SNE Research: Market Share of the Top Three Korean Battery Companies Drops by 10 Percentage Points in One Year

Last year, the market share of the three major domestic battery companies?LG Energy Solution, Samsung SDI, and SK On?in the global electric vehicle (EV) and energy storage system (ESS) markets dropped significantly. This was due to the all-out offensive by Chinese companies leading with low-cost LFP (Lithium Iron Phosphate) batteries. There are urgent calls for domestic companies to develop strategies to respond to the low-priced Chinese LFP batteries.

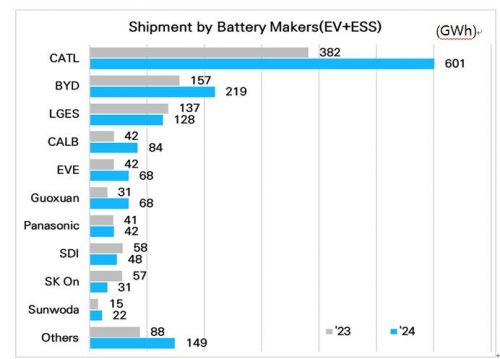

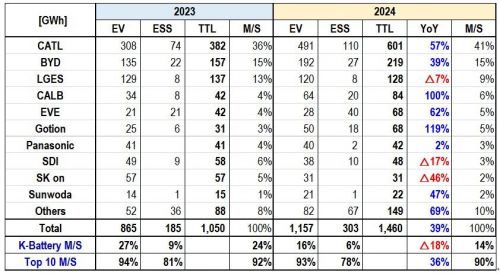

According to the "2024 Global EV and ESS Market Battery Sales Performance by Company" released on the 24th by market research firm SNE Research, the three domestic battery companies all ranked within the top 10 in terms of shipment volume, but their overall market share declined.

LG Energy Solution ranked 3rd with a 9% market share, while Samsung SDI and SK On ranked 8th and 9th with 3% and 2% market shares, respectively. In the same survey, the combined market share of the three domestic battery companies was 24% in 2023, but it fell by 10 percentage points within a year.

The biggest reason for the sharp decline in domestic companies' market share is analyzed to be the rapid spread of LFP batteries. SNE Research explained, "LFP batteries have excellent price competitiveness and thermal stability, leading to increased adoption not only in ESS but also in electric vehicles. The three domestic companies are currently preparing for mass production, so they have no choice but to cede market share to Chinese companies."

On the other hand, Chinese battery companies are further strengthening their dominance in the global market. CATL recorded a 41% market share last year, rapidly growing in both the EV and ESS markets. Chinese companies such as BYD, CALB, and EVE also continued their growth trends.

SNE Research pointed out the urgent need for the three Korean battery companies to develop LFP batteries and establish production lines. LG Energy Solution plans to operate an ESS LFP battery line in the United States starting at the end of this year, aiming to increase its market share in the North American market by more than 30%.

Samsung SDI will also begin full-scale mass production of LFP batteries in Korea starting next year. From 2027, it plans to expand its market share in the ESS and EV markets in North America through local production in the United States.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.