KOCCA Publishes "2024 Korea Game White Paper"

Domestic Game Revenue in 2023 Up 3.4% Year-on-Year... Exports Down 6.5%

Mobile Games Account for 60% of Total... Highest Growth Rate

Game Industry Exports Near 11 Trillion KRW

In 2023, the domestic game industry revenue in South Korea increased by 3.4% compared to the previous year, approaching 23 trillion KRW. South Korea ranked 4th in the global game market share.

The Ministry of Culture, Sports and Tourism and the Korea Creative Content Agency (KOCCA) announced on the 17th that they published the "2024 Korea Game White Paper," summarizing the status of the domestic and international game industry in 2023, on the 14th.

Infographic on the Current Status of the Domestic Game Industry. Provided by Korea Creative Content Agency

Infographic on the Current Status of the Domestic Game Industry. Provided by Korea Creative Content Agency

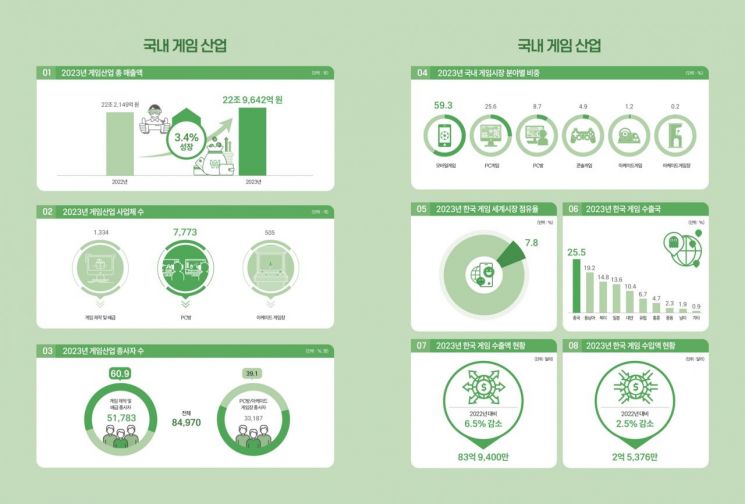

According to the report, although the growth rate of the domestic game market slowed compared to the previous year, the size of the game industry continued to grow. The 2023 domestic game industry revenue was recorded at 22.9642 trillion KRW, a 3.4% increase from the previous year. Exports amounted to 8.394 billion USD (approximately 10.9785 trillion KRW), a 6.5% decrease compared to the previous year.

The number of workers in the domestic game industry in 2023 was 84,970, a 0.7% increase from the previous year. By job category, the number of workers in game production and distribution was 51,783 (60.9%), and those in game distribution were 33,187 (39.1%). For the second consecutive year, the number of workers in game production and distribution exceeded those in distribution.

KOCCA projected that the domestic game market size in 2024 will reach 25.1899 trillion KRW. The game industry is expected to continue growing with ongoing efforts such as diversification of intellectual property (IP) and attempts to expand genres.

Looking at revenue by platform, the mobile market's revenue share approached 60%, overwhelmingly surpassing PC and console. Mobile game revenue in 2023 was 13.6118 trillion KRW, accounting for 59.3% of the total game industry revenue. This was followed by PC games (5.8888 trillion KRW, 25.6% share), console games (1.1291 trillion KRW, 4.9% share), and arcade games (285.2 billion KRW, 1.2% share).

Revenue from game platforms increased across the board except for arcade games. Revenue growth rates by platform were 4.1% for mobile games, 1.4% for PC games, 0.8% for console games, and -4.2% for arcade games. Arcade game centers (growth rate 14.2%) are expected to continue benefiting from the introduction of electronic currency usage for the time being. PC bangs (growth rate 6.5%) showed slight growth compared to the previous year but signs of slowing growth were observed.

The report estimated the global game market size in 2023 at 205.189 billion USD, a 2% increase from the previous year. South Korea's market share ranking remained 4th globally at 7.8%, unchanged from the previous year, with the global rankings also unchanged: the United States, China, and Japan in order.

In the global game market, South Korea's share by platform was highest in PC games at 13.2%, followed by mobile games at 11.6%. Although the PC game market size decreased from 4.6 billion USD in 2022 to 4.5 billion USD in 2023, mobile games rose by 0.2 percentage points to 11.6%, ranking 3rd globally.

In 2023, South Korea's game industry export revenue was 8.394 billion USD (approximately 10.9576 trillion KRW), a 6.5% decrease from the previous year. Export shares by country were China (25.5%), Southeast Asia (19.2%), North America (14.8%), Japan (13.6%), Taiwan (10.4%), and Europe (6.7%). Compared to 2022, Southeast Asia's share increased by 5.0 percentage points, while China's decreased by 4.6 percentage points. Import revenue was recorded at 253.76 million USD (approximately 331.3 billion KRW), a 2.5% decrease.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.