Tourism Balance Deficit Surpasses 10 Billion Dollars Last Year... Up 4% from Previous Year

Nearly 40 Trillion Won Spent by Korean Tourists on Overseas Travel

Overseas Spending Far Exceeds Revenue Increase from Foreign Tourists

Declining Duty-Free Sales and Rising Proportion of Cruise Travelers Also Widen Deficit

Last year, South Korea's tourism balance deficit exceeded 10 billion dollars for the first time in six years. The country recorded a deficit close to 15 trillion won in just one year. Although tourism revenue increased by nearly 10% due to a rise in foreign tourists entering the country, the large-scale deficit was caused by South Korean tourists' overseas travel expenditures far surpassing that increase.

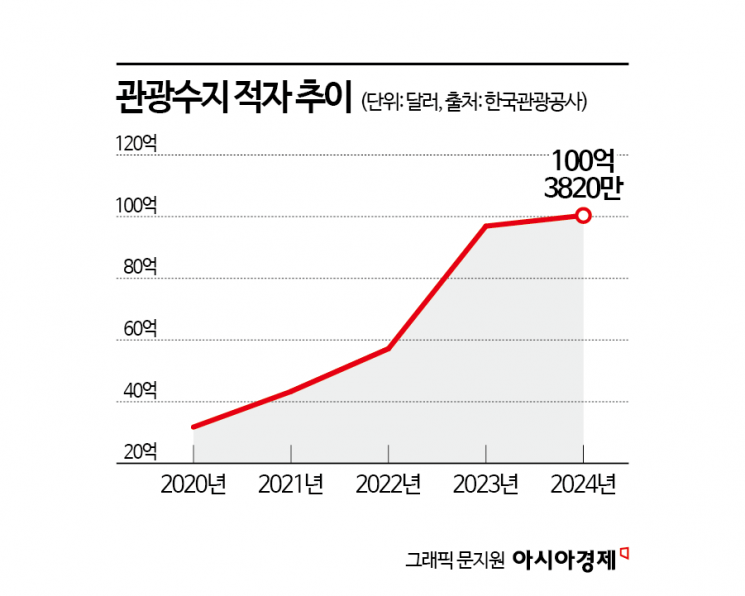

According to the Korea Tourism Organization on the 4th, South Korea's tourism balance deficit last year was 10.0382 billion dollars (approximately 14.67 trillion won), a 3.6% increase compared to the previous year (9.6922 billion dollars). Tourism revenue last year was 16.4543 billion dollars (about 24.04 trillion won), up 1.3889 billion dollars from the previous year, but tourism expenditures increased by a larger margin (1.7349 billion dollars) to 26.4925 billion dollars (about 38.7 trillion won), expanding the deficit.

The tourism balance deficit exceeding 10 billion dollars is the first time since 2018, six years ago. South Korea's tourism balance deficit reached a record high of 14.6959 billion dollars (about 21.47 trillion won) in 2017, and although it slightly decreased the following year, it still recorded a deficit of 13.278 billion dollars, marking the worst period. This was a result of an unofficial travel ban on South Korea imposed by China related to the deployment of THAAD (Terminal High Altitude Area Defense). After the COVID-19 pandemic, the tourism industry itself shrank, reducing the deficit to 3.1753 billion dollars in 2020, but it has since grown again every year, more than tripling in four years.

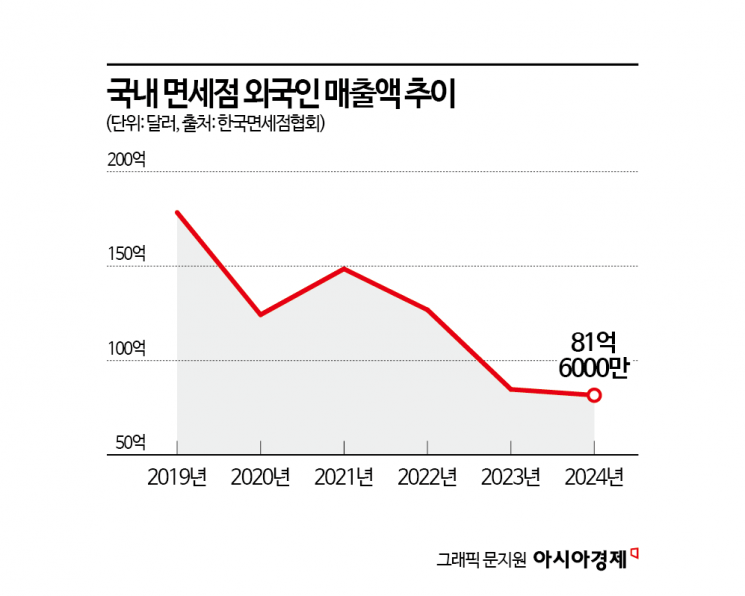

Last year's tourism balance deficit exceeding 10 billion dollars again was largely influenced by decreased duty-free shop sales and the short stays of cruise travelers. First, the decline in duty-free shop sales is pointed out. Foreign sales at domestic duty-free shops, which peaked at 17.84205 billion dollars (about 26.07 trillion won) in 2019, steadily shrank to 8.46604 billion dollars in 2023, halving in four years, and further decreased by 3.6% to 8.16102 billion dollars (about 11.92 trillion won) last year, retreating even more.

Additionally, the increase in cruise travelers among foreign visitors entering South Korea also slowed the recovery of tourism revenue. The number of cruise travelers, which was around 171,000 in 2019, rose to 202,000 in 2023 and jumped to 731,000 last year. However, tourists entering the country via cruise travel tend to have short stays and relatively low spending, contributing to the increase in visitor numbers but not significantly boosting actual tourism revenue.

Moreover, the decrease in the proportion of business travelers, who tend to have large expenditures, is also analyzed as a major factor slowing the recovery of tourism revenue. The proportion of business travelers visiting South Korea increased from 17.9% in 2019 to 18.6% in 2023 but dropped to 14.7% last year. This likely indicates that the reduced demand for business travelers, who are expected to spend heavily, negatively impacted tourism revenue.

The expanding domestic tourism balance deficit clearly shows that South Korea's tourism industry is not benefiting from the recent rapid growth of the global tourism industry. Global travel demand has been continuously increasing since 2015, reaching an all-time high in 2019. Although it sharply declined due to COVID-19 in the following year, it has shown a strong rebound and rapid recovery since 2022.

Last year, global tourism revenue was about 1.6 trillion dollars, a 7.4% increase compared to 2019 (1.49 trillion dollars). In contrast, South Korea's tourism revenue last year was 16.5 billion dollars, still below the 2019 level of 20.7 billion dollars. This shows that South Korea's tourism performance is lagging behind the global industry trend.

The high dependence on Chinese tourists is also pointed out as a risk factor. Among tourists visiting South Korea last year, Chinese tourists accounted for 28.1%, overwhelmingly ranking first. The problem is that China's prolonged real estate market slump and the resulting decline in asset values have significantly dampened consumer sentiment, weakening its influence in the overseas travel market compared to before.

In fact, the number of Chinese visitors from the Asia region, which reached 46.04 million in 2019, dropped by 36.4% to 25.83 million last year, directly impacting Asian tourism demand. Hong Seok-won, Senior Researcher at Yanolja Research, said, "It is necessary to shift from a China-dependent structure to a stable diversified structure," adding, "Customized marketing strategies aligned with global tourism trends and diversified tourism product development are required."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.