Fount is launching the first-ever robo-advisor discretionary service for retirement pensions in the financial sector.

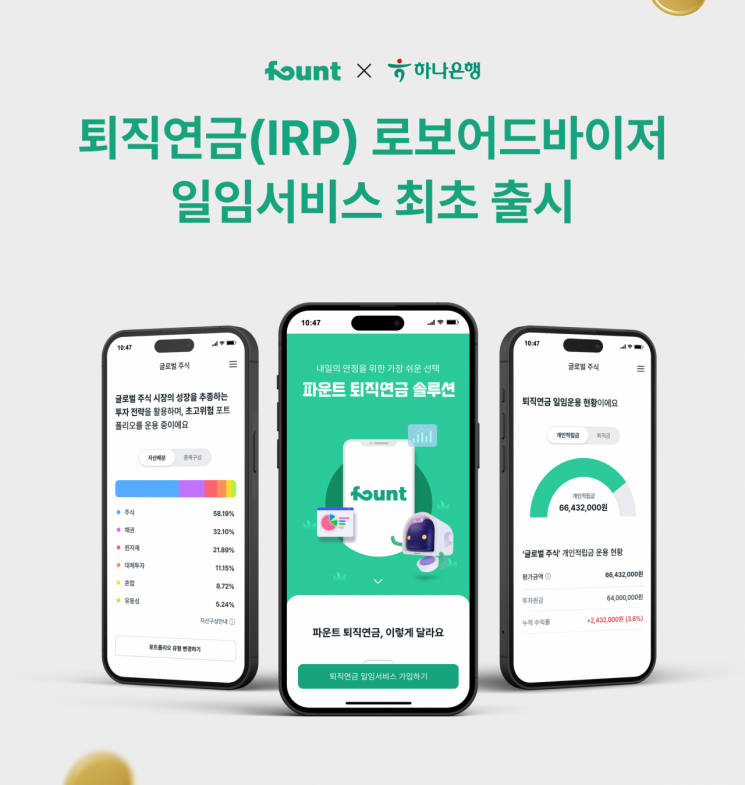

Robo-advisor specialist Fount announced on the 31st that its subsidiary, Fount Investment Advisory, has partnered with Hana Bank to exclusively launch the industry's first retirement pension asset management service, the 'Fount Retirement Pension (IRP) Discretionary Service.'

The retirement pension robo-advisor discretionary service automatically constructs portfolios based on investor preferences using algorithms developed through big data analysis, and manages individual retirement pensions (IRP) on a discretionary basis.

While discretionary services were previously unavailable for retirement pensions, the financial authorities temporarily eased regulations by designating it as an innovative financial service (regulatory sandbox) at the end of last year, enabling discretionary management of individual retirement pensions.

Fount Investment Advisory applied for the innovative financial service designation for the retirement pension robo-advisor discretionary service in September last year and began full-scale service development with Hana Bank. Testing has reportedly been underway since early this year.

Hana Bank, one of the largest retirement pension providers in Korea with total retirement pension assets exceeding 40 trillion KRW, and Fount, a leader in the domestic robo-advisor market, have combined their financial services and technology development expertise through collaboration to launch the retirement pension robo-advisor discretionary service.

The Fount Retirement Pension (IRP) Discretionary Service is offered to new and existing IRP account holders at Hana Bank. Customers can select products that match their investment strategies and subscribe via Hana One Q, Hana Bank's mobile app.

The Fount Retirement Pension (IRP) Discretionary Service products available through the Hana One Q app include three types: ▲Global Stocks ▲Global Growth Regions and Sectors ▲Comfortable Investment for You.

The Global Stocks strategy diversifies investments across various sector asset classes in the global stock market, while the Global Growth Regions and Sectors strategy constructs and manages fund portfolios targeting customers who wish to invest in regions or industries with high economic growth rates or expected operating profit margins.

'Comfortable Investment for You' is a strategy centered on TDFs (Target Date Funds) that invest in the U.S. market, which has shown excellent long-term performance, adjusting the ratio of risky and safe assets according to the retirement timeline.

Kim Young-bin, CEO of Fount, said, "There were many challenges in developing a service that did not previously exist," adding, "By integrating the financial and IT experience and know-how of both Fount and Hana Bank, we were able to achieve the milestone of being the first in the industry to launch this service."

He continued, "We have completed the infrastructure necessary for efficient collaboration with existing financial companies," and explained, "Starting with Hana Bank, we will gradually expand the development of retirement pension robo-advisor discretionary services with other financial companies and sectors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.