Hanwha Aerospace and Samsung SDI Announce Consecutive Rights Offerings

Reflecting a Sense of Crisis: "Failure to Act in Time Means Falling Behind"

Hanwha Aerospace and Samsung SDI are attracting industry attention by consecutively deciding on large-scale rights offerings under the banner of ‘supercycle investment.’ Although they are experiencing polar opposite market conditions?special demand from the U.S. and a chasm (temporary demand stagnation)?this is interpreted as reflecting a shared sense of crisis that failure to act in time could lead to obsolescence.

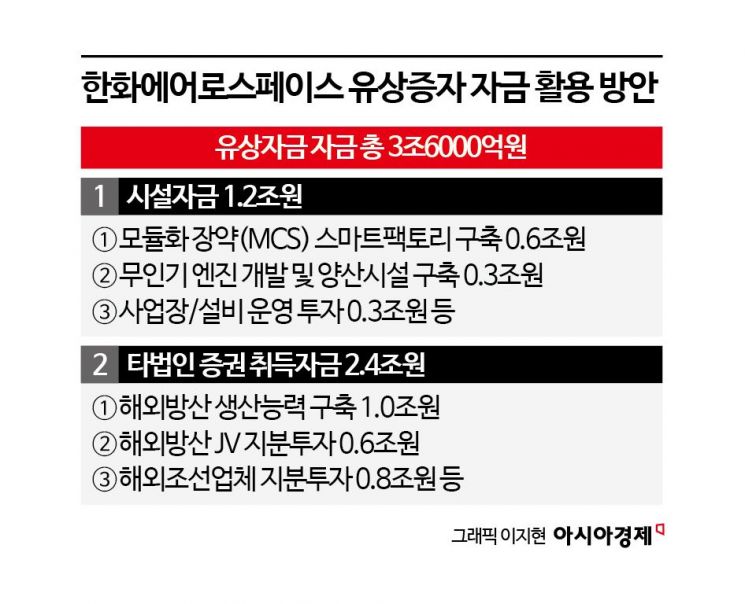

According to the industry on the 24th, Hanwha Aerospace and Samsung SDI recently decided on rights offerings worth 3.6 trillion KRW and 2 trillion KRW, respectively. A rights offering, which involves issuing new company shares, is one of the methods to easily raise capital without financial burdens compared to issuing corporate bonds or borrowing. The rights offerings by the two companies are similar in that they were made suddenly without prior notice, and after the announcement, the CEOs decided to purchase their own shares worth 3 billion KRW and 190 million KRW, respectively.

Hanwha Aerospace was already under financial strain due to its recent acquisition of a 1.3 trillion KRW stake in Hanwha Ocean. Additionally, the delay in interest rate cuts made it difficult to reduce funding costs, which also acted as a burden. The company explained that large-scale fundraising was inevitable as securing local production bases has become essential for defense and aerospace companies amid strengthened regional production policies in major countries such as Europe and the U.S.

While Hanwha Aerospace carried out the rights offering for proactive investment and securing global competitiveness, Samsung SDI’s move is closer to a survival strategy to respond to deteriorating business conditions such as the slowdown in electric vehicle growth and aggressive expansion by Chinese battery companies. In contrast to Hanwha Aerospace, which conducted the rights offering during a stock price surge, Samsung SDI’s stock price has plummeted nearly 60% from close to 500,000 KRW a year ago. It is a choice to replenish insufficient investment capacity and build stamina to wait for the ‘supercycle.’ Senior Research Fellow Lee Hyoseop of the Korea Capital Market Institute explained, “In a situation where competition with Chinese companies continues to intensify, they likely judged that large-scale investment was necessary to secure new technological capabilities.”

However, making decisions that harm shareholder interests in the short term amid active discussions on amendments to the Commercial Act is likely to become a burden for the business community later. In particular, in the case of Hanwha Aerospace, the industry consensus is that it was inappropriate to aggressively push for a rights offering through a general public offering of forfeited shares after shareholder allocation rather than third-party allotment at a time when the stock price had surged more than threefold over the past year due to an earnings surprise. Professor Lee Junseo of Dongguk University’s Department of Business Administration diagnosed, “When the stock price is rising, the burden on the company is relatively less if a rights offering is conducted.” Senior Research Fellow Lee Hyoseop pointed out, “If the scale was this large, the offering should have been done sequentially or there should have been more active dialogue with shareholders.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.