Sales Reached 785 Billion KRW Last Year, Up About 4% Year-on-Year

Continued Decline Due to Low Birth Rate, Gradual Recovery Underway

Market Leader Lotte Wellfood's Share Shrinks... Imported Chocolate on the Rise

The domestic chocolate market, which had contracted due to low birth rates and the wellness trend, is showing signs of recovery. New products such as 'Zero Chocolate' have been launched to overcome the market slump, rekindling consumer interest. The market leader remains the traditional powerhouse Lotte Wellfood. However, as tastes become more sophisticated, the influence of imported chocolates continues to grow, leading to a decline in market share.

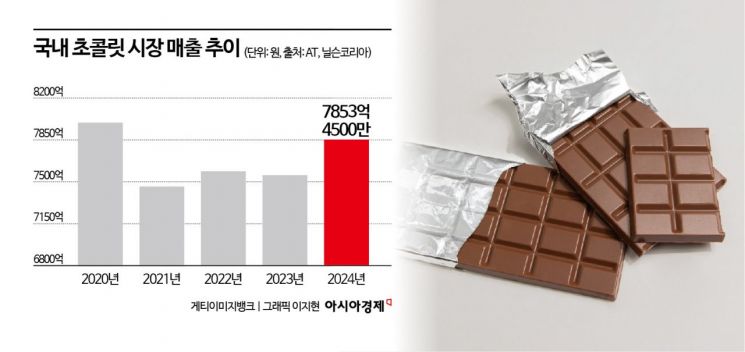

According to the Food Industry Statistics Information System (aTFIS) on the 14th, retail sales of the domestic chocolate market last year amounted to 785.345 billion KRW, a 3.94% increase compared to the previous year (755.574 billion KRW).

The domestic chocolate market has been shrinking continuously since 2018 due to the low birth rate, which caused the main consumer groups such as children and adolescents to shrink. In 2021, the market fell below 800 billion KRW for the first time, plunging to 746.777 billion KRW. Fortunately, recently, the market size has been recovering with the launch of 'Healthy Pleasure' new products aimed at overcoming the chocolate market slump. Healthy Pleasure is a trend that combines health and taste, with representative products including Lotte Wellfood’s sugar-free chocolate, 'Zero Mild Chocolate.'

An official from the Korea Agro-Fisheries & Food Trade Corporation explained, "Since 2018, the domestic chocolate market has been continuously declining, but with the release of new products that meet consumer demands, it has turned to a recovery trend since 2022."

The strongest player in the domestic chocolate market is Lotte Wellfood. Lotte Wellfood boasts an overwhelming market share with flagship products such as Pepero and Ghana. Last year, its market share was 37.24%. However, its influence is gradually decreasing. After recording 40.85% in 2022, the 40% barrier was broken, and it recorded 39.18% in 2023, continuing to shrink last year as well.

The gap left by Lotte Wellfood is being filled by imported chocolates. According to the Korea Agricultural Trade Information (KATI), the import value of domestic chocolates in 2023 was 243.69 million USD (approximately 351.7 billion KRW), showing an average annual growth rate of 3.5% since 2019.

An official from the Korea Agro-Fisheries & Food Trade Corporation said, "As consumption of premium desserts and gift chocolates increases, interest in imported chocolates, which are perceived as premium, is also rising, steadily expanding the imported chocolate market."

Meanwhile, due to abnormal weather conditions such as heatwaves, global cocoa prices are soaring. Cocoa, the main ingredient of chocolate, reached a record high futures price of 12,565 USD per ton on December 20 last year. Cocoa prices rose 172% over the past year.

As a result, domestic chocolate product prices have been continuously rising, increasing the burden on consumers. Lotte Wellfood will raise prices of 26 products, including Pepero and Ghana Mild, by an average of 9.5% starting from the 17th. Orion raised prices of 13 products, including Choco Song-i and Bicho B, by an average of 10.6% starting from December last year. Haitai Confectionery also raised prices of 10 chocolate products, including Home Run Ball and Free Time, by an average of 8.6% starting from December.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.