Average Cost to Develop a New Drug Rises to $2.23 Billion

GLP-1 Therapeutics Drive Up R&D Expenses and ROI

Deloitte: Focus on Unmet Medical Needs for Future Growth

It has been revealed that global big pharma companies invest an average of $2.23 billion (approximately 3.275 trillion KRW) to develop a single new drug.

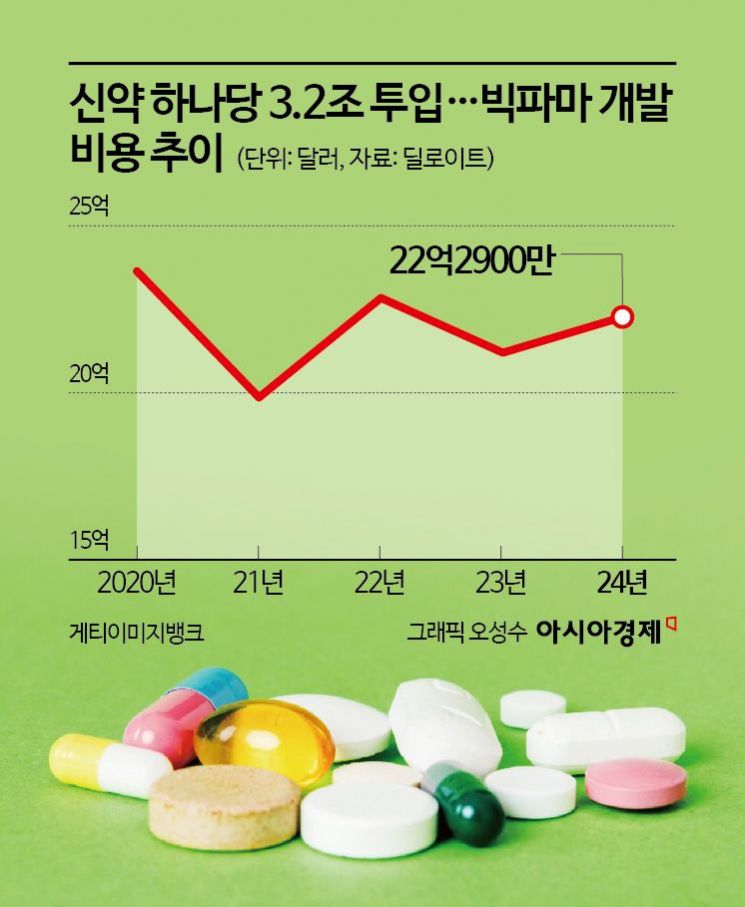

According to data released on the 27th by the Korea Bio Association citing Deloitte's annual report, the average cost for 20 global pharmaceutical companies to develop one new drug increased by $110 million (approximately 161.48 billion KRW) from $2.12 billion (approximately 3.113 trillion KRW) in 2023 to $2.23 billion last year.

This cost increase appears to be influenced by the development boom of glucagon-like peptide-1 (GLP-1) class therapeutics, triggered by Novo Nordisk's obesity treatment 'Wegovy.' Additionally, it was confirmed that the average cost per asset surged for 12 out of the 20 companies, attributed to ▲ longer clinical trial durations ▲ more complex research areas ▲ macroeconomic factors ▲ technological advancements and high turnover rates. Notably, $7.7 billion (approximately 11.3051 trillion KRW) was spent on clinical trial drug candidates that ended last year.

What is noteworthy is that the growth rate of research and development (R&D) expenses among global pharmaceutical companies has been slowing in recent years. Although R&D costs continue to rise annually, the average annual growth rate decreased slightly from 7.69% between 2013 and 2020 to 6.44% between 2020 and 2024. It appears that big pharma is focusing on improving the efficiency of R&D spending.

As R&D costs increase, the expected return on investment (ROI) is also rising. For pharmaceutical R&D, ROI increased by 1.6 percentage points from an internal rate of return of 4.3% in 2023 to 5.9% last year. Notably, excluding GLP-1, the ROI dropped to 3.8%, indicating that GLP-1 therapeutics have a significant impact on profitability.

The average expected maximum sales per product among the top 20 pharmaceutical companies was $510 million (approximately 747.3 billion KRW), but excluding GLP-1, this average sharply declined to $370 million (approximately 542.2 billion KRW), resulting in an internal rate of return of 3.8% last year and 3.4% in 2023.

A Deloitte representative stated, "Another factor influencing the high internal rate of return for big pharma is the resurgence of potential blockbusters (drugs with annual sales exceeding 1 trillion KRW) in late-stage pipelines and increased commercial forecasts for assets following positive clinical trial results." They added, "In particular, 29 blockbuster drugs entered late development stages last year, a 53% increase from 19 new blockbuster assets in 2023."

Deloitte also advised pharmaceutical companies to target areas of unmet medical needs. The company explained, "Fields with high unmet medical needs involve greater complexity and risk than incremental improvements on already launched drugs and require more time for development and regulatory approval." However, they emphasized, "The rewards for bold companies pursuing these areas can be substantial both financially and in terms of improving global health outcomes. Companies should diversify their portfolios and build expertise in therapeutic areas with low market saturation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.