Market Share of Korean Battery Companies Drops Below 20%

Chinese Companies Expand Presence, Led by CATL and BYD

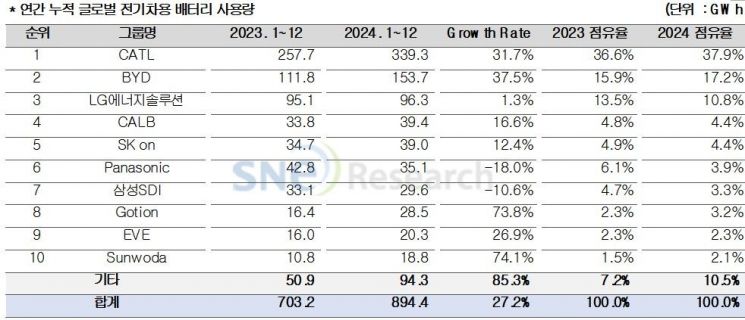

Last year, the global market share of the three major domestic battery companies?LG Energy Solution, Samsung SDI, and SK On?dropped by 4.7 percentage points (p), hovering below 20%.

According to the "2024 January-December Global Electric Vehicle Battery Usage Report" released on the 11th by market research firm SNE Research, the combined market share of the three domestic battery companies last year was 18.4%. This represents a 4.7%p decrease from the previous year (23.1%).

Meanwhile, Chinese companies competing with Korea in the global market saw their market shares rise, supported by domestic demand and emerging markets. CATL's market share increased from 36.6% to 37.9%, and BYD's share rose from 15.9% to 17.2%, ranking first and second respectively. The combined market share of these two companies alone reached 55.1%.

This phenomenon is interpreted as a result of sluggish electric vehicle sales in North America and Europe, which are the main markets for domestic companies. In contrast, the Chinese electric vehicle market continues to grow steadily. Despite an overall slowdown, global electric vehicle battery usage last year increased by 27.2% year-on-year to 894.4 gigawatt-hours (GWh), driven by growth in the Chinese market.

Looking at each company, LG Energy Solution's electric vehicle battery market share fell from 13.5% to 10.8%. The largest users of LG Energy Solution’s batteries were Tesla, Volkswagen, and Ford, in that order. Notably, battery supply for the Tesla Model 3 increased by 47% compared to the previous year, showing remarkable growth. As sales of Chevrolet’s electric vehicles equipped with the Ultium platform?Equinox, Blazer, and Silverado?expanded, Chevrolet’s usage of LG Energy Solution batteries also increased by 24.0%.

Samsung SDI’s electric vehicle battery supply decreased by 10.6% year-on-year, showing negative growth. Its market share also dropped from 4.7% to 3.3%. SNE Research analyzed that "the main cause was the reduced battery demand from major automaker customers in the European and North American markets." One of Samsung SDI’s key customers, Rivian, negatively impacted the results by equipping some models with lithium iron phosphate (LFP) batteries. Battery usage in Audi vehicles equipped with Samsung SDI batteries also declined by 30.9%.

SK On’s market share fell from 4.9% to 4.4%. The company’s battery usage was highest with Hyundai Motor Group, Mercedes-Benz, Ford, and Volkswagen, in that order. Sales of Hyundai Motor Group’s electric commercial vehicles, Bongo3 EV and Porter2 EV, decreased, leading to a 60.3% and 59.2% reduction in battery usage year-on-year, respectively. The Kia EV9 saw a 235.9% increase in battery usage, supported by expanded overseas sales.

SNE Research advised, "The impact of changes in the U.S. Inflation Reduction Act (IRA) policy is likely to be a significant variable across the battery industry." It added, "Korean battery companies must respond to the changing market environment through supply chain diversification, cost reduction, and technological innovation, and proactive investment and strategic partnerships are essential to expand market share in emerging markets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.