Inspire Reports Operating Loss of 150 Billion Won Last Year

Paradise and GKL See Decline in Operating Profit

Emergence of New Competitor and Increased Marketing Costs Estimated

Fiercer Competition for Customers Expected

Last year's business performance reports released by foreign casino operators such as Paradise and Grand Korea Leisure (GKL) can be summarized as "sales held up well, profitability declined." This is the result of being driven into cutthroat competition following the entry of Mohegan Inspire Entertainment Resort (Inspire), which marked its first anniversary in Korea. Although the customer base expanded due to the emergence of a new operator, fierce competition among companies to attract visitors led to increased related expenses.

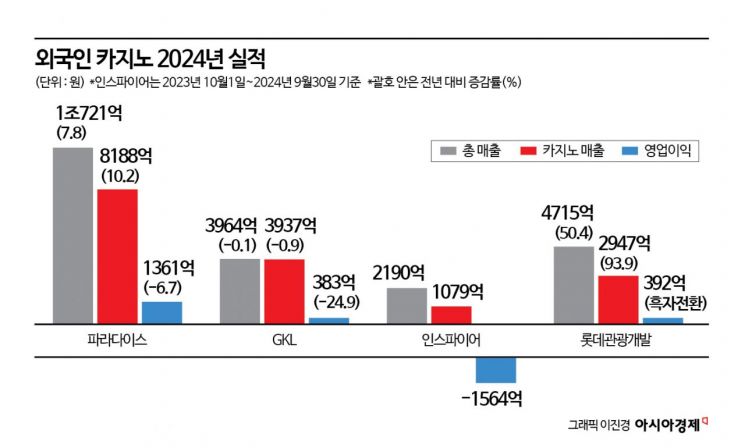

According to the industry on the 13th, Paradise's consolidated sales last year increased by 7.8% year-on-year to 1.0721 trillion won, surpassing 1 trillion won in annual sales for the first time since its founding, but operating profit decreased by 6.7% to 136.1 billion won. GKL's sales during the same period slightly declined by 0.1% to 396.4 billion won, maintaining a similar level, while operating profit fell by 24.9% to 38.3 billion won.

These companies explained that "annual operating profit decreased due to increased costs from strengthened marketing." For example, GKL spent 32.6 billion won on selling and administrative expenses last year, a 12% increase from the previous year, and marketing activity expenses rose by 15% to 66.6 billion won. Investments in related costs also resulted in an increase in the number of visitors to Paradise and GKL. Paradise, which strengthened marketing activities mainly targeting VIPs, saw 82,687 Japanese VIP visitors last year, an 8.3% increase from the previous year. Chinese VIP visitors increased by 55.4% to 36,621. GKL's combined number of Japanese visitors, including VIPs and mass (general customers), rose by 53% year-on-year to 342,000 last year, and Chinese visitors increased by 34% to 485,000.

However, it is estimated that some of the performance of Paradise and GKL, which operate casino venues mainly in the metropolitan area and inland, flowed to Inspire, which has operated a foreigner-only casino since February last year. This is because Inspire Casino, based in Yeongjongdo, Incheon, is geographically competing with four Paradise casinos (Seoul Walkerhill, Busan, Jeju Grand, Incheon Paradise City) and GKL-operated Seven Luck casinos (Seoul Gangnam·Yongsan, Busan).

In fact, Inspire recently disclosed its business performance for the first time since entering the domestic market, covering the previous fiscal year (October 1, 2023 ? September 30, 2024), reporting total sales of 219 billion won across its integrated resort, including casino, hotel, food and beverage, and entertainment. However, due to operating expenses of 375.4 billion won, including labor costs for initial staffing, it recorded an operating loss of 156.4 billion won.

Among this, the foreigner-only casino generated sales of 107.9 billion won over about seven months, averaging 15.4 billion won per month. Paradise and GKL's annual casino sales were 818.8 billion won and 393.7 billion won, respectively, which translates to monthly averages of 68.2 billion won and 32.8 billion won. Although Inspire lagged behind these companies, its first-year performance is considered not bad. The securities industry reports that Inspire Casino's monthly sales rose to around 30 billion won in August last year.

An industry insider said, "Inspire aggressively attracted foreign tourists by promoting K-pop and overseas famous artist concerts, international conferences, and other events based on entertainment facilities such as a 15,000-seat multipurpose arena." He added, "It seems to have absorbed some of the customer base from casino competitors in Japan and Greater China." He also predicted, "With the limited number of foreign tourists visiting Korea annually, the behind-the-scenes competition to steal customers from competitors and create new demand will become much fiercer."

Meanwhile, Lotte Tour Development, which operates a foreigner-only casino within the Jeju Dream Tower integrated resort, is relatively free from cutthroat competition unlike inland areas, and its performance rebounded as direct flight routes connecting Jeju and overseas expanded. Lotte Tour Development's sales last year, including casino and hotel, increased by 50.4% year-on-year to 471.5 billion won, the highest since the integrated resort opened in December 2020. Operating profit also turned positive for the first time at 39.2 billion won. Among this, casino sales rose sharply by 93.3% to 294.7 billion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.