Many Mirae Asset Financial Services Planners Involved

GA Agencies Colluded with Lending Companies... Handed Over Investment Funds

97 insurance planners affiliated with corporate insurance agencies (GA) were caught by financial authorities for committing a 'Ponzi scheme (multi-level financial fraud)' involving approximately 140 billion KRW from insurance policyholders.

On the 23rd, the Financial Supervisory Service (FSS) announced the results of an emergency on-site inspection conducted from December last year to February this year on two GAs suspected of involvement in illegal fundraising, according to Yonhap News. The FSS uncovered that 97 planners belonging to these GAs raised 140.6 billion KRW in illegal fundraising funds from 765 insurance policyholders, including young adults starting their careers, and failed to repay about 34.2 billion KRW. It was confirmed that a total of 134 insurance planners from 28 GAs were involved.

A, a former insurance planner and CEO of the lending company PS Financial, was the mastermind behind this Ponzi scheme. In January 2022, he directly established GA B and operated its planner organization like a four-level pyramid scheme for illegal fundraising. B is known as a large GA with 760 members. Mirae Asset Financial Services, a GA under Mirae Asset Life Insurance, also participated in the fraud with its affiliated planner organization in the same manner.

Insurance planners belonging to these GAs actively encouraged insurance customers to invest in short-term bond investment products and PS Financial’s loan fund management investment products, promising high returns. Planners who raised funds from customers received sales commissions, and managers received managerial commissions based on sales performance, forming a pyramid structure. Separately, special bonus commissions were paid to planners who achieved target performance, and travel expenses were provided for bringing in new salespeople, introducing promotions to encourage insurance sales directly into the illegal fundraising scheme. The top-performing planner in B reportedly raised about 36 billion KRW from insurance policyholders and received approximately 1.1 billion KRW in illegal fundraising recruitment commissions.

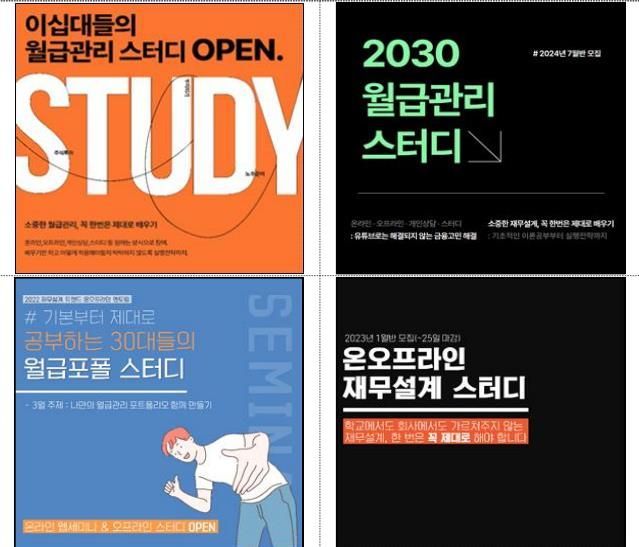

Social Network Service (SNS) advertisement. Provided by the Financial Supervisory Service, Yonhap News Agency

Social Network Service (SNS) advertisement. Provided by the Financial Supervisory Service, Yonhap News Agency

The FSS explained that insurance planners from the GAs approached young adults through social networking service (SNS) advertisements such as monthly salary management studies and financial planning consultations, then persuaded them to cancel existing savings deposits to invest in illegal fundraising. Furthermore, these planners, aware that the investment products they sold were unclear in substance, were enticed by the prospect of high commission income and actively encouraged existing customers to invest funds using customer information (DB) obtained during insurance sales. Moreover, actual contracts were conducted as loan agreements where customers lent money directly to the lending company’s CEO, and investment funds were deposited into the CEO’s personal account. Since the second half of last year, when PS Financial experienced fund shortages, they also focused on selling a super high-interest product called the 'Asset Leap Savings Account' with an annual interest rate of 50%.

The FSS plans to strictly prevent insurance planners and GAs involved in illegal fundraising from operating in the insurance market by applying a zero-tolerance policy including registration cancellation, personal sanctions, and fines, and will report violations to investigative authorities. In particular, executives and planners of GA B, which effectively operated the GA and lending company as a single business entity, will face severe disciplinary actions and be reported to investigative agencies. Additionally, the CEO of B will be separately reported on charges such as embezzlement for misappropriation of corporate funds. The FSS will also add illegal fundraising and related punishment records as grounds for cancellation of registration for GAs and planners, and will promote related institutional improvements such as preparing guidelines for insurance companies commissioning sales to closely manage GAs linked to lending companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.