Trump Administration's Universal Tariffs Expected to Cause Sharp Decline in South Korean Exports This Year

1% Universal Tariff May Cut Exports by 1.8 Trillion Won, 10% by 18 Trillion Won

Export Decrease Projected Across Most Industries

It is projected that if the United States imposes a 10% universal tariff on South Korea this year, our total exports will decrease by more than 18 trillion won. Since universal tariffs are likely to impact small and medium-sized enterprises (SMEs) more severely than large corporations, there are calls to develop support measures targeting these businesses.

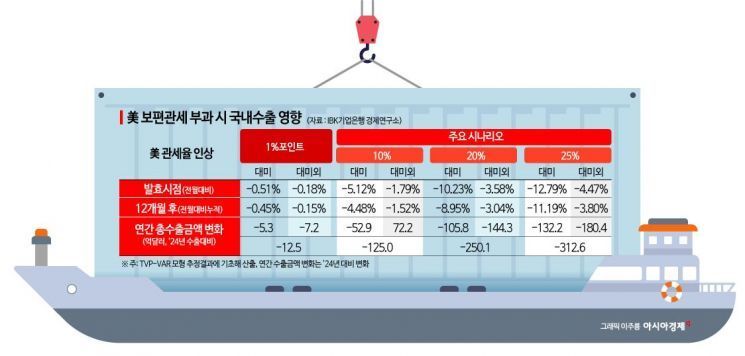

According to the report "The Impact of US Universal Tariffs on Domestic Exports" released on the 14th by IBK Industrial Bank of Korea's Economic Research Institute, the possibility is increasing that the new US administration under Donald Trump will apply universal tariffs to South Korea, following Mexico, Canada, and China. If the US universal tariffs become a reality, negative effects on domestic exports will be inevitable.

The report predicts that if the US tariff rate increases by 1%, South Korea's exports to the US will decrease by 0.45% and exports to countries other than the US will decrease by 0.15% after 12 months, resulting in an annual total export reduction of $1.25 billion (1.8 trillion won) compared to last year. If the 10% rate imposed on China is applied to South Korea, annual total exports will decrease by $12.5 billion (18 trillion won) compared to last year. If tariffs of 20% or more are imposed, as with Mexico and Canada, South Korea's total exports will decrease by more than 36 trillion won.

Jang Han-ik, a research fellow at IBK Industrial Bank of Korea's Economic Research Institute, explained, "The export reduction effect from tariff increases stabilizes after an adjustment period of about six months," but added, "If the US's demands are not met, it is expected to use pressure strategies to further raise tariffs, so the actual shock could be larger and last longer."

US universal tariffs are expected to negatively affect most domestic export industries. In particular, industries with significant exports to the US such as fine chemicals, machinery, computers, telecommunications equipment, steel, non-ferrous metals, textiles, and food and beverages are expected to suffer damage.

Analysis also shows that SMEs will be more affected than large corporations. When tariffs increase by 1%, exports from large corporations decrease by 0.36%, while those from SMEs decrease by 0.50%. There are concerns about damage to SMEs that import raw materials from China, process them, and sell to the US, or those that establish local factories in Mexico and export to the US.

Research fellow Jang emphasized, "Stable funding supply for more than six months and customized support measures by detailed industry should be prepared for export SMEs expected to experience large declines in exports to the US," and added, "We must also prepare for the possibility of a rise in the dollar value and increased exchange rate volatility due to the export decline shock."

Earlier, the Korea Institute for Industrial Economics and Trade also released a report last week expressing concerns about damage to Korean industries from the imposition of US universal tariffs. According to the institute, South Korea is currently the sixth-largest import country for the US, and major export items to the US such as automobiles (34% of exports to the US) and semiconductors (8% of exports to the US) are primary targets of universal tariffs.

The institute estimated that exports to the US would decrease by 9-13% due to the 10% universal tariff, with automobile exports declining by 6-14% and semiconductor exports by about 5-8%. The damage to SMEs is expected to be greater, with exports of major SME items to the US potentially decreasing by up to 1.2 trillion won (11.3%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.