Orion and Samyang Foods Increase Year-End Dividends

Most Major Food Companies Freeze Year-End Dividends

Attention on Whether Shareholder Activism Will Spread to the Food Industry

As calls grow louder to enhance corporate value through shareholder returns such as dividend increases and treasury stock cancellations, the so-called 'stingy dividends' in the food industry, which have been criticized for being frugal with shareholder dividends, remain unchanged. Although some food companies that recorded record-breaking performance last year significantly increased their dividends, criticism persists that they are stingy relative to their corporate value.

According to the Financial Supervisory Service's electronic disclosure system on the 13th, Orion's year-end dividend last year was 2,500 KRW per common share, doubling from 1,250 KRW a year earlier. The total dividend amount also increased from 49.4 billion KRW to 98.8 billion KRW, and the dividend yield rose by 1.2 percentage points from 1.1% to 2.4%. The dividend yield is an indicator showing the dividend amount relative to the stock price on the dividend record date.

When the stock price on the record date falls, the dividend yield increases, and a higher dividend yield generally indicates a higher dividend payout tendency of the company. In the stock market, companies with a dividend yield of 5% or more are generally classified as high-dividend stocks.

Orion entered the '3 trillion KRW sales club' with record-high performance last year as overseas sales increased. Consolidated sales were 3.1043 trillion KRW, and operating profit was 543.6 billion KRW, up 6.6% and 10.4% respectively from the previous year. This performance was thanks to the growth of its China and Vietnam subsidiaries, with overseas sales accounting for 65% of Orion's total sales last year. Orion explained the background for expanding dividends by stating, "Although the business environment was challenging due to rising raw material prices, overseas subsidiaries showed strong performance," and "financial stability has also strengthened, with net cash holdings at around 1.6 trillion KRW."

Samyang Foods, which led the K-Food wave and achieved its highest performance since its founding last year, also implemented a dividend increase policy by deciding on a dividend of 1,800 KRW per share, up 700 KRW from 1,100 KRW the previous year. Including an interim dividend of 1,500 KRW, the total annual dividend for 2024 is 3,300 KRW per share, a significant increase from 2,100 KRW in 2023. Samyang Foods' sales last year were 1.1729 trillion KRW, up 45% from the previous year, and operating profit increased by 133% to 344.2 billion KRW. CJ CheilJedang, the largest food company in the industry, also decided on an annual dividend of 6,000 KRW, combining a year-end dividend of 3,000 KRW and quarterly dividends totaling 3,000 KRW, up from 5,500 KRW a year earlier.

However, most major food companies either froze dividends or made only slight increases. Pulmuone recorded its highest performance last year, surpassing 3 trillion KRW in annual sales, and operating profit jumped 50%, nearing 100 billion KRW. Net income also increased by 154.7% to 34 billion KRW compared to the previous year, but dividends were frozen. The dividend per share has been fixed at 102 KRW for six consecutive years.

Dongwon F&B also improved profitability with a 10.0% increase in operating profit (183.5 billion KRW) and a 15.8% rise in net income (126 billion KRW) last year due to improved export and B2B business earnings, but dividends were frozen. The dividend per share remained at 800 KRW for two consecutive years, and the total dividend amount was unchanged at 15.4 billion KRW.

With sluggish shareholder returns... will shareholder activism turn to the food industry?

