Cold Winds for Korean Cosmetics in China After the 'Hanhanryeong' Ban

Patriotic Consumption Drives Explosive Growth of Chinese Local Brands

"China Remains the Top Export Destination... Difficult to Give Up"

Domestic cosmetics companies continue to challenge the Chinese market. Although K-Beauty's local performance plummeted after the Chinese government's retaliatory measure of the 'Hanhanryeong (限韓令·Korean Wave ban)' in response to South Korea's deployment of the Terminal High Altitude Area Defense (THAAD) system in 2017, they have not abandoned the Chinese market. Recently, while the North American market has shown rapid growth, it is still in its early stages, making sustainability uncertain. Moreover, China, with its population of 1.4 billion, remains an attractive market that cannot be given up.

According to the industry on the 22nd, Cosmecca Korea, considered one of the 'Big 3' domestic cosmetics original design manufacturers (ODM), recently appointed Kim Hyung-ryeol as the general manager of Cosmecca China. The general manager refers to the highest decision-maker in China. The newly appointed General Manager Kim is recognized for leading sales growth at the Chinese representative cosmetics brand ‘PROYA.’ General Manager Kim stated, “I will lead the expansion of client companies and sales growth in China to achieve group sales of 1 trillion won.”

K-Beauty Faces Consecutive Setbacks in the Chinese Market

Cosmecca Korea's sales last year reached 524.3 billion won, an 11% increase from the previous year, but during the same period, sales in China (Cosmecca China) decreased by about 10 billion won to 40.4 billion won. Additionally, it recorded an operating loss of 1.1 billion won in China, turning to a deficit. A Cosmecca Korea official explained, "Due to poor performance in China last year, we appointed (General Manager Kim) to strengthen the Chinese business and expand client companies."

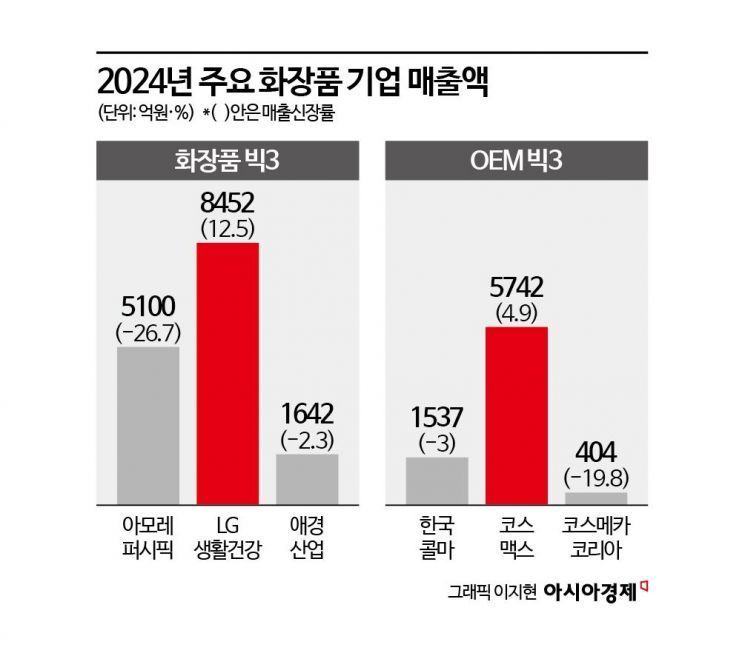

Competing cosmetics ODM companies are also struggling in the Chinese market. Last year, Korea Kolmar's Chinese subsidiary (Wuxi, China) recorded sales of 153.7 billion won, a 3% decrease from the previous year. Operating profit was 8 billion won, down 37% from the previous year. Cosmax's Chinese subsidiaries (China, Guangzhou, Easen JV) recorded sales of 574.2 billion won last year, a 4.9% increase from the previous year, but compared to the Korean subsidiary's sales (1.3577 trillion won), which surged 28.4%, this is not considered satisfactory.

The same applies to major cosmetics companies. Last year, Amorepacific showed a high growth rate of 105.3% in sales in Western countries including the United States, but experienced a 26.7% decline in the Greater China region. LG Household & Health Care recorded 845.2 billion won in sales in China last year, a 12.5% increase from the previous year. However, considering the 1.3 trillion won sales three years ago in China, it is still in the recovery phase. Aekyung Industrial, with a 24.2% share of sales from China, saw its Chinese sales decrease by 2.3% to 164.2 billion won last year.

China’s Patriotic Consumption 'Guochao' Spreads... Yet K-Beauty Cannot Give Up

The reason K-Beauty is struggling in the Chinese market is due to the spread of the 'Guochao (?潮)' trend, where local consumers prefer domestic brands. The Chinese cosmetics market has grown significantly through the COVID-19 pandemic, with most benefits going to local Chinese brands.

In fact, during last November's 'Singles' Day' shopping festival, Alibaba's platforms such as Tmall and Taobao reported that the Chinese local brand 'PROYA' ranked first in sales in the basic cosmetics category. LG Household & Health Care’s ‘Whoo’ and Amorepacific’s 'Sulwhasoo,' which had been among the top ranks, did not make it into the rankings.

On January 2, cosmetics from LG Household & Health Care and road shop brands such as Missha, A'PIEU, and Etude, which have raised or announced price increases for the New Year, are displayed at a cosmetics store in Seoul. Photo by Kang Jin-hyung

On January 2, cosmetics from LG Household & Health Care and road shop brands such as Missha, A'PIEU, and Etude, which have raised or announced price increases for the New Year, are displayed at a cosmetics store in Seoul. Photo by Kang Jin-hyung

Currently, Chinese local brands that have gained great popularity in China have significantly improved their quality by growing through Korean cosmetics manufacturers such as Korea Kolmar and Cosmax. As a result, the quality gap with Korean cosmetics has narrowed, leading to increased consumption of local brands. A Cosmax official explained, "During the COVID-19 period, major clients such as Perfect Diary, Florasis, Into You, Uniclub, and Colorkey, which are Chinese local indie brands, emerged and grew significantly."

However, China remains the top export destination for Korean cosmetics, making it a market that the K-Beauty industry cannot ignore. According to Korea Customs Service export-import trade statistics, last year, the export value of cosmetics to the United States was $1.1909 billion. During the same period, China’s export value was much higher at $1.79289 billion. Although exports to the United States have rapidly caught up this year with $166.56 million compared to China’s $179.68 million, China has not yet been surpassed. According to Euromonitor, China’s cosmetics industry market size ranks second globally, following the United States (first).

Another reason for not giving up on the Chinese market is that it is still too early to feel secure about the North American market. A cosmetics industry official said, “Good performance in regions such as the United States and Japan is just finding a breakthrough to replace China,” adding, “Although sales are increasing in the United States, the costs are high, and it remains to be seen how sustainable this early stage is.” He added, “However, it is meaningful that a market has emerged to compensate for the poor performance in the Chinese market.”

K-Beauty companies are currently focusing on business efficiency through restructuring in the Chinese market. Last year, Amorepacific streamlined its brand stores and is improving its structure to focus on online channels. Instead of excessive marketing expenses or aggressive investments as in the past, it has shifted to a strategy focusing on qualitative growth. In May last year, Amorepacific replaced the heads of its subsidiaries in the United States, Japan, and China. The strategy was to reorganize the global business centered on China and secure new growth engines. LG Household & Health Care is pioneering the premium beauty market in China, focusing on 'The History of Whoo,' classified as a luxury brand.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.