An heir who evaded the inheritance of the decedent's outstanding tax liabilities by embezzling inherited property and then renouncing the inheritance was caught by the National Tax Service (NTS).

On the 13th, the NTS announced that it is continuously strengthening asset-tracing investigations against high-value, habitual tax delinquents who hide assets through sophisticated and deceptive methods or deliberately fail to pay taxes despite having the ability to do so, and disclosed an exemplary case of such tracing.

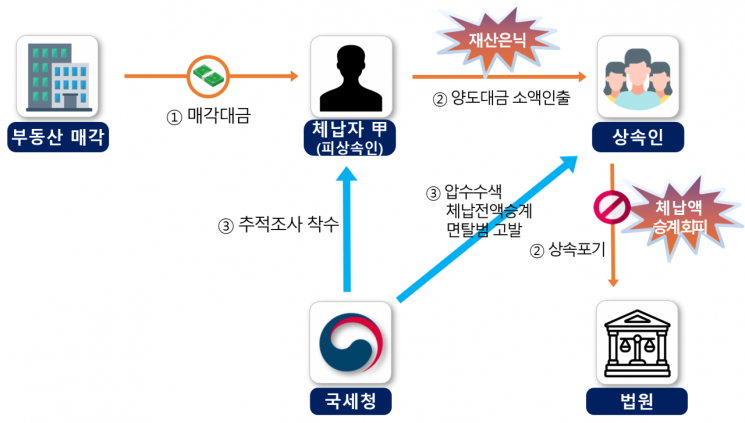

According to the NTS, the decedent A transferred high-value real estate before death and defaulted on capital gains tax. However, since there were no assets under the delinquent's name and the children either filed for limited acceptance or renounced the inheritance, the NTS was unable to collect the delinquent tax from the decedent or the children.

In response, the NTS traced the decedent’s bank accounts and discovered that the transfer proceeds were withdrawn in small cash amounts hundreds of times or withdrawn as cash through other people's accounts. They also secured CCTV footage from the ATMs where the cash withdrawals occurred, revealing that the children withdrew the transfer proceeds in cash from the decedent’s financial accounts. Subsequently, the NTS obtained search warrants for the children’s residences, conducted searches, and seized cash and other assets. Furthermore, under civil law, the children were deemed to have accepted the inheritance, thereby inheriting the decedent’s outstanding tax liabilities in full, and were reported as offenders evading tax collection.

The NTS is conducting thorough pre-analysis to carry out on-site searches at actual residences and actively filing lawsuits to recover assets embezzled to avoid forced collection. At the same time, it is enhancing its delinquent asset analysis system to strictly respond to high-value, habitual tax delinquents. Since the operation of dedicated asset-tracing investigation teams at tax offices in 2022, the number of offices operating such teams has been significantly expanded from 25 to 73 this year based on past achievements.

An NTS official stated, "We will conduct even more rigorous tracing investigations, providing appropriate performance rewards to employees who find and collect hidden assets of high-value, habitual tax delinquents through risky on-site searches, complex financial tracing, and persistent civil litigation." He added, "Going forward, the NTS will firmly respond to malicious high-value, habitual tax delinquents by relentlessly tracing and collecting hidden assets to realize tax justice and fair taxation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.