeting held at the Bank of Korea headquarters in Jung-gu, Seoul, on the 17th. Photo by Joint Press Corps

Financial Instability Triggered by Trump’s Tariffs: "We Need to Monitor for the Time Being"

The Monetary Policy Board’s stance is to pause on rate cuts amid the increased volatility caused by sharp fluctuations in the exchange rate due to Trump’s tariff shocks and to observe whether the market stabilizes. Bank of Korea Governor Lee Chang-yong has mentioned that when deciding on interest rates, the Board places more weight on volatility than on the absolute level of the exchange rate.

The won-dollar exchange rate dropped to around 1,434 won after the removal of domestic political uncertainty following the impeachment of former President Yoon Seok-yeol on the 4th, but then surged to about 1,484 won within three trading days amid fears of an escalating U.S.-China tariff war. Subsequently, after the U.S. granted a 90-day tariff exemption to approximately 75 countries excluding China, the exchange rate fluctuated around 1,420 won and fell to about 1,410 won early in the trading session on the day. The weekly closing exchange rate fluctuation this month reached 60 won. Shinhan Investment Corp. analyst Ahn Jae-kyun said, "Given the extreme global capital movement, it was judged that a rate cut could cause side effects. Rather than rushing a rate cut in April, the possibility of responding to future monetary policy by monitoring changes in domestic and international economic and financial conditions was left open."

The expectation that the U.S. Federal Reserve (Fed) will not lower policy rates for the time being also weighed on the decision. The Fed has stated it will observe economic conditions further before adjusting monetary policy. The U.S. policy rate stands at 4.25?4.50%, with the Korea-U.S. rate gap at 1.75 percentage points at the upper bound. Eugene Investment & Securities analyst Kim Ji-na noted, "Mutual tariffs have been temporarily suspended, but related uncertainties remain high. Given the large exchange rate volatility and the Fed’s unchanged stance, there was little reason for the Monetary Policy Board to take special action."

Reversed 'Land Transaction Permission System' Raises Household Debt Concerns: "Needs Verification"

Recent instability in the real estate market caused by Seoul’s reversal of the Land Transaction Permission System (Toheoje) also supported the decision to keep rates steady. The risk of expanding household debt has increased again due to real estate price fluctuations in some areas such as Gangnam-gu. Although the market is regaining stability following Seoul’s re-designation of land transaction permission zones (Toheoguyeok), the loan expansion resulting from the earlier lifting of restrictions has yet to be confirmed. The Monetary Policy Board sees the need for further verification of household debt sensitivity and the balloon effect in the metropolitan area.

Professor Lee Yoon-soo of Sogang University’s Department of Economics said, "The recent overheating of the real estate market has highlighted the burden of household debt. Although there are concerns about economic slowdown, the decision to hold rates reflects the added anxiety over household debt amid external uncertainties." Daishin Securities analyst Gong Dong-rak also explained, "The decision considered financial stability concerns arising from rising real estate prices and increased household loans in some parts of Seoul in March."

Regarding the Board’s decision to hold rates, Professor Kang Sung-jin of Korea University’s Department of Economics evaluated it as "an economically natural direction." Professor Kang said, "Given the large interest rate gap with the U.S., where rates remain unchanged, and the need to address exchange rate issues, household debt, and price stability domestically, the main variable is economic sluggishness. Under current circumstances, price stability should be prioritized."

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee's plenary meeting at the Bank of Korea headquarters in Jung-gu, Seoul, on the 17th. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee's plenary meeting at the Bank of Korea headquarters in Jung-gu, Seoul, on the 17th. Photo by Joint Press Corps

Downside Risks to the Economy Have Increased... Rate Cut Expected in May

There is growing consensus that the next rate cut will come in May. The downside risk to the economy has increased due to stronger-than-expected tariff measures. Following President Trump’s announcement of mutual tariffs, many foreign investment banks have lowered their growth forecasts for South Korea this year to below 1%. Experts expect that the worsening first-quarter growth rate and the Bank of Korea’s downward revision of the economic outlook in May will increase the likelihood of a rate cut.

Analyst Kim said, "Regardless of the tariff exemption, the downside risk to this year’s growth rate is greater than the Bank of Korea’s February economic outlook. How much won depreciation and instability will be tolerated during the dollar’s weak phase, and at what level the focus will shift from exchange rate to economic defense, will determine the timing and extent of future rate cuts." Professor Kang added, "We need to monitor the direct impact and magnitude of Trump’s tariffs on the domestic market. The interest rate gap with the U.S. should also be considered when deciding the timing of the next rate cut."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.