Turned to Deficit Due to Timep Incident, Despite Record Revenue

Six New Game Titles to Launch This Year

Doorey to Develop Image Processing and Music Production Technologies

Despite achieving its highest-ever annual revenue, NHN posted a loss due to the delayed settlements caused by the Tmon and Wemakeprice (Timep) incident.

On the 14th, NHN announced that its consolidated revenue for last year reached a record high of 2.4561 trillion KRW, an 8.2% increase compared to the previous year. However, it recorded an operating loss of 32.6 billion KRW, turning to a deficit. This was due to the bad debt write-off related to uncollected receivables from the Timep incident in the third quarter of last year. NHN explained, "Excluding the one-time costs related to Timep, operating profit increased by 94% year-on-year to 18.1 billion KRW, marking an all-time high."

Consolidated revenue for the fourth quarter rose 7.6% year-on-year to 643.9 billion KRW, setting a new quarterly record. Operating profit for the fourth quarter turned positive to 25 billion KRW compared to the same period last year.

Looking at the fourth quarter revenue by segment, the gaming division recorded 119 billion KRW, a 6.5% increase year-on-year, driven by strong performance of major web board games and Japanese mobile games. The payment and advertising division's fourth-quarter revenue was 307 billion KRW, up 4.8% year-on-year. The core business, B2B corporate welfare solutions, saw a 44% increase in transaction volume compared to the same period last year.

The technology division achieved its highest quarterly revenue of 118.5 billion KRW, a 50.2% increase year-on-year. NHN Cloud succeeded in public cloud transition projects, and NHN Doorey and Techorus each recorded double-digit revenue growth rates. The commerce division's revenue decreased by 16.6% year-on-year due to management efficiency improvements. The content division recorded 51.8 billion KRW, a 4.0% increase year-on-year, thanks to NHN Link's year-end performance business results.

This year, NHN plans to focus on generating results in its gaming and cloud businesses while improving profitability through structural efficiency in key business divisions. In the gaming sector, it plans to release a total of six new titles, including Darkest Days, Abyssdia, Pebble, Pebble City, and Project STAR.

Darkest Days will undergo final testing at the 'Steam Next Fest,' an event where players can experience upcoming releases, starting on the 25th, before its global launch. Abyssdia is focusing on content enhancement ahead of its planned release in Japan in the second quarter of this year. The social casino platform Pebble will be unveiled next week and will target the North American market, its home base, for global expansion. NHN CEO Jung Woo-jin stated, "We have internally set a business goal for new games to contribute at least a 25% revenue growth rate."

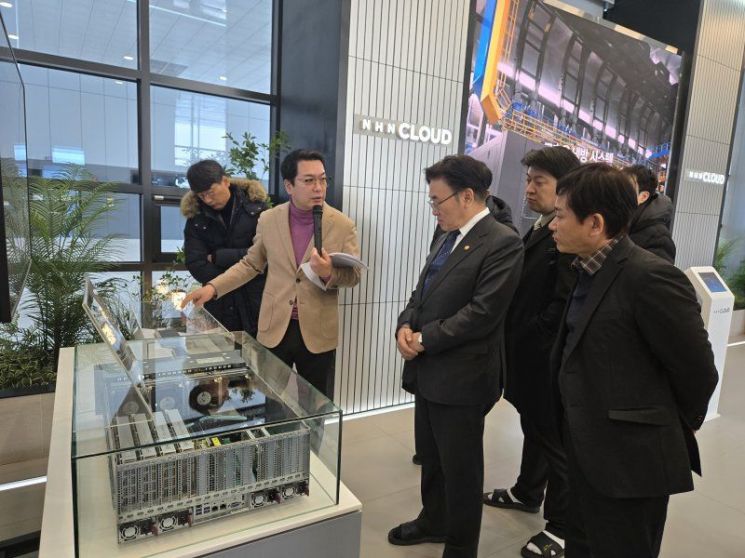

Yoo Sang-im, Minister of Science and ICT, is inspecting the operation status of the Gwangju AI Data Center at the Gwangju AI Industry Convergence Complex on the 6th.

Yoo Sang-im, Minister of Science and ICT, is inspecting the operation status of the Gwangju AI Data Center at the Gwangju AI Industry Convergence Complex on the 6th.

NHN Cloud plans to expand its GPU-as-a-Service (GPUaaS) business based on the Gwangju Artificial Intelligence (AI) Data Center and actively respond to government AI projects. It will also expand services linked to NHN Doorey and generative AI. Recently, it has been preparing to develop and launch cloud-based services such as image processing and music production. NHN Techorus achieved a 14% growth rate last year and aims for an even higher growth rate this year.

Additionally, NHN will focus its capabilities on core businesses and gradually discontinue some low-profit services. Last year, NHN streamlined 14 subsidiaries. CEO Jung said, "Most of the subsidiaries and investment companies related to commerce were reorganized, and cloud-related subsidiaries were also streamlined. Regarding overseas subsidiaries, local government approvals may be delayed, potentially pushing timelines to 2026."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.