Large-scale Funding Fuels Solid-state Battery Investments

Solid-state Battery Market Expands from EVs to Humanoids

Strengthened Cooperation Expected with Companies Securing Solid-state Technology

Samsung SDI, which is raising large-scale funds through a paid-in capital increase, will mass-produce the 'game changer' solid-state batteries starting in 2027. Although its performance was sluggish last year due to the electric vehicle (EV) demand chasm (temporary demand stagnation), it has disclosed plans to shareholders for large-scale investments in preparation for the upcoming supercycle. As the mass production timing of solid-state batteries approaches, interest in companies within the supply chain is growing. Attention is focused on Samsung SDI as well as Lotte Energy Materials, CIS, and Isu Specialty Chemical.

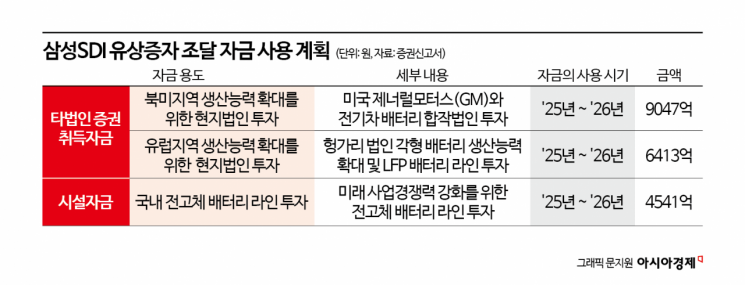

According to the Financial Supervisory Service's electronic disclosure system on the 20th, Samsung SDI will raise 2 trillion KRW through a paid-in capital increase by rights offering followed by a general public offering of forfeited shares.

The raised funds will be used for acquiring securities of other corporations to expand production capacity of local subsidiaries in North America and Europe, and for facility investments in domestic solid-state battery production.

At the shareholders' meeting held the previous day, Samsung SDI explained that for solid-state batteries, it aims for mass production in 2027 and plans to complete the next steps of high-capacity development and mass production technology within this year. It also emphasized that solid-state batteries are attracting attention as a game changer that will grow the EV market by dramatically improving the most important characteristics of electric vehicles?driving range and safety. By replacing the existing liquid electrolyte with a solid electrolyte, the risk of battery fires is reduced, and by applying an anode-free technology, energy density can be increased.

Junsoo Kwon, a researcher at Kiwoom Securities, said, "Since Samsung SDI has proactively developed sulfide-based solid-state batteries, some sample test results are expected to become visible within this year," adding, "The related supply chain construction will accelerate." He continued, "Samsung SDI is building its supply chain mainly with Korean companies to reduce dependence on China," and emphasized, "Considering the 2027 mass production target, related investments will take place between this year and next year."

The reason Samsung SDI is rushing investments in solid-state batteries even while facing shareholder opposition to the capital increase is attributed to its intention to secure a leading position in the humanoid robot market. To operate various sensors, cameras, drive motors, wireless communication, and GPS based on artificial intelligence (AI) humanoid operation, battery capacity inevitably needs to increase. As performance improves, power consumption is expected to increase proportionally. There is a growing trend of cooperation between robot developers and battery companies, and if Samsung SDI quickly mass-produces solid-state batteries, it can secure a leading position in the humanoid market. Analysts suggest that aggressive investment was inevitable as the competition for solid-state batteries expanded from electric vehicles to the humanoid market.

Investment capacity through the sale of Samsung Display shares is also a noteworthy factor. Cheoljoong Kim, a researcher at Mirae Asset Securities, analyzed, "The asset value of Samsung Display is 58 trillion KRW, and considering Samsung SDI's 15.2% stake, there is a possibility of additional group support amounting to about 7 trillion KRW."

Interest is also expanding in the domestic stock market for companies that will enter the solid-state battery supply chain. Lotte Energy Materials has completed the development of nickel-plated foil for solid-state batteries. Nickel-plated foil is a next-generation material with nickel plated on both sides of electrolytic copper foil. SK Nexilis recently developed nickel (Ni) foil, nickel (Ni)-plated foil, and nickel (Ni)-alloy foil for solid-state batteries.

CIS is developing sulfide-based solid electrolytes for solid-state batteries and dedicated process equipment for solid-state batteries. It is known to have participated in solid electrolyte evaluations with European electric vehicle companies since 2021. Isu Specialty Chemical possesses production technology for products (TDM) generated through synthesis with hydrogen sulfide compounds such as lithium sulfide. Lithium sulfide is expected to begin mass production in 2027, generating sales.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.