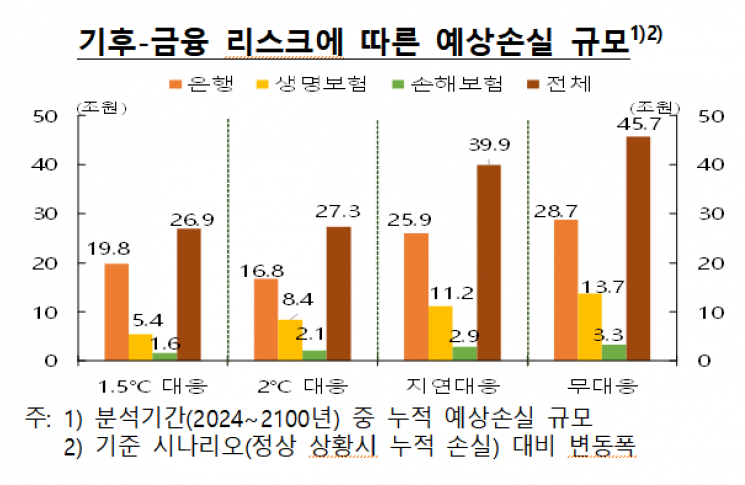

Scale of Financial Institution Losses from Climate Risks

45.7 Trillion KRW under No Response Scenario

Early Climate Policy Introduction Limits Losses to High-Carbon Industries

Delayed or No Response May Cause Nonlinear Expansion of Losses

"The scale of losses for financial institutions due to climate risks is expected to reach up to 45.7 trillion KRW. To reduce climate risks, banks need to strengthen management of credit losses, while insurance companies should enhance management of market losses and insurance losses related to wind and flood damage."

On the 18th, the Bank of Korea announced this at the climate finance conference jointly held with the Financial Supervisory Service at the Bank of Korea in Jung-gu, Seoul, through a presentation titled "Introduction of Climate Scenarios and Results of Bank of Korea’s Top-Down Tests." It stated, "In the future, climate risks will act as a key risk that undermines the soundness of domestic financial institutions and financial stability." By industry, it explained that when climate response policies are implemented, risk management should be strengthened for high-carbon manufacturing industries, and in the case of no response, for climate-vulnerable industries such as food and construction.

From 2024 to 2100, South Korea’s greenhouse gas reduction pathways were set into four scenarios: ▲1.5℃ response (achieving carbon neutrality by 2050), ▲2℃ response (reducing carbon emissions by 80% compared to current levels by 2050), ▲delayed response (no response until 2030, then late implementation of carbon neutrality policies), and ▲no response (no climate policy introduction). The real economy ripple effects were analyzed for each pathway.

The Bank of Korea stated that the negative impact of climate risks on gross domestic product (GDP) is estimated to be smallest under the 1.5℃ response pathway aiming for carbon neutrality by 2050, and largest under the no response pathway. The impact on producer prices is similar between the 1.5℃ response and no response pathways; however, the 1.5℃ response pathway gradually eases after 2050, whereas the no response pathway expands over time and diverges.

Early introduction of climate policies starting this year causes losses such as asset value declines in high-carbon industries, but the scale is limited. Conversely, delaying or consistently avoiding climate policy introduction is estimated to significantly increase losses in the financial sector. The scale of losses for financial institutions due to climate risks is analyzed to reach 45.7 trillion KRW under the no response scenario, driven by the expansion of physical risks such as increased heat and precipitation damage. Under the delayed response scenario, expected financial sector losses are about 39.9 trillion KRW due to expanded transition risks from rapid carbon reduction. Under the 2℃ response scenario, losses are limited to 27.3 trillion KRW, and under the 1.5℃ response scenario, 26.9 trillion KRW. Kim Jaeyoon, head of the Bank of Korea’s Sustainability Growth Office, explained, "In the case of the 1.5℃ response, the loss scale peaks around 2050 and then decreases, whereas under no response, it continuously expands over time." These are credit, market, and insurance losses estimated for 14 financial companies participating in the climate stress test task force.

For banks, credit losses accounted for more than 95% of total expected losses, while for insurance companies, market losses accounted for a high proportion?76% for life insurers and 48% for non-life insurers. This is due to banks’ asset portfolios being centered on loans, and insurance companies’ portfolios being centered on bonds and stocks. For non-life insurers, insurance losses accounted for about 6% of total losses.

When climate response policies are implemented, banks’ losses are heavily concentrated in so-called smokestack industries such as steel, metal products, and cement. Under no response, losses expand in climate-vulnerable industries such as food, restaurants, construction, and real estate. For insurance companies, losses in the electronic components manufacturing sector, which has a relatively high investment proportion, accounted for a large share across most scenarios.

Bank soundness is expected to be affected by increased credit risk, with some or all banks’ Bank for International Settlements (BIS) capital adequacy ratios potentially falling below the regulatory ratio (11.5%) depending on the scenario. Kim explained, "Especially under the 1.5℃ response and delayed response pathways, the BIS ratio decline shock is likely to intensify around 2050, and under the no response pathway, after 2080." For insurance companies, the scale of credit risk exposure is relatively small, so the degree of capital adequacy deterioration due to climate risks is expected to be limited compared to banks. However, as natural disasters such as typhoons and floods have recently occurred more frequently and intensely than expected, it is necessary to prepare for increased insurance losses related to these events.

Kim said, "To enable financial institutions to systematically respond to climate risks, it is necessary to promptly promote improvements in risk management guidelines, strengthen preparations for unexpected losses, and activate green and adaptation investments." He added, "It is necessary to mandate the currently discretionary 'climate scenario analysis and stress testing' within the 'Climate Risk Management Guidelines' for financial companies to induce banks and insurers to enhance their awareness and response capabilities regarding climate risks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.