FSS Releases "2024 IPO Market Trend Analysis"

High Competition and Offering Prices in First Half, Decline in Second Half

Last Year's IPO Fundraising Rose to 3.9 Trillion Won... "Driven by Increase in Large Companies"

The 2024 initial public offering (IPO) market showed a top-heavy trend. While subscription competition rates and desired offering prices were set at high levels in the first half, the market underperformed in the second half due to increased uncertainties such as stock market instability.

According to the Financial Supervisory Service's (FSS) "2024 IPO Market Trend Analysis" released on the 18th, the demand forecast competition rate for institutional investors last year was 775 to 1, down 16.2% from the previous year. The competition rate decreased due to the imposition of obligations to verify the ability to pay for shares.

The decline in competition rates was more pronounced in the second half compared to the first half. The competition rate in the first half of last year was 871 to 1, while in the second half it was 717 to 1. Factors such as limiting institutional participants' subscription quotas to their own capital (proprietary assets) or AUM (assets under management) and increased uncertainties in the second half influenced this trend.

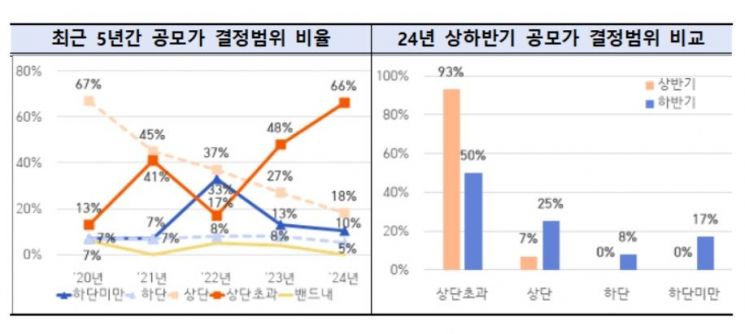

Along with this, the rate of confirming offering prices exceeding the upper limit of the price band also increased, but the trend differed between the first and second halves. The proportion of institutional investors proposing desired prices exceeding the upper limit of the offering price band rose to 83.8%, up 13.8 percentage points from 70.0% in 2023, reaching an all-time high. Due to the increase in price proposals exceeding the upper limit, the rate of final offering prices exceeding the upper band last year was 66%, an 18 percentage point increase compared to the previous year.

However, as the year progressed into the second half, a more selective trend emerged. While 93% of IPOs in the first half were priced above the upper band, the proportion dropped to around 50% in the second half. The proportion of offerings priced below the lower band also increased from 0% in the first half to 25% in the second half.

Due to the IPO boom in the first half, the number of participating institutions reached a record high. This is interpreted as influenced by increased participation from asset management companies and discretionary investment managers using their own assets. The number rose 24.2% from 1,507 companies in 2023 to 1,871 companies last year.

The subscription rate among general investors also showed a top-heavy trend. The subscription competition rate for general investors last year decreased from 1,624 to 1 in the first half to 650 to 1 in the second half. The overall subscription competition rate last year was 1,016 to 1, an 8.8% increase compared to 934 to 1 in 2023. The total subscription deposit from general investors was 355 trillion won, up 20.2% from 295 trillion won in 2023.

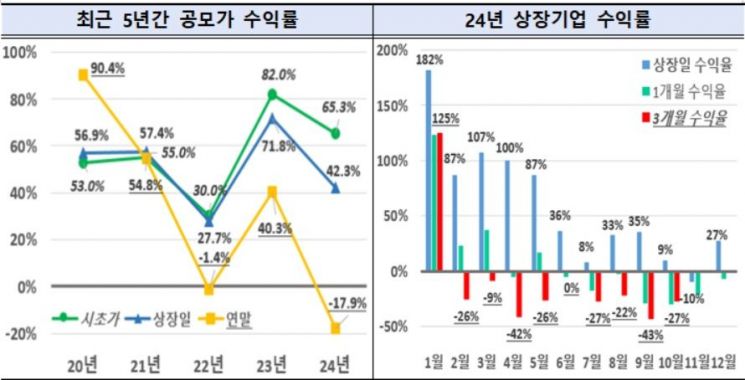

The initial and closing price returns on the listing day compared to the offering price declined from the record highs seen in 2023. Specifically, the initial price return dropped from 82% to 65%, and the closing price return fell from 72% to 42%. Additionally, the listing day return (closing price) showed a downward trend since January. In November last year, 9 out of 11 newly listed companies recorded losses.

The total IPO fundraising amount last year was 3.9 trillion won, a 16.4% increase from 3.3 trillion won the previous year. However, the number of IPO companies decreased by five to 77 compared to the previous year. This is attributed to a decline in small and medium-sized IPOs from 68 in 2023 to 62 last year. By market, 7 companies entered the KOSPI market and 70 companies entered the KOSDAQ market.

The number of special listing companies last year reached a record high of 41, up 24.2% from 33 the previous year. They accounted for 58.6% of KOSDAQ-listed companies. By type, technology evaluations continued to increase with 36 companies. By industry, biotech led with 10 companies, followed by science and technology-related manufacturing such as robotics, aerospace, and spacecraft with 9 companies, and research and development (R&D) with 7 companies. The FSS explained, "The proportion of biotech decreased from 68% in 2020 to 25.0% last year," adding, "The trend of diversification from biotech to non-biotech industries is continuously increasing."

The FSS plans to continuously strive to enhance fairness and rationality in the IPO market and protect investors. The FSS emphasized, "We will support the IPO market to be rationalized from short-term profit-seeking investments to investments based on corporate value," and added, "We will strengthen communication by sharing notable issues identified during the IPO review process and listening to industry difficulties through meetings with underwriters."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.