5 Out of 10 Global IBs Predict "0 to 1 Fed Rate Cuts This Year"

Bank of Korea Faces Tough Decisions Amid Cautious Fed Rate Cut Outlook

Half of global investment banks (IB) predicted that the U.S. Federal Reserve (Fed) will cut policy interest rates no more than once this year. As inflation remains somewhat elevated and the labor market continues to show solid performance, the view that the Fed will implement rate cuts more cautiously is gaining traction.

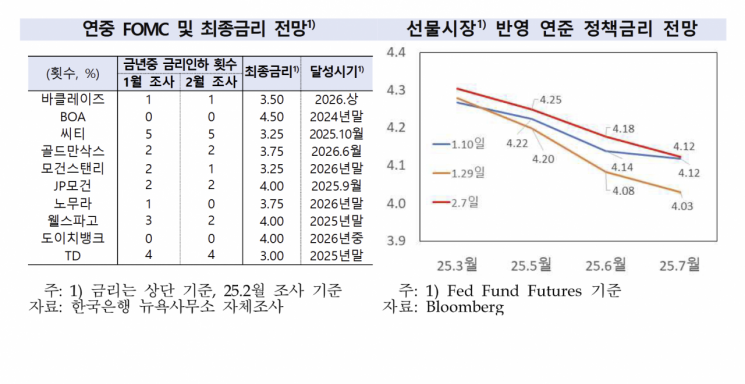

According to the 'Recent U.S. Economic Conditions and Assessment' report published by the Bank of Korea's New York office on the 11th, 5 out of 10 global IBs forecast the Fed's number of rate cuts this year to be between 0 and 1.

Bank of America (BOA) and Deutsche Bank expected rates to remain unchanged this year, continuing their outlook from last month. Nomura revised its forecast from one cut last month to no cuts this month. Morgan Stanley also adjusted its forecast from two cuts to one cut. Along with Barclays maintaining its forecast of one cut, five global IBs now expect 0 to 1 rate cuts within the year.

The Fed policy rate outlook reflected in the futures market has also risen. The year-end rate forecast for the first half of this year increased by 0.10 percentage points from 4.08% as of the 29th of last month to 4.18% on the 7th of this month. This is 0.32 percentage points lower than the current 4.50%.

The Bank of Korea explained in the report, "At last month's U.S. Federal Open Market Committee (FOMC) meeting, the policy rate was held steady as expected, but the policy statement was somewhat hawkish (favoring monetary tightening)." However, "Fed Chair Jerome Powell's press conference was interpreted as somewhat dovish, so there was little impact on financial market price variables."

As the cautious stance on Fed rate cuts gains momentum, attention is turning to the Bank of Korea's Monetary Policy Committee meeting scheduled for the 25th of this month, which will decide the second base rate of the year. With expectations weighted toward a 0.25 percentage point rate cut, the Fed's pace adjustment adds pressure due to the widening interest rate gap between Korea and the U.S.

Bank of Korea Governor Lee Chang-yong said in a foreign media interview on the 6th that regarding the predominance of rate cut forecasts in February, "A rate cut at this Monetary Policy Committee meeting is not inevitable." Governor Lee added, "Fiscal stimulus is necessary. I believe there is room for more cooperation between monetary policy and fiscal policy," reiterating support for the supplementary budget (Chugyeong) formulation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.