Posted and Deleted on Social Media

Preemptive Rights and Injunction Unlikely

No Major Obstacles Expected for Hanwha's First Deal Closing

There continues to be noise in the process of Hanwha Hotels & Resorts' acquisition and merger (M&A) of Ourhome. Although the management dispute within the Ourhome owner family has been settled and Hanwha signed a contract to acquire management rights of Ourhome, former Ourhome Vice Chairman Gu Ji-eun maintains her opposition. Industry insiders analyze that while it is virtually impossible for former Vice Chairman Gu to regain management rights, she may continue to engage in power struggles with Hanwha Group during key decision-making processes.

According to the industry on the 14th, former Vice Chairman Gu shared a news report on her Facebook on the 12th, writing, "Another novel has come out." The article contained content that former Vice Chairman Gu expressed willingness to sell shares to Hanwha Hotels & Resorts on the premise of participating in management.

Former Vice Chairman Gu criticized, "I can sense the anxiety of the acquisition candidate," adding, "The closing date is approaching, but they have no money and nothing is going well, so they are struggling." She also said, "Business and investment must be done with philosophy and conviction," and added, "I will show that money is not everything. Watch closely."

Earlier, former Vice Chairman Gu stepped down from management last May when her eldest daughter, Chairwoman Gu Mi-hyun, joined forces with her eldest son, former Vice Chairman Gu Bon-seong, and was appointed as the new representative. Since then, she has consistently opposed the sale of Ourhome led by her eldest sister and brother.

The new management of Ourhome decided to sell shares to Hanwha Hotels & Resorts, and Hanwha signed a stock purchase agreement (SPA) in February to acquire 58.62% of Ourhome shares. The investment date is set for the 29th of this month, with the final acquisition imminent. The acquisition amount is 750.8 billion KRW, and Hanwha plans to purchase an additional 8.00% stake for 118.7 billion KRW within two years.

It is reported that former Vice Chairman Gu also attended the Ourhome regular shareholders' meeting held on the 27th of last month and expressed opposition to Hanwha Group's acquisition of Ourhome.

She reportedly pointed out that the stock purchase agreement was signed without board approval and without following the existing shareholders' preemptive rights exercise procedures. In particular, she claimed that Hanwha Group would not be able to complete the deal as it could not raise approximately 870 billion KRW to pay for the shares of the eldest son and eldest daughter. She also argued that company information should not be shared or reported to Hanwha before the management rights share transaction with Hanwha is completed.

Following the wishes of the late Gu Jahak, former chairman of Ourhome, former Vice Chairman Gu was the first among the four siblings to begin management training and broke the eldest son succession tradition of the LG family by being appointed as the first female CEO (Vice Chairman). In the first year after her appointment as CEO, Ourhome returned to profitability, and two years later, in 2023, it achieved record-breaking performance. An industry insider said, "Since former Vice Chairman Gu, who was favored by her father, gained external recognition for her management ability through Ourhome, it will not be easy for her to give up the company," adding, "Her inner feelings are also complicated."

However, it appears that former Vice Chairman Gu has given up on filing an injunction with the court to halt the share sale or using the preemptive rights card.

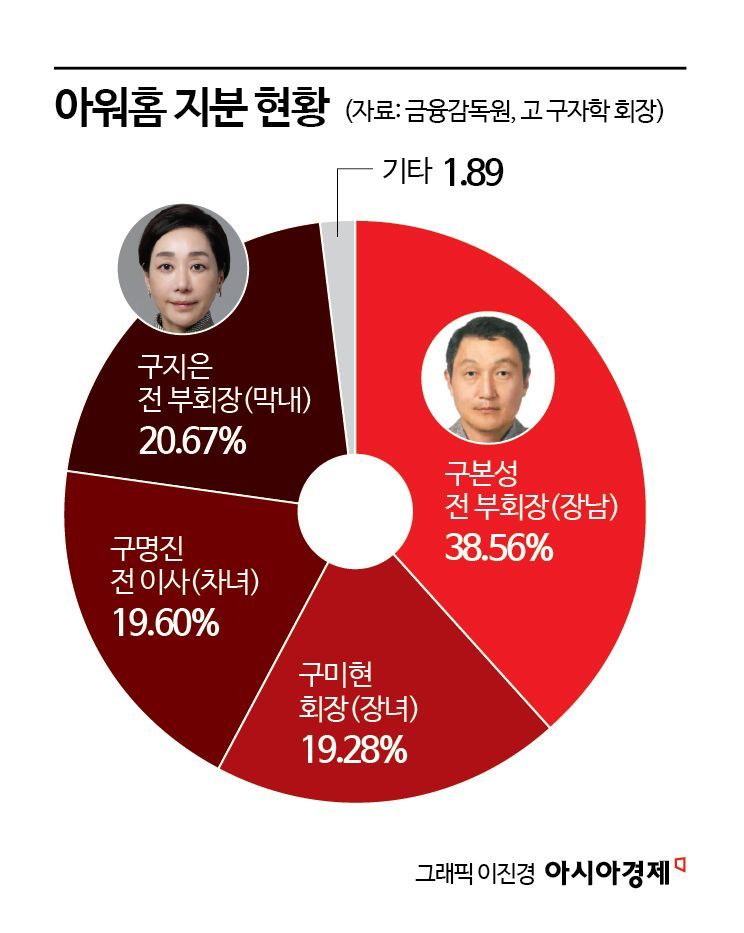

Former Chairwoman Gu holds 40.27% of Ourhome shares (Gu Ji-eun 20.67% and Gu Myung-jin 19.6%), but even if she tries to counterattack using the 'preemptive rights' card, raising funds is difficult. To purchase the shares held by former Vice Chairman Gu Bon-seong and Chairwoman Gu Mi-hyun, former Vice Chairman Gu would need approximately 870 billion KRW, but it is reported that finding suitable financial investors (FIs) is not easy.

There are also divided opinions regarding the legal validity of the preemptive rights held by former Vice Chairman Gu. This is because the preemptive rights in Ourhome's articles of incorporation are interpreted as violating the Commercial Act, which restricts the transfer of shares to others. Also, exercising preemptive rights requires approval from the Ourhome board of directors, all three of whom are currently personnel aligned with the eldest son and eldest daughter. The current contract stipulates that Hanwha Hotels' consent is required for the board's voting rights exercise.

Another industry insider said, "(The possibility of a legal dispute between former Vice Chairman Gu and Hanwha) is slim but not zero," adding, "Since former Vice Chairman Gu remains a major shareholder, there is a possibility of confrontation with Hanwha, so from Hanwha's perspective, diluting former Vice Chairman Gu's shares is most important."

Currently, with Hanwha Group's funding progressing smoothly, the prevailing view is that the first deal closing will proceed without issues. Hanwha Hotels & Resorts has established a special purpose company (SPA) called 'Woori Jib F&B' to acquire management rights shares of Ourhome and will transfer the status, rights, and obligations as a party to the stock purchase agreement. The investment object is 250,000 common shares, and the investment amount is 250 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.