Annual Sales Surpass 40 Trillion Won, Record-High Revenue

Major E-Commerce Players Like Gmarket and SSG.com Suffer Poor Results

E-Mart Joins Hands with Alibaba... Will There Be a Seismic Shift?

Thanks to its rapid growth last year, Coupang surpassed 40 trillion won in annual sales among distribution companies. It once again proved its rapid growth by overcoming the wave of paid membership (Wow) fee increases. As Coupang's dominance continues, the positions of domestic e-commerce competitors have further shrunk.

However, as Chinese e-commerce (C-commerce) platforms facing withdrawal threats from the U.S. market strengthen their Korean market penetration with ultra-low-priced products, attention is focused on whether the domestic e-commerce market will be reshaped as E-Mart takes strategic steps by partnering with China's Alibaba.

Annual Sales of 40 Trillion Won, Coupang Soared Alone

According to Coupang on the 26th, Coupang INC recorded sales of 41.29 trillion won (30.268 billion USD) last year, a 29% increase compared to the previous year (31.83 trillion won / 24.383 billion USD). While domestic distributors' performance has been declining due to domestic demand stagnation, Coupang earned nearly 10 trillion won more in just one year. Operating profit reached 602.3 billion won, marking two consecutive years of profitability. Considering the Fair Trade Commission's fine in Q2 (163 billion won) and accounting costs due to the ruling on ordinary wages (40.1 billion won), operating profit reached the 800 billion won level.

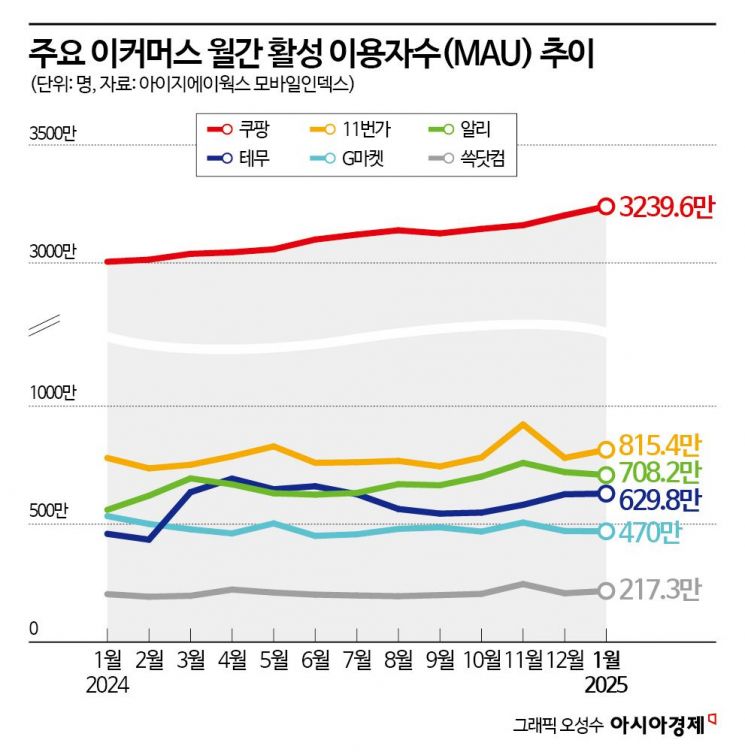

Despite concerns about '탈팡 (탈팡 means customers leaving Coupang)' due to the paid membership (Wow Membership) price increase in the second half of last year, Coupang's user base grew further. As of Q4 last year, the number of active Coupang customers (those who made at least one purchase) was 22.8 million, a 10% increase from 20.8 million the previous year.

Coupang's average spending per customer also rose. Last year, Coupang's sales per customer reached 446,500 won, a 6% increase from the previous year. Kim Beom-seok, Chairman of Coupang INC and founder of Coupang, said, "Last year, we improved logistics processes to increase same-day and dawn delivery volumes by 45%, enhancing customer experience," adding, "This is the result of continuously innovating on behalf of customers to reduce costs while raising service quality standards."

