Multi-Child Household Standard Lowered from Three to Two Children for Low Birth Rate Response

Preferential Rate for Newlyweds Increased by 0.1 Percentage Points

Small Business Owners, Non-Metropolitan Homeowners, and Those Acquiring Homes through Inheritance or Gifts Now Eligible to Apply for Living Stabilization Funds

Households with two or more children will now be eligible for preferential interest rates when using the Bogeumjari Loan. In addition, the combined income requirements for couples in households with one or two children applying for the Bogeumjari Loan will be relaxed. Small business owners, homeowners in non-metropolitan areas, and those acquiring homes through inheritance or gifts will also be able to apply for living stabilization funds.

The Korea Housing Finance Corporation (President Kim Kyunghwan) announced on the 24th that, starting April 1, it will ease the requirements for the Bogeumjari Loan in order to address the low birth rate, strengthen support for small business owners, and assist homeowners in non-metropolitan areas.

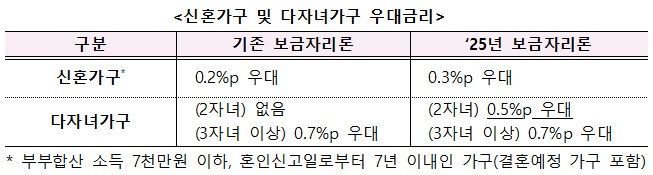

To address the low birth rate, the preferential interest rate for newlywed households will be increased (from 0.2 to 0.3 percentage points), and a new preferential rate (0.5 percentage points) will be introduced for households with two children.

Additionally, the income requirements for the Bogeumjari Loan for households with one or two children have been relaxed by 10 million KRW each, lowering the threshold for real homebuyers to apply for loans.

In terms of support for vulnerable groups, small business owners, homeowners in non-metropolitan areas, and those acquiring homes through inheritance or gifts will be able to use the Bogeumjari Loan for living stabilization funds. Since March 2020, the use of living stabilization funds for purposes other than returning lease deposits had been restricted.

To reduce the burden on financial consumers, the early repayment fee rate applied when repaying the Bogeumjari Loan within three years will be lowered by 0.2 percentage points (from 0.7% to 0.5%).

Kim Kyunghwan, President of the Korea Housing Finance Corporation, stated, “As a representative policy mortgage product, the Bogeumjari Loan will continue to support national efforts to address the low birth rate and strive to reduce the financial burden on consumers.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)