Stellantis Down 57.6%, GM Down 23.8%

The Mexican automotive industry, which had been growing steadily by leveraging exports to the United States, has already suffered damage due to U.S. President Donald Trump's threat to impose tariffs. In particular, U.S.-based companies with production facilities in Mexico have also faced backlash. U.S. automakers Stellantis and General Motors (GM) recorded a decline in exports of vehicles from Mexico by over 50% and around 20%, respectively, in January.

'January Small Car Production and Export Status Report' released by the Mexican National Institute of Statistics and Geography (INEGI). Data source: INEGI

'January Small Car Production and Export Status Report' released by the Mexican National Institute of Statistics and Geography (INEGI). Data source: INEGI

According to the "January Small Car Production and Export Status Report" released on the 10th (local time) by Mexico's National Institute of Statistics and Geography (INEGI), small car production in Mexico last month totaled 312,257 units, a slight increase of 1.7% compared to the same period last year (307,090 units).

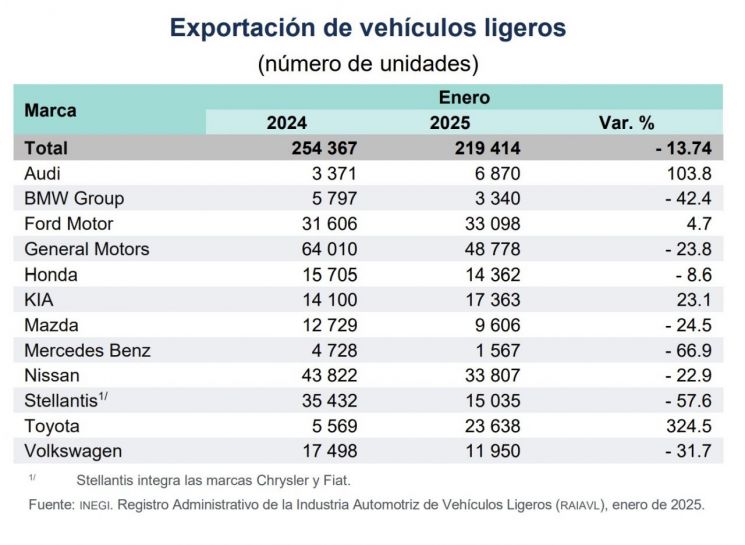

Domestic sales in Mexico reached 119,811 units, up 5.9% from January last year (110,397 units). However, exports, which account for 70-80% of production, totaled 219,414 units, a sharp decline of 13.7% compared to January last year (254,369 units). This is the lowest level in recent years since the full-scale nearshoring (relocation of production bases to neighboring areas) began following the implementation of the United States-Mexico-Canada Agreement (USMCA) in 2020.

By company, the decline among U.S.-based automakers is particularly notable. Stellantis, born from the merger of the U.S.-Italian joint venture Fiat Chrysler and the French company PSA, owner of Peugeot, exported 15,035 units, down 57.6% from January last year (35,432 units). General Motors also saw its export volume in January this year (48,778 units) decrease by 23.8% compared to January last year (64,010 units).

'January Small Car Production and Export Status Report' released by the Mexican National Institute of Statistics and Geography (INEGI). Data=INEGI

'January Small Car Production and Export Status Report' released by the Mexican National Institute of Statistics and Geography (INEGI). Data=INEGI

Global automakers such as Mercedes-Benz (-66.9%), BMW (-42.4%), Volkswagen (-31.7%), and Mazda (-24.5%) also experienced significant drops in export performance. In contrast, Toyota's exports increased by 324.5%, which is attributed to an unusually low export volume in January last year (5,569 units). Ford's exports rose by 4.7%. Kia Mexico also exported 17,362 units in January this year, up 23.1% from 14,100 units in January last year.

This data is interpreted as directly showing the impact of President Trump's threat to impose a 25% tariff on Mexican products on the industry. Mexico produces 3.8 million vehicles annually, and the Mexican Automotive Industry Association (AMIA) reports that 80% of the shipments for export are destined for the United States. This means that most automakers operating in Mexico are targeting the U.S. market.

In particular, looking at last year's sales by company, the top ranks are occupied by U.S.-based companies GM, Stellantis, and Ford. If the U.S. imposes tariffs on Mexico, U.S. companies are structurally the ones who will suffer the most damage, at least in automotive-related items. Claudia Sheinbaum, President of Mexico City, and Marcelo Ebrard, Minister of Economy, have repeatedly warned that "considering the closely intertwined trade relationship between the two countries, Trump's tariff threat could have a negative impact on the U.S. economy."

On the 1st, President Trump signed an executive order imposing a 25% general tariff on neighboring countries Mexico and Canada, and an additional 10% on China, marking the beginning of the second term's tariff war. Although the tariff imposition on Mexico and Canada was postponed for one month following a phone call between leaders on the 3rd, the announcement of "reciprocal tariffs" by President Trump still raises concerns about a major upheaval in the international trade order.

A Korean automotive parts company operating in Mexico expressed concern, saying, "As uncertainty continues, the Mexican automotive industry will maintain a conservative market approach for the time being," and added, "The burden on first-, second-, and third-tier vendors (suppliers) will increase further."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.