6 Out of 10 Companies Miss Market Expectations on Earnings

C&C International Posts Largest Shortfall vs. Consensus

23 Companies Expected to Be Profitable End Up in the Red

Hanwha Solutions Delivers the Biggest Earnings Surprise

As the earnings season for the fourth quarter of last year is coming to a close, corporate earnings have fallen short of expectations. About 65% of companies reported results below market forecasts.

According to financial information provider FnGuide on the 5th, an analysis of the earnings of 243 companies with at least three institutions estimating operating profit consensus (average securities firm forecasts) as of the end of last month showed that 158 companies posted results below consensus. Among them, 23 companies were expected to be profitable but recorded losses, and 18 companies had larger-than-expected losses.

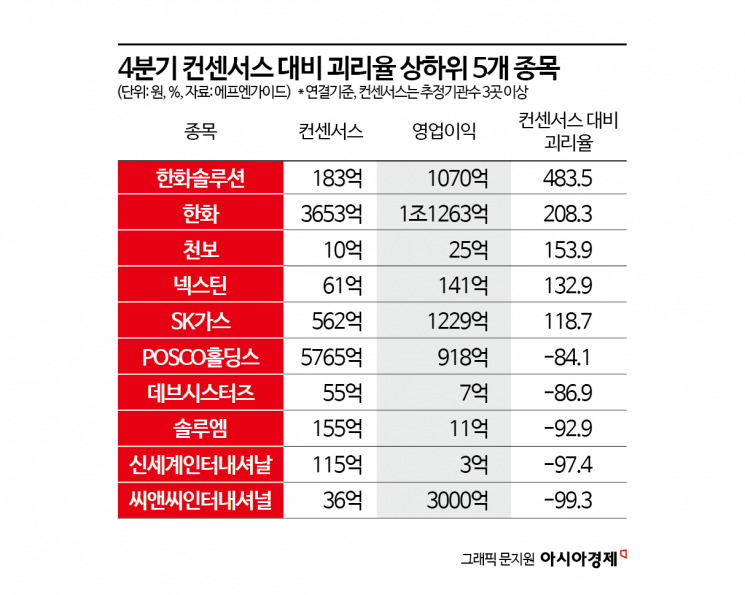

The company with the largest gap below expectations was C&C International. The estimated operating profit for C&C International in the fourth quarter was 3.6 billion KRW, but the actual result was only 30 million KRW, resulting in a deviation rate of -99.3% compared to the estimate. Gayoung Lee, a researcher at Samsung Securities, analyzed C&C International, stating, "Fourth-quarter sales declined by 11% year-on-year, and the operating profit margin was 0%, barely avoiding a loss," adding, "It even fell short of the lowered market expectations."

Other companies that significantly underperformed expectations include Shinsegae International (-97.4%), SoluM (-92.9%), Devsisters (-86.9%), POSCO Holdings (-84.1%), SK Ocean Plant (-83.9%), and Lotte Tour Development (-82.0%).

Hyundai Construction, E-Mart, Hyundai Steel, Hanon Systems, LG, Lotte Wellfood, HD Hyundai Infracore, SeAH Besteel Holdings, Jeju Air, and others were expected to post profits by the securities industry but recorded losses. In the case of Hyundai Construction, the fourth-quarter operating profit consensus was 60.8 billion KRW, but the actual result was an operating loss of 1.7334 trillion KRW. Kyungwon Moon, a researcher at Meritz Securities, explained, "Hyundai Construction recorded an operating loss of 1.7334 trillion KRW in the fourth quarter, turning to a loss compared to the same period last year. This was an earnings shock that significantly missed consensus and marked the largest operating loss ever," adding, "The cause was the reflection of large costs at overseas sites, especially the Bali-Papan site in Indonesia, which accounted for most of it. Common factors included failed negotiations with the client during the surge in construction costs, additional construction performed under insufficient preparation, and no agreement on cost delivery with local partners."

E-Mart was also expected to post an operating profit of 19.5 billion KRW by the market but recorded an operating loss of 7.71 billion KRW. Younghoon Joo, a researcher at NH Investment & Securities, explained, "E-Mart's fourth-quarter sales and operating loss were 7.2497 trillion KRW and 7.71 billion KRW, respectively, falling short of consensus," adding, "This was due to one-time costs such as ordinary wages amounting to 18.95 billion KRW, and impairment losses related to Gmarket also occurred outside operating profit, resulting in a net loss for the period." He added, "However, excluding one-time factors, profitability improvement trends are judged to have continued."

On the other hand, 85 companies posted results exceeding market expectations. Among them, three stocks were expected to post losses but recorded profits, and four stocks had smaller losses than market estimates.

The biggest earnings surprise was Hanwha Solutions, whose fourth-quarter operating profit exceeded estimates by 483.5%, recording the largest deviation rate. Hanwha Solutions' fourth-quarter operating profit was 107 billion KRW, while the consensus was 18.3 billion KRW. Jaesung Yoon, a researcher at Hana Securities, said, "Hanwha Solutions' fourth-quarter operating profit significantly exceeded consensus due to a gain of 96.7 billion KRW from the sale of company housing in Ulsan," adding, "Renewable energy operating profit turned positive at 60.6 billion KRW. Considering about 60 billion KRW in restructuring costs for overseas subsidiaries, the actual operating profit is estimated to have approached 120 billion KRW." Hanwha, whose subsidiaries including Hanwha Solutions recorded a large number of earnings surprises in the fourth quarter last year, followed. Hanwha's operating profit consensus was 365.3 billion KRW, but the actual result was 1.1263 trillion KRW, with a deviation rate of 208.3%.

Other companies that significantly exceeded consensus include Cheonbo (153.9%), Nextin (132.9%), SK Gas (118.7%), KEPCO Engineering & Construction (96.6%), Daewoo Construction (89.0%), Korea Gas Corporation (85.6%), and Mirae Asset Securities (82.3%).

Jiyoung Han, a researcher at Kiwoom Securities, evaluated, "The earnings season for the fourth quarter of last year showed a larger gap below market consensus compared to the previous quarter," adding, "In the fourth quarter, one-time costs were reflected, leading to a tendency for large earnings shocks, but considering that there was already weight on the possibility of downward revisions in earnings forecasts and that the gap below consensus was not large compared to the historical average, excessive pessimism about the fourth-quarter earnings should be limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.