Continuous Expansion of Shareholdings

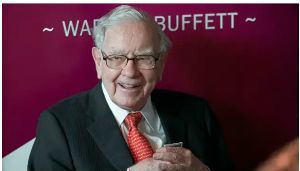

Berkshire Hathaway, led by Chairman Warren Buffett, has reportedly increased its stakes in five major Japanese general trading companies.

According to the Nihon Keizai Shimbun (Nikkei) on the 17th, an analysis of the amendments to large shareholding reports submitted to the Kanto Finance Bureau revealed that Berkshire's ownership ratios in the five Japanese general trading companies each increased by more than 1 percentage point compared to June 2023.

Mitsui & Co. expanded its stake from 8.09% to 9.82%, and Mitsubishi Corporation from 8.31% to 9.67%. Marubeni (8.3% → 9.3%), Sumitomo Corporation (8.23% → 9.29%), and Itochu Corporation (7.47% → 8.53%) also saw increases in their shareholdings.

In his annual letter to shareholders last month, Chairman Buffett stated that they may further increase their holdings in the five major Japanese general trading companies, agreeing to raise the stakes slightly above the previous 'under 10%' threshold.

Since publicly announcing in August 2020 that Berkshire had acquired more than 5% stakes in each of the five major Japanese general trading companies, the company has continuously increased its holdings. As a result, the stock prices of these Japanese trading companies have steadily risen, with Itochu Corporation and Mitsubishi Corporation surpassing a market capitalization of 10 trillion yen (approximately 98 trillion won).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.