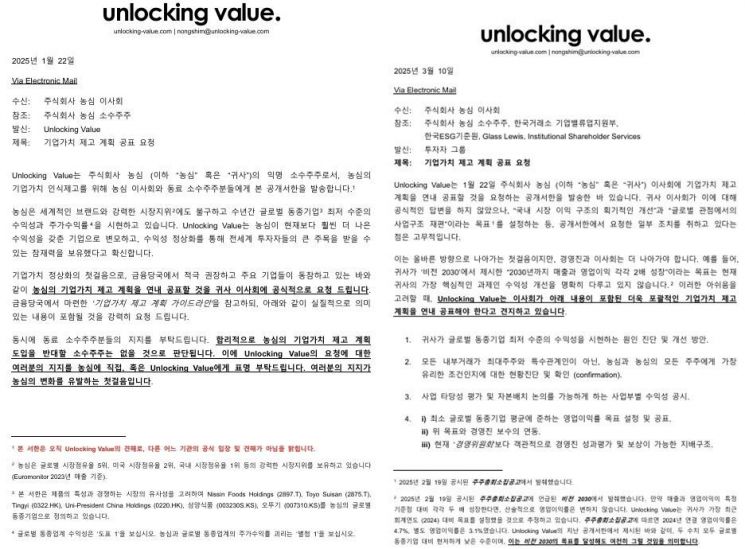

As the government continues to emphasize 'value-up (corporate value enhancement)' for companies, the food industry still shows a passive stance toward shareholder returns, raising expectations that shareholder activism may intensify, especially among minority shareholders. If a company has a stable profit structure but lacks shareholder returns, it is highly likely to become a target of activist campaigns. In fact, recently, Nongshim's anonymous minority shareholder group 'Unlocking Value' sent a public shareholder letter demanding Nongshim announce a corporate value enhancement plan within the year. This is the second public letter following one in January.

While the dividend payout ratio of domestic companies is evaluated as low compared to major countries, pressure to expand shareholder returns may increase for companies in a net cash position. Nongshim was also identified as a company likely to face demands for dividend increases. Kim Yoon-jung, a researcher at LS Securities, noted, "Nongshim's dividend payout ratio is below the average of the past three years," adding, "The capital retention ratio has steadily increased over the past three years, indicating capacity for expanding shareholder returns in a net cash position, and with a price-to-book ratio (PBR) below 1, it is undervalued, making it a likely target for shareholder proposals to increase dividends."

Open Letter Disclosing the Unlocking Value for Individual Shareholders Delivered to Nongshim [Source=Unlocking Value Website]

Open Letter Disclosing the Unlocking Value for Individual Shareholders Delivered to Nongshim [Source=Unlocking Value Website]

With the reorganization of treasury stock-related regulations, shareholder activism demanding shareholder returns through treasury stock cancellations is also expected to increase. On December 31 of last year, the revised Enforcement Decree of the Capital Market Act, which includes amendments to the treasury stock system, came into effect. The main points include restrictions on new share allotments to treasury stock during corporate spin-offs of listed companies, significantly strengthened disclosure requirements during treasury stock holding and disposal processes, and elimination of regulatory arbitrage in treasury stock acquisition and disposal processes. As a result, companies holding 5% or more of treasury stock as of the end of last year (fiscal year-end) will be required to disclose future plans and may simultaneously become targets of activist funds' shareholder proposals for profit cancellation.

Already this year, some companies have begun enhancing shareholder value through treasury stock repurchases and cancellations. Earlier, Hyundai Green Food announced plans to acquire approximately 183,000 shares of treasury stock worth about 2.5 billion KRW through on-market purchases by May 23, and Namyang Dairy Products disclosed that its board decided on May 7 to cancel about 305,464 shares of treasury stock worth approximately 20 billion KRW. Both companies stated that enhancing shareholder value was the purpose of acquiring and canceling treasury stock. Repurchasing and canceling treasury stock reduces the number of shares circulating in the market, which tends to increase the stock price.

Meanwhile, the so-called 'blind dividends' have improved significantly but still persist to some extent. In the past, domestic listed companies were criticized for 'blind dividends' by determining shareholders eligible for dividends at year-end first and then confirming the dividend amount at the shareholders' meeting held the following year. However, since January 2023, financial authorities have improved the system to a 'dividend amount confirmed first, then shareholders eligible for dividends confirmed' method, allowing investors to confirm the dividend amount before investing. Although amendments to articles of incorporation to move the dividend record date after dividend amount confirmation have been continuously made, companies such as HiteJinro, Nongshim, SPC Samlip, and Maeil Dairies still maintain the old practice.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.