Hanwha Asset Management announced on the 14th that the 'PLUS Global Defense' exchange-traded fund (ETF), which invests in major defense companies in Europe and the United States, has risen 38% since the beginning of the year.

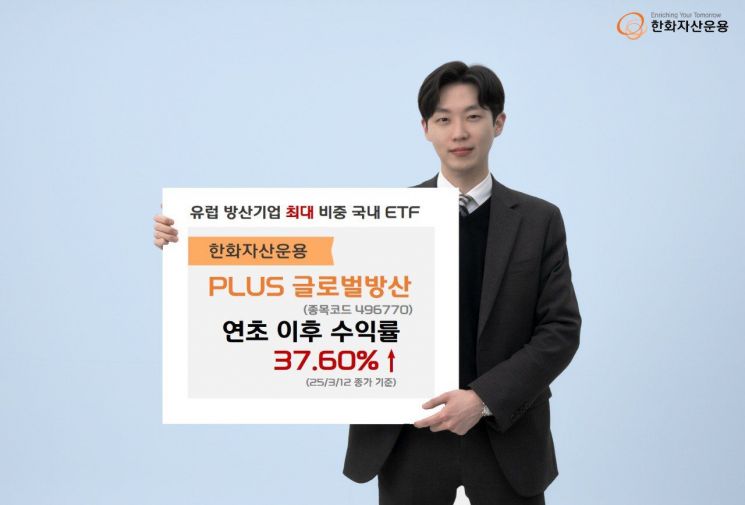

According to the Korea Exchange Information Data System, the 'PLUS Global Defense' ETF rose 37.60% as of the closing price on the 12th since the beginning of the year.

The stock prices of European defense companies held by PLUS Global Defense have recently surged significantly. Based on the year-to-date increase rate, Germany's Rheinmetall rose 109.44%, Italy's Leonardo 67.77%, the United Kingdom's BAE Systems 37.36%, France's Thales 73.55%, and Sweden's Saab 66.88%. This contrasts with the representative U.S. indices, the S&P 500 and NASDAQ 100, which have recorded negative returns since the beginning of the year.

PLUS Global Defense is a domestic listed ETF that invests with the highest proportion (about 65%) in European defense companies. In addition to European defense companies, it also invests in leading U.S. defense companies such as RTX, Northrop Grumman, Lockheed Martin, General Dynamics, and L3Harris Technologies.

The rise in stock prices of European defense companies is attributed to Europe's recent moves to strengthen its own defense capabilities. This is due to former U.S. President Donald Trump halting support for Ukraine, which is at war with Russia, and taking steps to foster closer relations with Russia, causing Europe to feel a sense of crisis.

In fact, after the breakdown of the U.S.-Ukraine Washington talks, leaders of about ten major European countries including France and Germany, the European Union (EU) Commission President, and the Secretary General of the North Atlantic Treaty Organization (NATO) held an emergency summit in London, UK, announcing the EU rearmament plan (ReArm Europe) to expand military spending and strengthen their own defense capabilities, reinforcing the idea of ‘European self-reliance.’

Industry experts view that Europe’s defense industry has entered a long-term growth cycle. On the 3rd, JP Morgan released a report titled 'European Defence,' forecasting that increased European defense spending and the establishment of supply chains centered on European military contractors will be major growth drivers, and raised the target stock prices of related companies by an average of 25%.

Choi Young-jin, Head of Strategic Business Division at Hanwha Asset Management, said, "Former U.S. President Donald Trump has been consistently pressuring Europe to raise its defense spending as a percentage of GDP, currently around 2%, to the 5% range." He added, "Considering that NATO countries also plan to increase the proportion of domestically sourced weapons to 50-60% by 2030-2035, investors should take a long-term view of the global defense industry, led by the European defense sector, in the era of Trump 2.0."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)