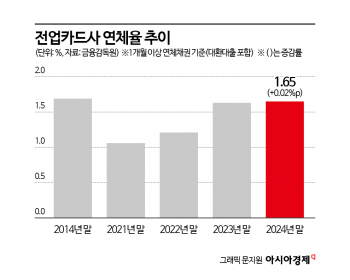

1.65% Last Year... Highest in a Decade

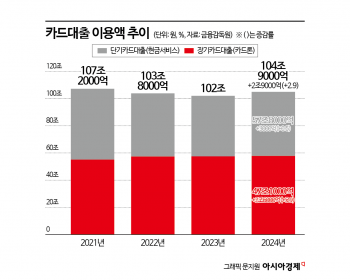

Increase in Loans Including Card Loans

Card Companies' Net Profit Stagnates

As the economic downturn continues, the delinquency rate of domestic specialized credit card companies reached its highest level in 10 years last year. The amount of card loans, known as a quick cash window for ordinary people, also recorded the highest level in three years.

According to the business performance of specialized credit finance companies announced by the Financial Supervisory Service on the 19th, the delinquency rate of eight specialized credit card companies (Samsung, Shinhan, Hyundai, KB Kookmin, Woori, Hana, Lotte, and BC Card) stood at 1.65% at the end of last year. This is 0.02 percentage points higher than the end of the previous year (1.63%). It is the highest level in 10 years since 2014 (1.69%). The delinquency rate has been on the rise for three consecutive years since 2022. Here, the delinquency rate refers to the rate of overdue payments of one month or more on card payments, installment payments, revolving credit, card loans, and credit loans.

The proportion of non-performing loans in credit card companies also increased. The ratio of non-performing loans classified as fixed or below by credit card companies stood at 1.16% at the end of last year, up 0.02 percentage points from the previous year. After a sharp rise of 0.29 percentage points from 0.85% in 2022 to 1.14% in 2023, it rose again. Financial institutions classify asset soundness into five stages: normal, precautionary, fixed, doubtful recovery, and estimated loss. The ratio of non-performing loans classified as fixed, doubtful recovery, and estimated loss to total loans is called the fixed or below non-performing loan ratio. A higher ratio indicates a larger proportion of non-performing loans.

Last year, the amount of card loan usage was 104.9 trillion won, an increase of 2.9% compared to the previous year (102 trillion won). The amount of card loan usage was 47.1 trillion won, up 5.9% from the previous year, and the amount of short-term card loans (cash services) was 57.8 trillion won, up 0.5%. Both card loan and cash service usage amounts reached their highest levels in three years.

Card companies' profits increased slightly. Last year, the total net profit of specialized credit card companies was 2.591 trillion won, an increase of 8.7 billion won (0.3%) compared to the previous year (2.5823 trillion won). Total revenue last year increased by 1.4304 trillion won (5.3%) compared to the previous year. This was due to increases in card loan income (467.3 billion won), installment card fee income (289.7 billion won), and merchant fee income (67 billion won). However, total expenses, including interest expenses (598.3 billion won) and bad debt expenses (210.7 billion won), increased by 1.4217 trillion won, resulting in a minimal increase in net profit.

The loan loss provision coverage ratio of card companies was 108.1%, down 1.8 percentage points from 109.9% at the end of the previous year. All card companies exceeded 100%.

Capital adequacy indicators were generally favorable. The adjusted capital adequacy ratio was 20.4%, significantly exceeding the management guidance ratio (8%) for all card companies. The leverage ratio (5.2 times) decreased compared to the end of 2022 (5.6 times) and the previous year-end (5.4 times). It remained below the regulatory limit (8 times).

Among 181 specialized credit finance companies excluding installment finance companies, leasing companies, and new technology finance companies, last year's net profit was 2.4898 trillion won, a decrease of 212.8 billion won (7.9%) compared to the previous year (2.7026 trillion won). The delinquency rate of these 181 companies was 2.10%, up 0.22 percentage points from the end of the previous year. The fixed or below non-performing loan ratio was 2.86%, up 0.66 percentage points during the same period. The loan loss provision coverage ratio was 133.5%, with all 181 companies exceeding 100%. The adjusted capital adequacy ratio was 18.6%, with all 181 companies exceeding the management guidance ratio (7%).

The Financial Supervisory Service evaluated, "Although asset soundness indicators such as delinquency rate and fixed or below non-performing loan ratio showed an upward trend, the increase was small. The loan loss provision coverage ratio and adjusted capital adequacy ratio exceeded regulatory ratios, indicating that loss absorption capacity is generally at a favorable level."

An official from the Financial Supervisory Service said, "We will closely monitor changes in the profitability of card companies and the profitability trends of non-card specialized credit finance companies. We plan to guide them to thoroughly manage soundness through activating self-debt restructuring and clearing non-performing project financing (PF) sites through auctions and public sales." He added, "Given the persistent uncertainties in domestic and international financial markets, we will check the liquidity management status of specialized credit finance companies and promote necessary institutional improvements."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.