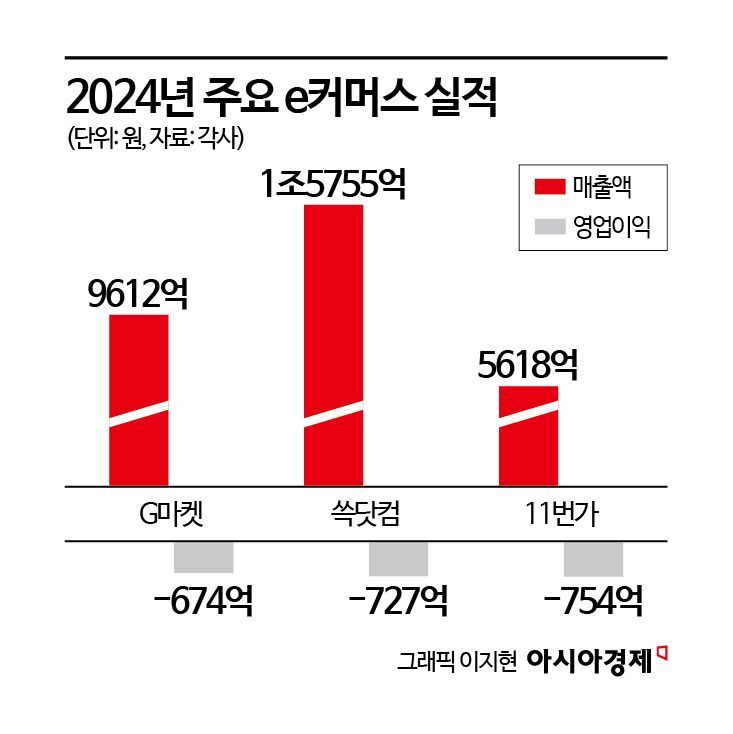

As Coupang showed unstoppable momentum, competing e-commerce companies saw their sales plummet one after another. Gmarket recorded sales of 961.2 billion won last year, down 20% from the previous year. Operating losses increased by 67.4 billion won, with deficits growing by 35 billion won. In the first half of last year, C-commerce's offensive led to heavy marketing losses, and in the second half, consumer trust in the e-commerce market declined following the 'Timemeup (Timon + Wemakeprice)' incident, resulting in poor sales of high-priced products such as digital electronics. The increase in one-time costs due to voluntary retirement, and direct support to sellers affected by the Timemeup incident also contributed to the widened deficit.

SSG.com recorded sales of 1.5755 trillion won and an operating loss of 72.7 billion won last year. Sales decreased by 6% compared to the previous year, and the company reduced its size by cutting marketing expenses to turn a profit. By reducing costs through restructuring and relocating its headquarters, operating losses decreased by about 30 billion won.

11st recorded sales of 561.8 billion won last year, a sharp 35% decline from the previous year. However, as a result of belt-tightening measures such as cost reduction, operating losses decreased by about 50 billion won, but a deficit of 75.4 billion won continued.

The concentration of Coupang in the domestic e-commerce market appears to be accelerating. According to mobile index data from the data platform IGAWorks, as of last month, Gmarket's monthly active users (MAU) were 4.7 million, showing a loss of about 600,000 users compared to January last year (5.34 million). On the other hand, Coupang's MAU last month reached 32.4 million, an increase of 2.4 million from 30 million in January last year. Last month's MAU for SSG.com and 11st were 2.07 million and 8.15 million, respectively.

E-Mart Partners with Alibaba, Temu's Direct Entry into Korea... Will There Be a 'Seismic Shift'?

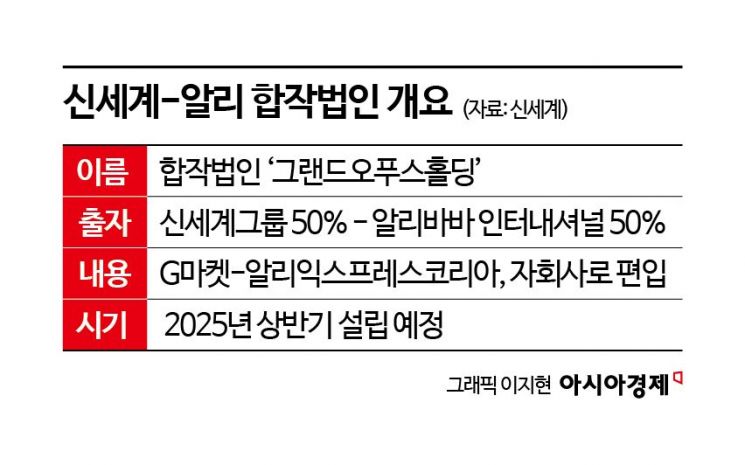

The industry expects that this year the e-commerce market battle between Coupang and C-commerce will intensify. Earlier, Shinsegae Group and Alibaba Group (Alibaba International) announced a strategic alliance, signaling a check against Coupang.

Shinsegae Group's Gmarket and AliExpress Korea established a joint venture (JV) called 'Grand Open Food Holdings' in the first half of this year to begin full-scale cooperation. Gmarket and AliExpress Korea will be subsidiaries of the JV, operating their platforms separately but sharing product offerings to create synergy.

Shinsegae Group expects to secure more customers through cooperation with Alibaba. They plan to absorb more customers by combining the existing open market business with ultra-low-priced Chinese products. In particular, if Alibaba International's global-level IT technology and stable investment attraction continue, competitiveness could also increase.

Alibaba Group is a company listed on the New York Stock Exchange, and Alibaba International has been the fastest-growing part of Alibaba over the past year. Utilizing Alibaba International is expected to quickly enhance shopping convenience by expanding product assortment, increasing price competitiveness, and improving personalized shopping. Recently, Gmarket also established a year-round delivery partnership with CJ Logistics to expand delivery competition.

AliExpress, which is launching an overwhelming offensive with unlimited coupons, low prices, and massive volume, is also expected to benefit. Gmarket sellers entering Ali, combined with Gmarket's accumulated quality control know-how and customer service, could increase consumers visiting the Ali platform. Ali has announced plans to invest 100 million USD by next year to build more logistics centers to improve delivery services and support domestic sellers.

Temu's direct entry into Korea is also attracting attention as a potential variable in the domestic e-commerce market. Temu entered Korea in July 2023 through direct purchase but had not made aggressive investments.

However, recently Temu added an open market business and began recruiting domestic sellers. This year, Temu has officially entered the domestic e-commerce market competition. In fact, Temu hired personnel in marketing, logistics, and HR at the end of last year and signed a long-term lease contract for a large logistics center located in Gimpo. Currently, Temu's MAU is higher than Gmarket and SSG.com.

An e-commerce industry insider said, "The biggest weakness of Chinese e-commerce companies is weak consumer trust and imperfect after-sales customer service," adding, "If these aspects improve, it will be difficult to withstand the volume offensive of Chinese e-commerce companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.