Acceleration of Bank Deposit Outflows Amid Interest Rate Cuts

Investment Funds Shift to Stocks, Cryptocurrencies, and Gold

Money Movement Expected to Continue with Further Rate Cuts Anticipated

As the full-scale interest rate cut phase begins and the average interest rates on savings and time deposits fall to the 2% range, it has been identified that funds are increasingly leaving banks. In particular, approximately 26 trillion won in time deposits has disappeared over the past three months. Until last year, funds that could not find suitable investment destinations flowed into banks due to stock market instability and a high-interest rate trend, but this year, with the interest rates on savings and time deposits sharply dropping, the outflow of funds is accelerating.

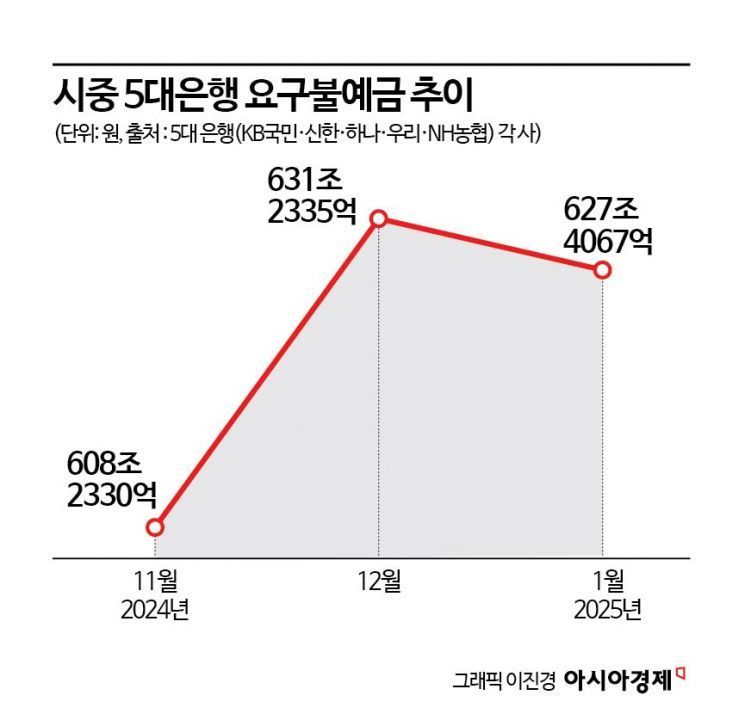

According to the banking sector on the 11th, demand deposits have returned to a decreasing trend this year. Demand deposits at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) increased from 608.233 trillion won in November last year to 631.2335 trillion won in December, but decreased again to 627.4067 trillion won this year. This represents a decrease of 2.8268 trillion won in the past month. Demand deposits are classified as investment standby funds because they can be deposited or withdrawn at any time and the interest rate is only about 0.1% per annum.

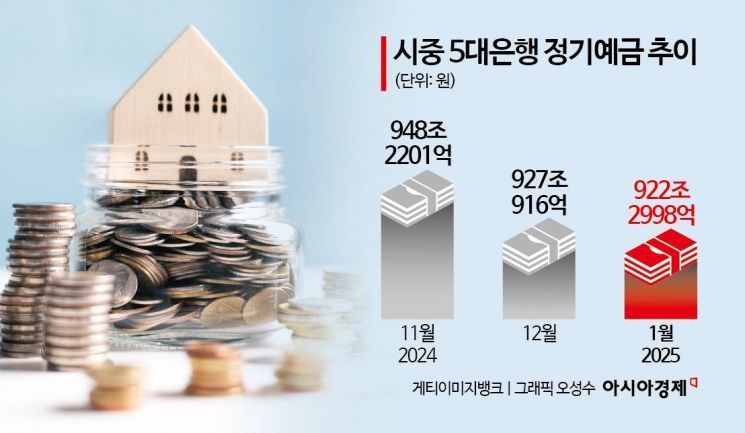

Time deposits also decreased by about 26 trillion won over the past three months. Time deposits at the five major commercial banks steadily decreased from 948.2201 trillion won in November last year to 927.0916 trillion won in December and 922.2998 trillion won in January this year. This is a decrease of 25.9203 trillion won over the past three months. This is interpreted as the effect of the average interest rates on savings and time deposits at commercial banks sharply dropping to the 2% range as the full-scale interest rate cut phase began.

In fact, according to the Korea Federation of Banks, the 12-month maturity time deposit interest rates at the five major commercial banks are at the level of 2.40~3.10%, which is 0.13~0.39 percentage points lower than the 12-month maturity time deposit interest rates of 2.79~3.23% handled in the previous month.

The funds that have left banks in this way appear to have moved to various investment destinations such as the domestic stock market, the U.S. stock market, cryptocurrencies, and gold. According to the Korea Financial Investment Association, investor deposits, which are standby funds for the stock market, increased by about 8 trillion won from 49.89 trillion won in early November last year to 58.2317 trillion won as of early this month (February 3).

Funds are flowing not only into the domestic stock market but also into the U.S. stock market. According to the Korea Securities Depository, the total transaction amount of U.S. stock purchases and sales settlements from November last year to February 7 this year was 201.91319 billion dollars (about 293.0366 trillion won), recording an average monthly amount of about 97 trillion won, which is about twice the amount of funds flowing into the domestic stock market.

Funds have also poured into alternative investment fields such as virtual assets and gold. The daily average transaction amount at domestic virtual asset exchanges was about 25 trillion won. Along with cryptocurrencies, gold, which is considered a representative alternative asset, also attracted funds. The gold banking balances of KB Kookmin, Shinhan, and Woori banks, which operate gold banking among commercial banks, amounted to 835.3 billion won as of the end of last month, an increase of 53.1 billion won compared to 782.2 billion won at the end of last year. More than 50 billion won flowed in within about a month. The number of gold banking accounts also increased by more than 20,000, from 252,332 to 275,424.

An official from a commercial bank said, "The Bank of Korea's base rate cut trend, which has continued since the second half of last year, has affected the reduction of deposit interest rates, making it difficult to find high-interest special savings and time deposits. Especially with additional interest rate cuts expected this year, this kind of money movement is expected to continue for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.