Rising Dining-Out Prices Drive Growth in Group Meal Service Market

Expansion to 49 Privately Contracted Military Units, 23 Meal Service Projects

Full Effort in Meal Service Bidding, Increased Supply of Food Ingredients

Starting this year, the military base meal service market has been fully opened, causing a stir in the private meal service market. As the number of cafeteria users increases due to rising dining-out prices, the group meal service market is rapidly growing, and fierce industry competition over new food offerings is expected.

According to the meal service industry on the 14th, the government plans to expand the number of privately contracted military units to 49 this year and conduct bidding for meal service projects at least for 23 units. On the Defense Electronic Procurement System of the Defense Acquisition Program Administration, bidding announcements totaling 40 billion KRW have been posted in the past month, including meal service consignment and delivery for the 5th Logistics Support Command, the officers' cafeteria of Unit 5067, and private consignment meal service for the barracks cafeteria of the 30th Regiment at the Army Training Center.

Full Opening of Military Base Meal Services... Formation of a 9 Trillion KRW Market

The industry expects fierce competition, although the volume is not large. This is because companies that have been struggling to discover future growth engines see a new market opening. According to the Ministry of Agriculture, Food and Rural Affairs and the Korean Meal Service Association, the military base meal service market is about 2 trillion KRW in size, and combined with the existing private meal service market (about 7 trillion KRW), it reaches 9 trillion KRW. Until now, large corporations' entry was restricted, but the government has been gradually expanding the opening since 2023 to resolve controversies over poor meal services. The competitive bidding ratio was raised to 70% last year, and from this year, it is fully opened.

The military meal service unit price is 13,000 KRW per day (4,300 KRW per meal), which is lower than that of general industrial meal services (6,000 to 7,000 KRW per meal), so profitability is not high. Nevertheless, companies are knocking on the door of military base meal services because it ensures a stable supply of meals and allows for various business expansions such as food ingredient distribution in the future. Besides meal service operations, profitability can be improved by concurrently handling food ingredient distribution.

To secure an early market position, companies have actively participated in military base meal service bids since last year. Samsung Welstory was selected as the meal service provider for the Korea Military Academy (12.7 billion KRW) and the Korea Army Academy at Yeongcheon (10.2 billion KRW). Ourhome won the operating rights for the Air Force 20th Fighter Wing soldiers' cafeteria (42.7 billion KRW) and the Army Unit 1989 barracks cafeteria (10.7 billion KRW).

Companies are also focusing on expanding the supply of various food ingredients such as ready-to-cook products and chicken bulgogi. According to the Korea Food Industry Association, 34 food companies supplied 240 items to military bases last year, a 39% increase from 172 items the previous year. Suppliers include Ourhome, Hyundai Green Food, Daesang, Dongwon F&B, CJ CheilJedang, Shinsegae Food, Sempio Foods, Ottogi, and CJ Freshway.

Continued Growth of the Group Meal Service Market

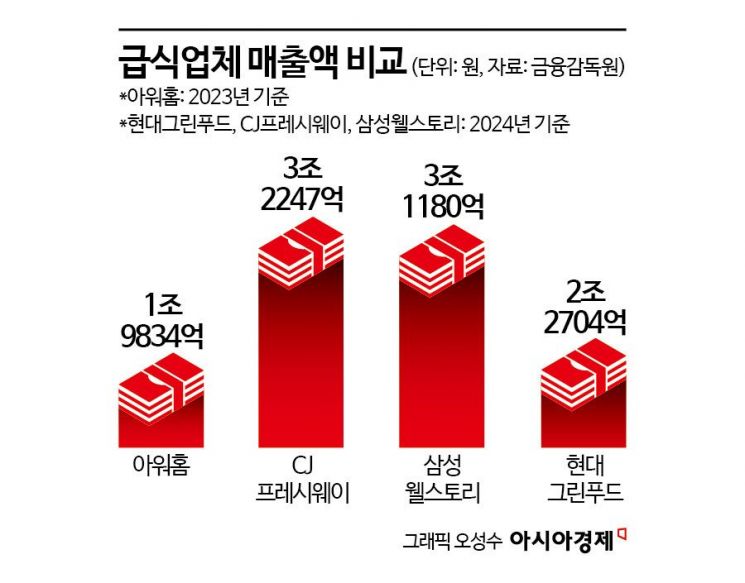

The domestic group meal service market is dominated by the top four companies?Samsung Welstory, Hyundai Green Food, CJ Freshway, and Ourhome?holding over 70% market share. As inflation continues, demand for relatively affordable meal services has increased, leading meal service companies to achieve record-high performance last year. Samsung Welstory, the industry leader, is estimated to have recorded sales of 1.8 trillion KRW in meal services last year, a 6% increase from the previous year. Meal services account for 60% of its total sales.

During the same period, Hyundai Green Food's meal service sales were about 1 trillion KRW, accounting for 47% of its total sales. Hyundai Green Food provides meal services at approximately 700 locations domestically and internationally. Based on experience operating for large clients such as Hyundai and Kia Motors, it continues to attract new customers. Ourhome and CJ Freshway recorded sales of 900 billion KRW (estimated) and 778.1 billion KRW, respectively.

The industry expects the market to steadily grow, supported by expanded corporate welfare, free school meal policies, and strengthened meal services at hospitals, military bases, and welfare facilities. According to the Korean Meal Service Association, about 17 million people use meal services daily in Korea, meaning one in three citizens uses meal services. An industry insider predicted, "Based on competitive pricing, the group meal service market will continue to show positive trends for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)