Financial Services Commission Forms RWA Easing Task Force

Instructs Financial Holding Companies to Submit Suggestions

The Financial Services Commission is considering a plan to ease the risk-weighted asset (RWA) application ratio on stock assets held by banks. By lowering the RWA regulations applied to assets such as stocks, the commission aims to encourage increased loan supply to companies affected by the U.S. reciprocal tariff shock.

According to financial authorities on the 15th, the Financial Services Commission recently formed a 'Capital Ratio Regulation Relaxation Task Force (TF)' to review this matter. Last week, the financial authorities convened the five major financial holding companies and policy financial institutions to request timely funding supply to companies in relation to the U.S. reciprocal tariffs. At this meeting, the banking sector reportedly requested a relaxation of RWA regulations to expand corporate lending.

Regarding banks' capital regulations, under the international Basel III standards, higher RWA weights are applied to corporate loans and assets such as stocks compared to household loans. Household loans have relatively lower RWA weights because they are secured by real estate such as apartments.

There are two main methods for calculating RWA: the 'Standardized Approach' and the 'Internal Ratings-Based Approach.' When applying the Standardized Approach, weights are calculated based on the corporate credit rating. For example, if a loan is made to a company rated BB- or below, 150% of the loan amount is included in the risk-weighted assets.

On the other hand, the Internal Ratings-Based Approach involves each bank analyzing companies in its own way and assigning credit ratings to apply risk weights. Most domestic banks apply the 'Internal Ratings-Based Approach' for corporate loans. Accordingly, while the financial authorities are reviewing plans to ease corporate loan RWA, there are also concerns that it is not easy to apply regulatory relaxation uniformly.

Therefore, the commission is considering easing regulations starting with stock assets, which use the Standardized Approach for RWA calculation. A Financial Services Commission official explained, "The purpose of easing capital regulations is to expand corporate lending, so we intend to create capital ratio capacity by relaxing RWA regulations on other assets." He added, "Through this, a trickle-down effect is expected to occur, increasing the supply of corporate loans."

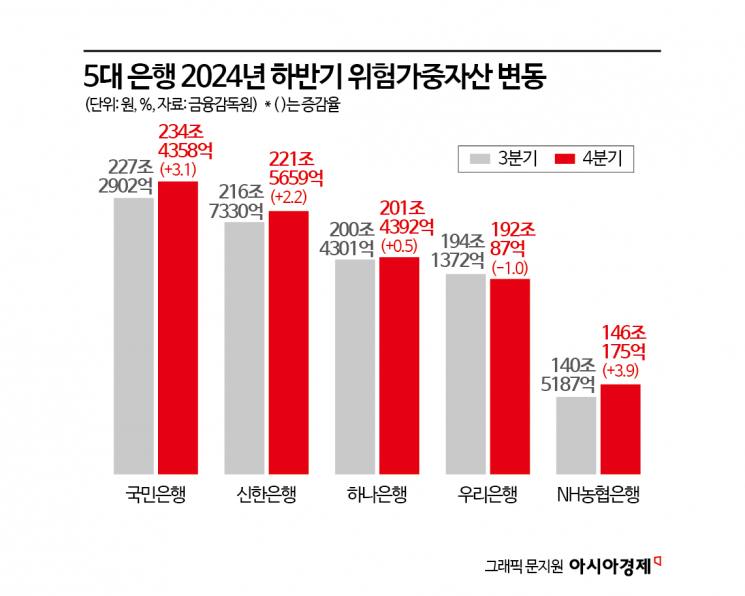

According to the Financial Supervisory Service's Financial Statistics Information System, as of the fourth quarter of last year, the RWA scale of the five major banks reached 995.4673 trillion won. This is an increase of 1.6% from the previous quarter and 9.4% from the same period last year.

In December last year, the won-dollar exchange rate surged from 1,401.30 won (December 2) to 1,472.50 won (December 31) based on closing prices due to the emergency martial law situation. Compared to 1,379.30 won on the first business day of the third quarter (July 1), this represents a steep rise.

When the won-dollar exchange rate rises, the scale of foreign currency liabilities classified as RWA also increases. In this case, to manage soundness, banks reduce corporate loans with high RWA weights. As banks focus their operations on real estate-secured loans with relatively low RWA weights, criticism has persisted that the capacity for corporate finance is further narrowed.

In fact, corporate loans by domestic banks decreased by 2.1 trillion won (balance of 1,324.3 trillion won) in March this year. This marked the first month-on-month decline in 20 years as of March. With the economic recession and growing external risks, it is analyzed that banks were reluctant to engage in lending with high RWA weights, such as loans to small and medium-sized enterprises, to manage credit risk.

A Financial Services Commission official stated, "We plan to finalize the details by reviewing matters related to the relaxation of banks' RWA regulations, including corporate loans, focusing on the banks' requests."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.