Corporate Value Reaches 5 Trillion KRW... SK Inc. to Secure 3 Trillion KRW

SK Group's Restructuring Nears Completion

Hahn & Company Acquires 10th Asset from SK Group

SK Group is expected to sell its management rights of SK Siltron, a leading domestic semiconductor silicon wafer manufacturer, to Korea's largest private equity firm, Hahn & Company.

According to the investment banking (IB) industry on the 8th, SK Inc. is currently negotiating to sell its directly held 51% stake and approximately 20% minority stake tied up in a TRS (Total Return Swap) contract to Hahn & Company.

Currently, SK Siltron's shares are held 51% by SK Inc., and 49% by an SPC established by NH Investment & Securities, Korea Investment & Securities, and Samsung Securities respectively. Of the 49% held by the SPC, 29.4% belongs to SK Group Chairman Chey Tae-won, and the remaining 19.6% is under a TRS contract with SK Inc. According to the TRS contract, the securities firms receive fees in exchange for being responsible for the acquisition payment from SK Inc. and Chairman Chey.

The management rights sale stake is known to total 70.6%, combining SK Inc.'s 51% and the 19.6% held by SK Inc. through the TRS. Considering SK Siltron's total corporate value is around 5 trillion KRW, SK Inc. will secure mid-3 trillion KRW in funds from this sale. Previously, in 2017, SK Inc. acquired a 51% stake in SK Siltron from LG for 620 billion KRW.

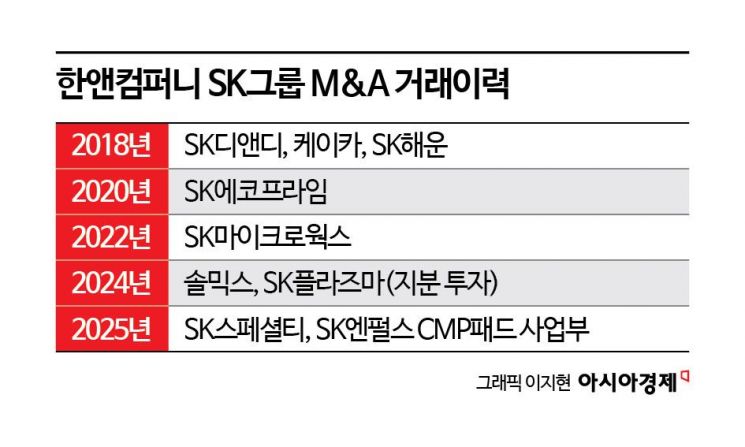

Meanwhile, if this sale contract is finalized, Hahn & Company will achieve its 10th successful deal with SK Group.

Hahn & Company began with acquiring SK's used car business K Car in 2018, followed by successive acquisitions of SK D&D and SK Shipping management rights. In 2020, it acquired SK Ecoprime (SK Chemical's biodiesel business), in 2022 SK Microworks (SKC film business), and in 2024 Solmix (formerly SK Enpulse Fine Ceramics Division) and minority shares of SK Plasma. This year, it also completed the acquisition of SK Specialty for 2.63 trillion KRW and SK Enpulse CMP Pad Division for 334.6 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.