6-Month Deposit Rates at Commercial Banks Surpass 1-Year Rates

Driven by Interest Rate Cuts

Increasing Trend Toward Maintaining Liquidity in a Low-Interest Environment

There is a phenomenon where the short- and long-term deposit interest rates at commercial banks are inverted. Typically, longer maturities offer higher interest rates, but the interest rate on 6-month deposits has become higher than that of 1-year deposits. As the full-scale interest rate cut phase begins, banks find it burdensome to offer high interest rates for the promised period, and consumers prefer to maintain liquidity so they can move their funds to suitable investments whenever they find them, rather than locking funds at low interest rates. This appears to be the cause of this phenomenon.

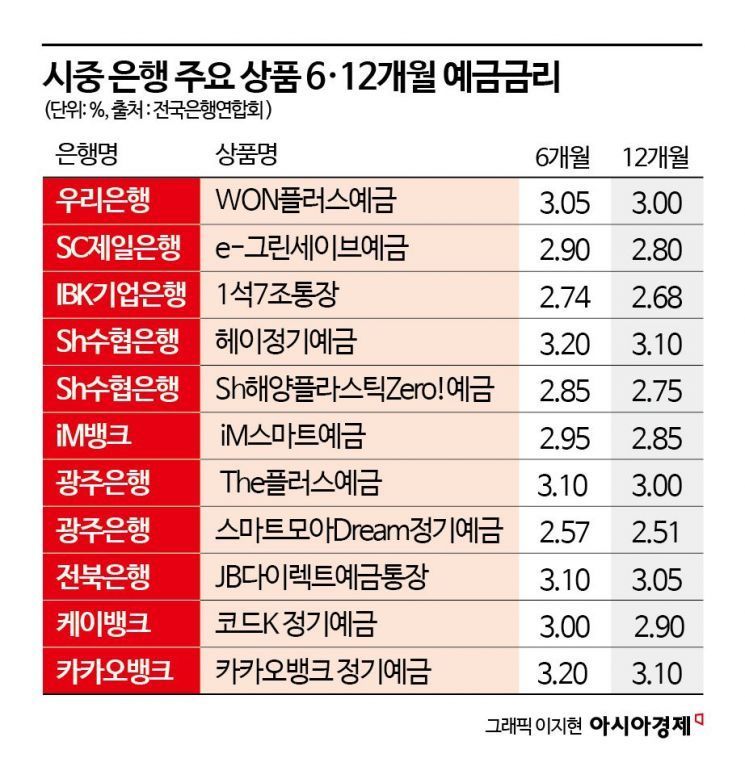

According to the banking sector on the 17th, a review of deposit products disclosed by the Korea Federation of Banks showed that 9 banks and 11 deposit products have higher 6-month deposit rates than 1-year deposit rates. SC First Bank’s e-Green Save Deposit, Sh Suhyup Bank’s Hey Jeonggi Deposit, Sh Marine Plastic Zero! Deposit, iM Bank’s iM Smart Deposit, Gwangju Bank’s The Plus Deposit, K Bank’s Code K Fixed Deposit, and Kakao Bank’s Kakao Bank Fixed Deposit have 6-month deposit rates that are 0.10 percentage points higher than their 1-year deposit products. Additionally, Woori Bank and Jeonbuk Bank have 1-year deposit rates that are 0.05 percentage points lower than their 6-month deposit products.

Generally, banks offer higher interest rates for longer deposit periods because longer deposits ensure more stable fund management from the bank’s perspective. However, this unusual inversion of short- and long-term interest rates is interpreted as an effect of interest rate cuts. Banks set deposit interest rates by adding a margin to market interest rates, and since the Bank of Korea cut rates twice after October last year, long-term interest rates in the bond market have fallen below short-term rates, which has been reflected in bank interest rates, according to the banking sector.

Furthermore, with additional interest rate cuts expected in the future, banks find it burdensome to offer high interest rates for the promised period. A banking sector official said, "For products that must provide high interest for a certain period in a falling interest rate environment, negative margins may occur after the base rate cuts become full-scale."

In a low interest rate environment where preference for deposits is not high, it is interpreted that banks are trying to attract customers with short-term products. Also, as part of banks’ liquidity management, they seem to be encouraging short-term deposits under one year to spread out maturity dates. A banking sector official explained, "Customers do not prefer to lock funds for a long time in a low interest rate environment, and from the bank’s perspective, it is advantageous to offer lower interest rates upon reinvestment after maturity, given the expectation of further rate declines."

In fact, compared to the past, customer preference for short-term deposits over long-term deposits of more than one year has increased. In the past three months, deposits withdrawn from the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) totaled 25.9203 trillion won. Deposits steadily decreased from 948.2201 trillion won in November last year to 927.0916 trillion won in December, and 922.2998 trillion won in January this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)